Samsung Asset Management Launches China Metaverse ETF and More

Targeting Retail Investors Amid Increased Market Volatility

[Asia Economy Reporter Hwang Junho] The competition among exchange-traded funds (ETFs) has intensified as the world's first ETF investing in China's metaverse industry is launched in South Korea. With growing market instability, including the KOSPI falling to the 2500 level, a battle has begun to attract investors turning to indirect investment.

According to the asset management industry on the 12th, Samsung Asset Management will launch the ‘KODEX China Metaverse Active’ ETF on the 17th. This fund is the first ETF to invest in the Chinese metaverse market. It aims to outperform the Bloomberg Greater China Media & Tech Index, which serves as its benchmark. Over 60% of the investment assets are allocated to Chinese metaverse-related companies (top 40 by market capitalization). The metaverse refers to a hyperrealistic world created by merging virtual reality and actual reality.

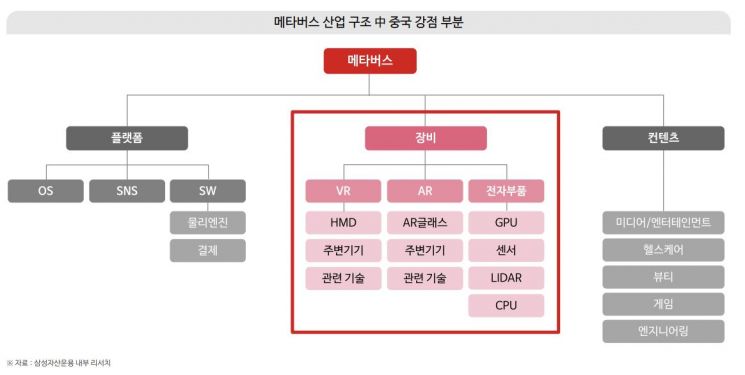

Im Taehyuk, head of ETF operations, explained, "The global metaverse market has strengths in the US (platforms), China (devices), and Korea (content), and the Chinese market is predicted to grow to a scale of $8 trillion (Morgan Stanley)." He added, "Through this product, Samsung can present the world's first lineup that allows investment in the Korea-US-China metaverse markets." This is analyzed as a strategy to spark a new thematic boom in the ETF market. Last year, the ‘electric vehicle’ theme gained tremendous popularity, with Mirae Asset Global Investments’ TIGER China Electric Vehicle SOLACTIVE attracting 3 trillion won in net assets.

Samsung Asset Management will also launch an ETF on the same day that invests in the global ETF market, which grew to $10 trillion (12,000 trillion won) as of last year. This product invests in US-listed ETF companies such as BlackRock, S&P Global, and MSCI (Morgan Stanley Capital International), making it a relatively unfamiliar product for domestic investors.

Hanwha Asset Management recently launched ETFs that allow domestic investors to easily invest in global alternative assets and private equity funds. Timefolio Asset Management released active products investing in the S&P 500 and Nasdaq 100, while Woori Asset Management listed an active treasury bond ETF designed for inflation protection. An industry insider analyzed, "Recently launched ETFs are characterized by unique themes or target global markets, and can be categorized as products aimed at attracting individual investors who are turning away from the domestic stock market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.