Survey of 322 Companies by the Korea Chamber of Commerce and Industry

Top Priority to Overcome Economic Situation

Recovery of Growth Engines, Price Stability, and Corporate Debt Management in Order

Large Corporations Prioritize 'Recovery of Growth Engines'

SMEs Demand 'Price Stability'

"Korean Economy Running Both '100m Sprint and Marathon'

Need for Tailored Support and Deregulation by Crisis Type"

President-elect Yoon Suk-yeol performing an uppercut ceremony at the closing ceremony of the 20th Presidential Transition Committee held on the lawn square of the Transition Committee in Samcheong-dong, Jongno-gu, Seoul, on the afternoon of the 6th. Photo by Transition Committee Press Corps

President-elect Yoon Suk-yeol performing an uppercut ceremony at the closing ceremony of the 20th Presidential Transition Committee held on the lawn square of the Transition Committee in Samcheong-dong, Jongno-gu, Seoul, on the afternoon of the 6th. Photo by Transition Committee Press Corps

[Asia Economy Reporter Moon Chaeseok] Companies experiencing the "triple management hardships" of high inflation, high exchange rates, and supply chain risks identified "restoring growth momentum" as the top priority task for the Yoon Suk-yeol administration. They also emphasized the need for proper risk management, including price stabilization and corporate debt management.

On the 8th, the Korea Chamber of Commerce and Industry (KCCI) announced the results of a survey titled "New Government Economic Policies and Recent Economic Conditions," conducted among 322 domestic companies.

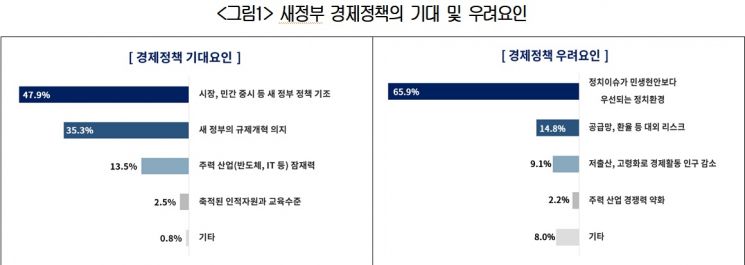

Overall, there was strong anticipation for the Yoon Suk-yeol administration's growth-promoting policy direction. Regarding the "new government's economic policies," 72.7% of respondent companies answered that they "have expectations." The reasons for expectations included "market- and private sector-oriented policy direction" (47.9%) and "willingness for regulatory reform" (35.3%). Concerns mainly involved "political issues" (65.9%) and "external risks such as supply chains" (14.8%).

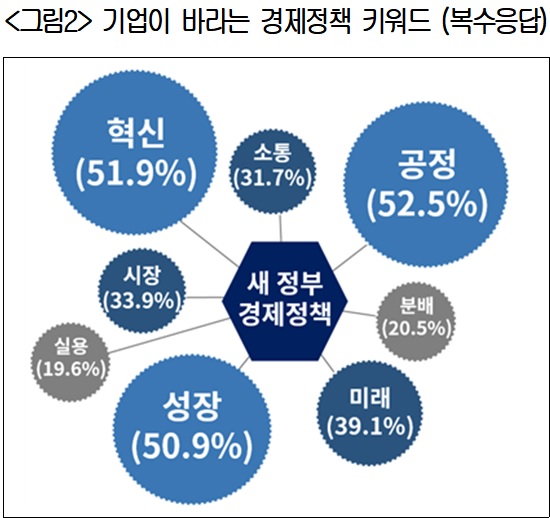

Keywords that should be reflected in economic policies included "fairness" (52.5%), "innovation" (51.9%), and "growth" (50.9%).

Success factors for the new government's economic policies were identified as "investment and infrastructure support" and "regulatory reform." Important elements for policy success were "investment and infrastructure support for the future" (96.3%) and "inducing corporate innovation through regulatory reform" (90.4%). "Labor-management conflict mediation" (86.8%) and "establishing public-private cooperation systems" (82.2%) were also pointed out.

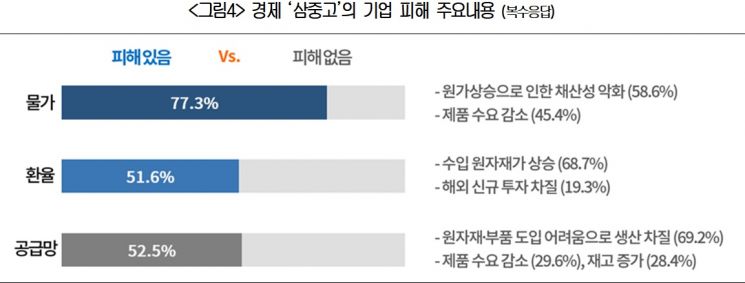

Companies unanimously stated that external factors such as inflation, exchange rates, and supply chains are weighing heavily on management. In particular, the inflation issue was found to be severe.

First, regarding inflation, 77.3% of respondent companies said they are "suffering damage." According to the KCCI, this was identified as the "biggest management risk" faced by companies. The damages caused by inflation included "deterioration of profitability due to rising production costs" (58.6%) and "decreased demand for products and services" (45.4%). Countermeasures included "raising product prices" (39.8%) and "reducing marketing and promotional expenses" (35.7%). Companies that said they "are downsizing or restructuring" accounted for 28.5%, and those that said they "have no means to respond" were 21.3%. Companies that temporarily suspended production accounted for 8.8%.

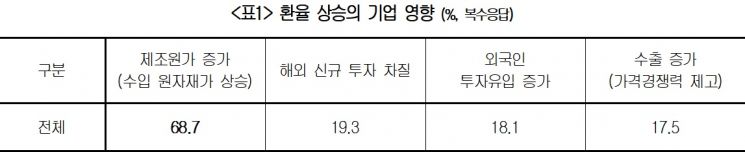

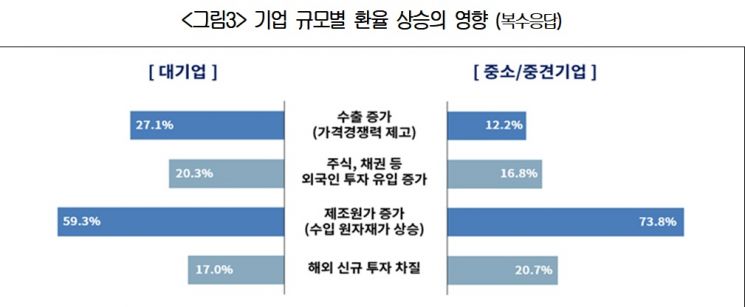

Rapid exchange rate increases are also a concern. 51.6% of companies reported "suffering damage" due to the rapid rise in exchange rates. The main damage was "increased manufacturing costs due to rising prices of imported raw materials" (68.7%). The perception of exchange rate impact was higher among small and medium-sized enterprises (SMEs) and mid-sized companies than among large corporations. Among large corporations, 59.3% said "manufacturing costs increased" due to exchange rates, while 73.8% of SMEs and mid-sized companies said the same. Conversely, among companies that said "exports increased due to improved price competitiveness," 27.1% were large corporations and 12.2% were SMEs and mid-sized companies.

52.5% of companies reported being affected by global supply chain disruptions. The most cited damage was "production disruptions due to shortages of raw materials and parts" (69.2%). Responses regarding countermeasures included "diversifying supply chains" (50.3%) and "securing inventory through advance purchases" (41.4%). The response "shifting production and sales activities domestically" (19.5%) was relatively low.

To overcome this "triple hardship," companies urged that "strengthening growth momentum should come first." Companies prioritized "restoring growth momentum" (37.9%) and "price stabilization" (35.4%). However, large corporations prioritized "restoring growth momentum," while SMEs and mid-sized companies prioritized "price stabilization."

Kim Hyun-soo, Director of Economic Policy at the KCCI, said, "Our economy is in a situation where it must simultaneously run a '100-meter sprint' to overcome immediate crisis factors such as inflation, exchange rates, and supply chains, and a 'marathon' to boost long-term growth momentum." He added, "I hope the new government establishes tailored support systems for each crisis factor, minimizes future uncertainties, and takes the lead in reducing regulations."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)