[Asia Economy Reporter Ryu Tae-min] The income-generating real estate transaction market, including knowledge industry centers, officetels, and residential-type lodging facilities (Saengsuk), which had been enjoying windfall benefits from the Moon Jae-in administration's apartment regulations, is freezing up. In particular, knowledge industry centers are seeing a surge in urgent sale properties even at 'minus premiums.' It is interpreted that the supply has increased significantly, resulting in an oversupply of listings, and the buying demand has sharply declined due to the price burden from the previously soaring premiums.

According to Knowledge Industry Center 114 on the 3rd, the contract area of 218.8㎡ at 'Seoul Forest Pohyu' in Seongsu-dong, Seoul, was traded for 2.1 billion KRW on February 21. This set a new record price of 31.73 million KRW per 3.3㎡. Considering that the market price per 3.3㎡ was less than 10 million KRW at the time of move-in in 2016, the price has more than tripled in six years.

The soaring value of knowledge industry centers is due to strong regulations on the housing market attracting investment demand. Knowledge industry centers are excluded from housing counts as well as various taxes such as property tax and capital gains tax. Unless the knowledge industry center was purchased in an industrial complex, resale of pre-sale rights is possible, and loans of up to 80% are available.

On the other hand, urgent sales are flooding in areas with poor location conditions. On online real estate communities, there are posts offering mid-level units of the S Knowledge Industry Center in Gurae-dong, Gimpo-si, Gyeonggi-do, at a 20 million KRW 'ma-pi' (price lower than the pre-sale price), indicating a willingness to accept losses. Similarly, the nearby D Knowledge Industry Center has numerous posts offering urgent sales at a 15 million KRW ma-pi. Additionally, cases of knowledge industry center pre-sale rights in outer areas of Gyeonggi such as Dongtan and Yeongtong being listed at ma-pi prices have also been found.

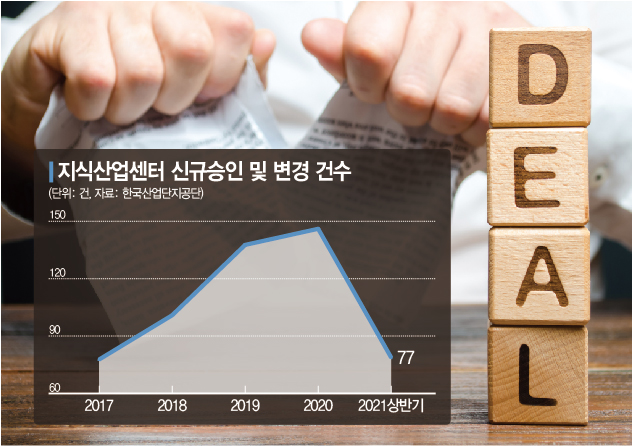

The intensifying regional polarization is due to the sharp increase in the supply of knowledge industry centers. According to the Korea Industrial Complex Corporation, the number of newly approved knowledge industry centers nationwide was 141 in 2020. This is about twice the number in 2017 (76), marking the highest since the data collection began in 1997. As of January, the total number of knowledge industry centers nationwide was 1,309.

Due to oversupply, the number of properties that failed to find tenants and went to auction has also increased. According to Shinhan Auction SA, the total number of individual units of knowledge industry centers auctioned last year was 307, the highest in the past five years. Among them, Seoul had 53 cases, the highest since 2018. Gyeonggi-do also saw an increase in listings with 127 cases in 2020 and 121 cases last year.

The non-residential product transaction market, including officetels and residential-type lodging facilities (Saengsuk), is also freezing up. The premium had soared, increasing the price burden, and combined with loan regulations and rising interest rates, buying demand has sharply declined.

Yoon Soo-min, a real estate specialist at NH Nonghyup Bank, advised, “Income-generating real estate such as knowledge industry centers or Saengsuk should be invested in carefully, considering long-term rental income rather than short-term capital gains.” He added, “Unlike Seoul, where supply is insufficient and demand is concentrated, the outskirts of Gyeonggi have an oversupply, so sufficient location analysis is necessary before investing.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.