KOSPI Maintains Uptrend... Gains Narrow

Foreigners Sell KOSPI After One Day

Institutions Lead Sales in Securities and Financial Investments

[Asia Economy Reporter Hwang Yoon-joo] On the morning of the 4th, the KOSPI's gains narrowed after the opening. The KOSDAQ reversed to a decline as foreign selling pressure increased. It appears that cautious sentiment and a wait-and-see stance continue ahead of the U.S. Federal Open Market Committee (FOMC) regular meeting results.

As of 10:30 a.m. on the 4th, the KOSPI stood at 2,685.89, up 5.98 points (0.22%) from the previous trading day. Unlike the 9.99-point (0.37%) rise at the start of the day, the upward momentum has weakened.

Looking at trading trends, individuals are leading the index by net buying 37.2 billion KRW alone. Meanwhile, foreigners and institutions are net selling 13.4 billion KRW and 29.6 billion KRW, respectively. Foreigners, who were buyers in the KOSPI market the previous day, switched to sellers in just one day.

Specifically, by institution type, financial investment firms (such as securities companies) are leading sales with 16.7 billion KRW, and private equity funds with 20.8 billion KRW. Pension funds turned from selling to buying early in the session.

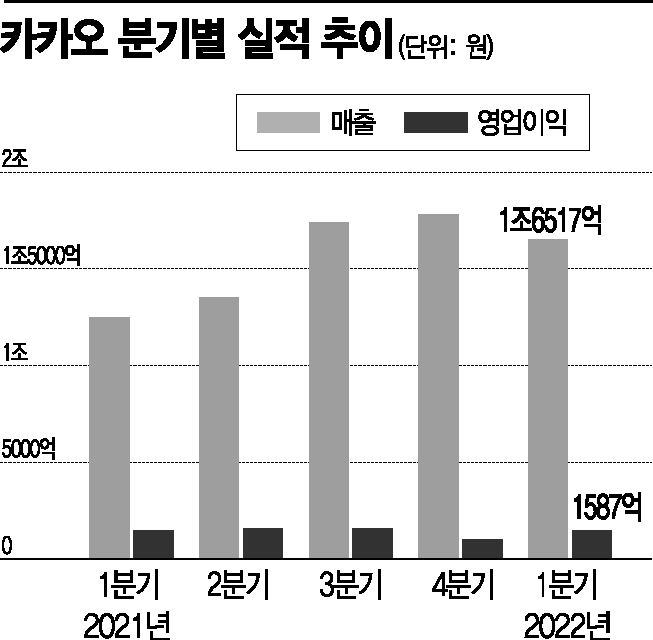

Among the top market capitalization stocks, LG Chem rose 1.35% and Kakao 1.13%, showing the highest gains. Kakao surged over 3% right after the opening but fell back to the 80,000 KRW range as foreign selling intensified.

Samsung Electronics rose 0.59%, and Naver 0.35%, maintaining upward trends. Samsung Electronics’ gains were halved due to selling by foreigners and institutions. LG Energy Solution, SK Hynix, and Hyundai Motor showed flat performance, while the rest declined.

By sector, only the electric and gas utilities sector maintained gains at +2.30%. Insurance +0.86%, machinery +0.87%, and financials +0.65% were among the top gainers. Conversely, pharmaceuticals -1.20% and textiles and apparel -1.11% had the largest declines.

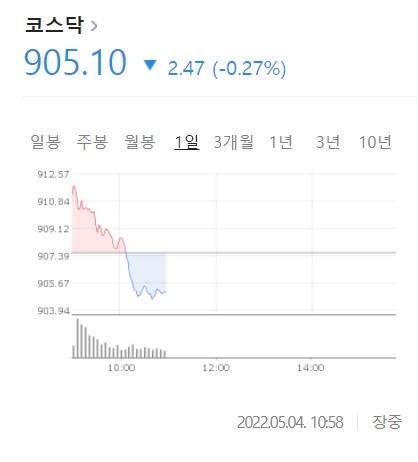

As of 10:39 a.m., the KOSDAQ was down 2.94 points (0.32%) at 904.63. The index started at 911.16, up 3.59 points (0.40%), but the gains gradually diminished and reversed to a decline during the morning session.

On the KOSDAQ, individuals and institutions are net buyers of 96.5 billion KRW and 0.2 billion KRW, respectively. Foreigners alone are net sellers of 91.5 billion KRW. Foreigners expanded their selling in the morning, while institutions reduced their selling and switched to buying. Among institutions, only financial investment firms (such as securities companies) are net sellers of 9 billion KRW. Pension funds (3 billion KRW), insurance (+2.5 billion KRW), and private equity funds (+2.3 billion KRW) are leading purchases.

Institutional trading trends on the KOSDAQ are continuously changing. Ahead of the FOMC regular meeting results, cautious sentiment is growing, resulting in mixed buying and selling behaviors.

Among the top market capitalization stocks, L&F rose 2.85%, ranking first in gains. Following were EcoPro BM +1.98%, Chunbo +1.80%, and Pearl Abyss +1.07%. Kakao Games +0.17% and Wemade +0.62% also showed slight increases. The rest are all declining.

By sector, general electric and electronics +1.37% and telecommunications equipment +1.08% are showing strength. Related stocks surged after news that Samsung Electronics secured a large-scale 5G equipment order from a U.S. carrier, driving the sector index.

Meanwhile, in the Seoul foreign exchange market, the won-dollar exchange rate opened at 1,262.0 KRW, down 5.8 KRW. It continued to decline during the session, reaching as low as 1,258.8 KRW at one point.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)