Olive Oil Sales Show Remarkable Growth

[Asia Economy Reporter Eunmo Koo] As dining out decreased due to COVID-19 and more people started preparing meals at home, the domestic cooking oil market also showed growth.

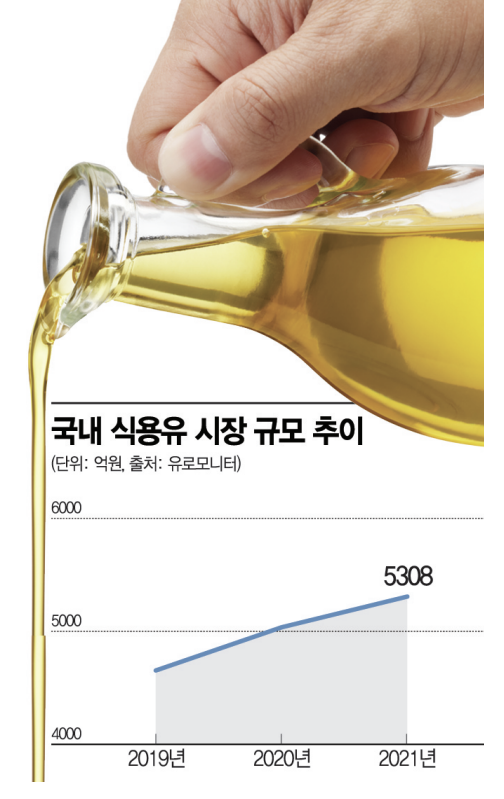

According to Euromonitor on the 2nd, the size of the domestic cooking oil market last year was 530.8 billion KRW, marking a 5.4% increase compared to the previous year (503.6 billion KRW). The domestic cooking oil market, which was around 498.6 billion KRW in 2016, had been on a continuous decline but shifted to an upward trend in 2020 as demand for home-cooked meals increased following the spread of COVID-19, and the growth continued last year. By distribution channel, large supermarkets still held a high share of 70.5%, though this was a 2.1 percentage point decrease from the previous year, while online (16.2%) and convenience store (5.3%) channels increased by 0.9 and 0.4 percentage points respectively.

However, with the recent lifting of social distancing measures and expectations that dining out consumption will recover and the home meal replacement (HMR) market such as meal kits will expand, the rapid growth is expected to slow down. The domestic cooking oil market is projected to grow at an average annual rate of 1.2%, reaching 563.5 billion KRW by 2026.

Among household cooking oils, olive oil showed a notable growth trend. According to the Korea Agro-Fisheries & Food Trade Corporation, olive oil sales in the first half of last year were 38.1 billion KRW, a 10.0% increase compared to the same period the previous year. Last year, the domestic import value of olive oil was 117.65 million USD (approximately 148.6 billion KRW), a 37.3% increase from the previous year. In the first quarter of this year, imports amounted to 34.36 million USD, a 52.2% increase compared to the same period last year, continuing the recent trend of rising demand.

Traditional oils such as sesame oil also maintained growth, with sales in the first half of last year increasing by 5.4% year-on-year to 62.7 billion KRW. Sesame oil recorded the highest market share at 25.9%, followed by canola oil (17.9%), soybean oil (16.1%), olive oil (15.8%), grape seed oil (8.5%), perilla oil (4.0%), and corn oil (3.3%).

With growing interest in health, there is a shift in the role and preference of cooking oils, including considering cooking methods that use less oil when frying. An industry insider explained, "Olive oil is gaining attention as it is used in sauces or dressings or consumed alone for health management," adding, "Sesame oil and perilla oil, which are used in various Korean dishes, have also seen increased sales and interest influenced by home cooking."

Meanwhile, in the household cooking oil market, CJ CheilJedang holds the leading position with a 38.1% market share, followed by Sajo Haepyo (21.4%), Daesang (11.0%), and Dongwon F&B (6.4%).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.