Q1 Sales Increase 17.6% to Record Quarterly High

Bio Business Drives Performance... Operating Profit Up 128%

[Asia Economy Reporter Eunmo Koo] CJ CheilJedang achieved its highest first-quarter performance despite cost burdens from recent raw material price increases, based on its diversified business portfolio. In particular, the bio business made significant strides as demand expanded for feed amino acids, a substitute for feed, due to rising grain prices.

According to the food industry on the 10th, CJ CheilJedang's first-quarter sales this year reached 4.3186 trillion KRW, a 17.6% increase compared to the same period last year, marking a record high for a quarter. Operating profit also rose 6.6% to 364.9 billion KRW during the same period.

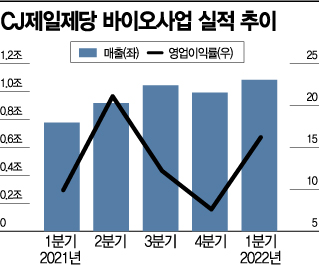

The bio business, focused on green bio products such as feed amino acids, played a key role. Sales in the bio business increased 39.3% year-on-year to 1.0828 trillion KRW, and operating profit surged 128.0% to 175.8 billion KRW, surpassing the food business (169.7 billion KRW). The operating profit margin also rose by 6.3 percentage points to 16.2%.

Leveraging market dominance, CJ CheilJedang strategically raised prices of key products such as the feed amino acid “Lysine.” Sales were smooth mainly in high-profit regions, maximizing profits. Jeongwook Kim, a researcher at Meritz Securities, explained, "The feed additive market, including Lysine, is enjoying a boom in the first half of this year due to rising feed prices caused by grain price increases, favorable livestock market conditions, and production setbacks among local Chinese companies." Amino acids help promote animal growth and strengthen immunity, and some essential amino acids like Lysine must be separately ingested through feed.

The flagship food business also contributed to external growth as K-Food performed well overseas. Sales reached 2.6095 trillion KRW, a 13% increase year-on-year, with home meal replacements (HMR) growing significantly domestically and processed food sales rising sharply overseas. By country, Europe grew 36%, Japan 31%, China 15%, and the U.S. 14%, all showing double-digit growth and accelerating global expansion. Consequently, the overseas share of total food segment sales exceeded 45%.

However, operating profit in the food business remained at 169.7 billion KRW, down 3.8%, due to the added burden of rising raw material prices. CJ CheilJedang stated, "We continued efforts to improve the profit structure but were not completely free from the effects of global inflation."

As grain prices remain strong and the price competitiveness of feed substitutes like Lysine is expected to be maintained, CJ CheilJedang’s performance improvement is likely to be driven by the bio business for the time being. Eunae Ryu, a researcher at KB Securities, predicted, "The price increases in the bio business, which underpinned the strong performance, will continue within the year. Although the burden of raw material costs is continuously increasing due to global supply shortages, CJ CheilJedang has market dominance that allows it to pass these costs on to selling prices."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.