[Asia Economy Reporter Ji Yeon-jin] There is a prospect that pig farming companies in China could actually benefit from the prolonged 'lockdown' due to the resurgence of COVID-19. This is because the lockdown has increased the likelihood of pork prices rising in the second half of this year.

According to a report published by KB Securities on the 7th, pork prices are currently trading at historically low levels due to oversupply this year. Additionally, the war between Russia and Ukraine has caused feed prices to soar, further expanding the losses of pig farming companies that were expected to turn a profit this year, with deficits widening in the first quarter.

However, it is analyzed that this situation is likely to improve toward the end of the year. First, due to distribution disruptions both domestically and internationally caused by the prolonged lockdown, pork supply has temporarily decreased, and as the deficit phase continues for a long time, the exit of small-scale companies is accelerating, leading to a gradual reduction in pork supply.

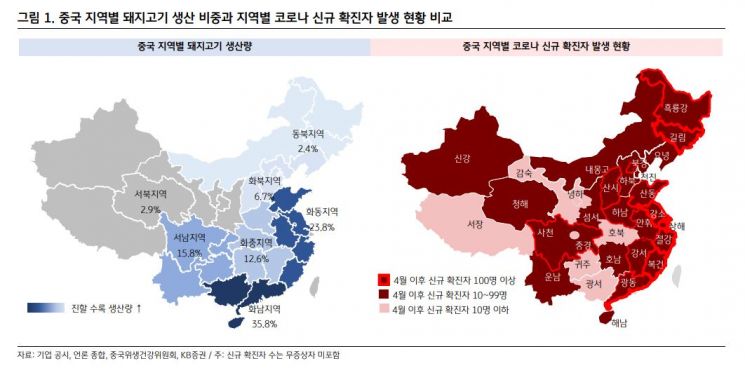

China's pork production capacity is concentrated about 60% in the South China (Huanan) region and East China (Huadong) region. These areas coincide with the regions where lockdowns have been implemented. In particular, Guangdong Province (Guangdong Sheng) completely banned pork distribution in May, and in Henan Province (Henan Sheng) and Shandong Province (Shandong Sheng), shipments from small-scale companies are also delayed.

Imports are also not smooth. About 7-10% of China's annual pork supply is met through imports. The city with the largest import volume is Shanghai (Shanghai), but shipments have been stuck at Shanghai Port for over a month. Pork imports in the first quarter of this year decreased by 63.8% compared to the previous year.

Moreover, with grain prices soaring and feed prices hitting new highs daily, pork prices remain low, causing pig farming companies to continue their losing streak. In fact, the ratio of pork prices to feed prices stands at 4.8 to 1 (as of April 29), remaining at a historic low. On average, pig farming companies cannot avoid losses when this ratio falls below 6:1, and this situation has persisted for over a year.

KB Securities researcher Kang Hyo-joo said, "With about 45% or more of China's pig farming industry consisting of small-scale companies with low risk management capabilities, these small companies are unlikely to withstand prolonged losses and are expected to exit the market." She added, "It is time to pay attention to the possibility of improvement in the pork market in the second half of the year, and we maintain our top pick in pig farming companies, Mokwon Food."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)