Seoul Welfare Foundation Announces Survey on Young Adults Applying for 'Personal Rehabilitation'

"More than Half Respondents Fear Default and Resort to Circular Borrowing, Increasing Debt to Unmanageable Levels"

[Asia Economy Reporter Lim Cheol-young] Among young people in their 20s who applied for personal rehabilitation, the debt ratio from secondary financial institutions was overwhelmingly high, and the most common reason for initially incurring debt was ‘to cover living expenses.’ It was found that the average debt amount at the time of applying for personal rehabilitation was 62.6 million KRW.

On the 4th, the Seoul Welfare Foundation’s Seoul Financial Welfare Counseling Center announced that it conducted a survey targeting 512 young people in their 20s who completed the Youth Financial Guide course at the center from October last year to February this year, and compared and analyzed the results with 1,582 general young people in their 20s who participated in the Seoul Youth Survey, revealing these findings.

Among them, 54% (277 people) responded that “debt increased to an unmanageable level due to rolling over other debts,” and the biggest reason for rolling over debts was “fear of becoming a defaulter (credit delinquent)” (313 people, 63%). Nevertheless, half of them (256 people, 50%) had never received any counseling for debt problem resolution such as bankruptcy or workout before applying for personal rehabilitation.

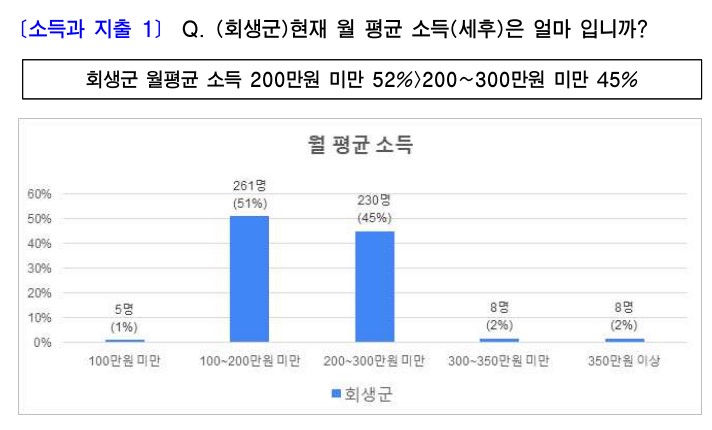

The average monthly income of young people who completed the Youth Financial Guide course was ‘between 1 million KRW and less than 2 million KRW’ (261 people, 51%) and ‘between 2 million KRW and less than 3 million KRW’ (230 people, 45%). Among them, 68% (346 people) were regular employees, but only 19% (99 people) reported having more than 3 years of continuous employment, indicating low job stability.

The debts of young people who applied for personal rehabilitation were mainly from secondary financial institution loans (400 people, 78%), credit card loans (388 people, 76%), and bank loans (370 people, 72%) in that order. About 38% (195 people) of these rehabilitation applicants had been contacted by debt collectors, and among them, 72% (139 people) received collection calls more than three times a day. This is a significantly higher figure compared to the Financial Supervisory Service statistics (6.75%).

Meanwhile, since its opening in July 2013, the center has supported the legal discharge of 2.2167 trillion KRW in malignant debts for 8,823 Seoul citizens suffering from household debt. It provides financial welfare services including ▲‘prevention of malignant debt expansion’ through public financial counseling and financial welfare education ▲support for public debt adjustment (personal bankruptcy, discharge, personal rehabilitation) to manage household debt scale ▲linking welfare services such as housing and employment to help citizens who have fallen due to debt to stand up again.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.