Korea Investment & Securities Report

[Asia Economy Reporter Myunghwan Lee] Amid the Indonesian government's suspension of exports of cooking oil and cooking oil raw materials since the 28th of last month, securities analysts have suggested that the export ban is unlikely to be prolonged.

On the 1st, Korea Investment & Securities analyzed the Indonesian export ban, stating, "The palm oil industry accounts for 4.7% of Indonesia's Gross Domestic Product (GDP)," and added, "Since the decision prioritizes stabilizing food prices, it is unlikely to be prolonged." Palm oil-related products make up 12.3% of Indonesia's total exports, and considering the income reduction for palm farmers, decreased export tax revenue, and shrinking trade balance, strengthening the export ban would also be burdensome for these stakeholders.

However, concerns have been raised that this Indonesian measure is causing global food prices to rise. Due to abnormal weather, production of canola oil (Canada) and soybean oil (Brazil, Argentina) has decreased, and the war between Russia and Ukraine has led to a shortage of sunflower oil. Korea Investment & Securities analyzed that the export ban by the world's largest palm oil producer amid supply shortages of substitutes is fueling a global cooking oil crisis. Indonesia's annual palm oil production is 44.5 million tons, accounting for 59% of global production.

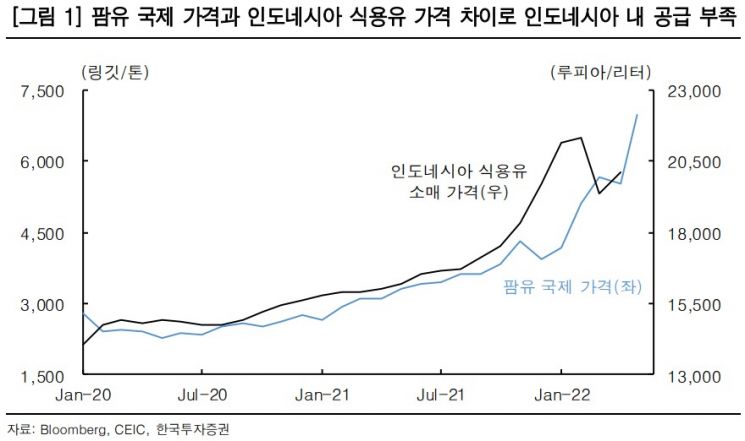

Despite criticism of resource nationalism, Korea Investment & Securities pointed out that the reason for Indonesia's palm oil export ban is the domestic shortage of cooking oil. The supply of cooking oil within Indonesia has been unstable due to the gap between international palm oil prices and domestic retail prices. In response, the Indonesian government introduced policies from January, including domestic supply obligations, price caps, and export taxes.

It was also explained that the recent surge in global palm oil demand has had an impact. April and May coincide with Ramadan, the largest consumption season in Islam, and the Lebaran festival, leading to seasonal increases in food consumption. Additionally, the easing of COVID-19 restrictions has released suppressed consumer sentiment.

The palm oil export ban by Indonesia caused crude palm oil prices to soar. After the Indonesian government announced export regulations on cooking oil and raw materials on the 23rd of last month, the international futures price of crude palm oil (CPO) surged 26.4% in April to 6,987 ringgit per ton (approximately 2.02 million KRW).

Korea Investment & Securities advised a conservative approach to investing in palm oil-related companies, citing the possibility that the regulation could escalate into a political issue, as seen in recent anti-government protests.

However, a positive outlook was given for the Indonesian stock market. The Jakarta Composite Index has risen 9.3% year-to-date, supported by its strengths as a raw material exporting country and a shift to net buying by foreign investors. So-yeon Lee, a researcher at Korea Investment & Securities, said, "In April, the Jakarta Index fluctuated around the 7,200 level, repeatedly hitting record highs," and advised, "Investments should consider the overall index rather than concerns about the palm oil export restrictions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)