Industrial products including petroleum up 7.8% due to Ukraine crisis... Overall CPI contribution 2.7%P

Wage increase pressure in labor market... Possible further inflation rise

Experts "Rate hikes must continue until inflation stabilizes"

The consumer price inflation rate in April soared to the high 4% range, the highest level since the 2008 financial crisis. On the 3rd, citizens were shopping at Yeongcheon Market in Seodaemun-gu, Seoul. Photo by Moon Honam munonam@

The consumer price inflation rate in April soared to the high 4% range, the highest level since the 2008 financial crisis. On the 3rd, citizens were shopping at Yeongcheon Market in Seodaemun-gu, Seoul. Photo by Moon Honam munonam@

[Asia Economy Sejong=Reporters Kwon Haeyoung and Son Seonhee] Last month, South Korea's consumer price inflation rate reached 4.8%, marking the highest level in 13 years since the 2008 financial crisis. This has raised concerns that the inflation rate could surpass 5% within the year and even soar into the 6% range. The surge is attributed to rising import prices driven by soaring international oil and grain prices due to the Russia-Ukraine conflict, coupled with a sharp increase in the won-dollar exchange rate. The high inflation is gradually increasing wage pressure, raising the possibility of a vicious cycle of "price increase → wage increase → further price increase." While the government is mobilizing all available policy tools such as cuts in fuel tax and tariff allocations, experts emphasize the need for continuous interest rate hikes until inflation stabilizes. This poses a burden on the real economy.

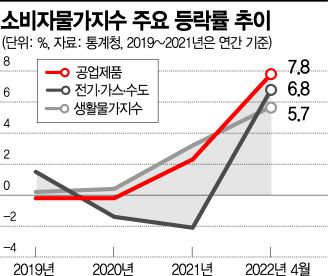

◆ "4.8% Inflation Rate Is Not the Peak" = According to Statistics Korea on the 3rd, the 4.8% year-on-year consumer price inflation last month was largely driven by a 7.8% rise in industrial products, which pushed up the overall price index. This was influenced by the sharp rise in international oil prices following Russia's invasion of Ukraine, causing prices of petroleum products and other industrial goods to surge. Petroleum products such as gasoline (28.5%) and diesel (42.4%) jumped 34.4%, and processed foods rose 7.2%, contributing 2.7 percentage points to the overall industrial product price index.

Although the price increase of agricultural, livestock, and fishery products slowed in March, it rose 1.9% last month. Electricity, gas, and water charges increased by 6.8% during the same period, stimulated by the Korea Electric Power Corporation's electricity rate hike, further pushing up overall consumer prices. Services also rose 3.2%, mainly driven by a 6.6% increase in dining-out prices and other personal services. The tightening monetary policy led by the U.S. caused the won-dollar exchange rate to rise, further stimulating import prices and impacting inflation.

Core inflation, which excludes temporary supply effects and shows the underlying trend, rose 3.6%, the highest since December 2011. Living costs, reflecting perceived inflation, increased by 5.7%, marking the largest rise since August 2008.

◆ "Interest Rate Hikes Needed Until Inflation Is Controlled" = The problem is that the inflationary trend is unlikely to ease anytime soon. Hong Namki, Deputy Prime Minister and Minister of Economy and Finance, stated at the final inflation-related ministers' meeting that "inflation in major advanced countries remains at unprecedentedly high levels due to the prolonged Russia-Ukraine war and other factors," adding, "Reflecting this, the International Monetary Fund (IMF) recently revised upward its annual inflation forecasts for major countries, and inflationary pressures are expected to persist for the time being." Eo Unseon, Director of Economic Trend Statistics at Statistics Korea, also said, "There is no sign that prices of petroleum products, processed foods, and industrial products will fall anytime soon, and the easing of COVID-19 restrictions is unlikely to slow the upward trend due to improved consumer sentiment." The Bank of Korea also expects inflation to continue rising in the 4% range for the time being due to rising raw material prices such as grains and increased demand-side inflationary pressures following the lifting of social distancing measures.

In the market, concerns are growing that if this rapid inflation trend continues without adequate policy tools, the consumer price inflation rate could reach 6% in the second half of the year. With wage pressures rising in the labor market amid the saying "everything but wages has gone up," there is a concern about falling into a vicious cycle of "high inflation → wage increase → increased corporate costs → product price hikes → further inflation." The Bank of Korea recently noted that the inflation shock could be reflected in wage increases in the second half of this year with a time lag.

Accordingly, inflation is expected to become the biggest challenge for the new government. Failure to control soaring prices could rapidly deteriorate public sentiment and weaken the momentum of national governance.

Experts advise that the new government’s economic team should form a united front with the Bank of Korea to stabilize prices. The last card available to control inflation is liquidity withdrawal, but it is not feasible to keep raising the base interest rate indefinitely for inflation control. Raising rates could increase concerns about economic downturns and household debt burdens.

Professor Sung Tae-yoon of Yonsei University's Department of Economics pointed out, "There is no fundamental way to control inflation other than continuous liquidity withdrawal." He added, "The Bank of Korea's interest rate hikes should continue until the inflationary trend subsides. However, since large hikes could burden the economy, they need to be implemented steadily."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)