[Asia Economy Reporter Ji Yeon-jin] There is a company whose corporate value surged over 700% in just one month, recording the upper price limit eight times. That company is Hyundai Feed, which has posted the highest returns in the domestic stock market this year.

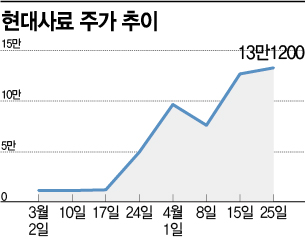

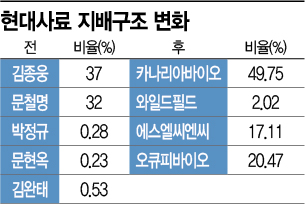

According to the Korea Exchange on the 28th, Hyundai Feed traded as high as 134,000 KRW during the session, up 8.59%. After hitting a 52-week high of 174,000 KRW on the 20th of this month, the stock had been declining but then rebounded. Hyundai Feed, which traded in the mid-10,000 KRW range earlier this year, surged starting from the 21st of last month and hit the upper price limit for seven consecutive days. This followed a disclosure that Hyundai Feed’s largest shareholders and related parties signed a contract to transfer 4,371,093 shares to Canario Bio and others for 100 billion KRW. Since then, the stock price has jumped 736.90% over the past month. The strong performance of Hyundai Feed’s stock on this day was also catalyzed by Canario Bio’s disclosure the previous day announcing the completion of the acquisition.

Canario Bio is the company formerly known as Duol Mulsan, which made headlines earlier this year by soaring 3,000 times on the over-the-counter market K-OTC. Duol Mulsan was spun off from Diarc, a KOSDAQ-listed company, and was relisted on K-OTC after Diarc was suspended from trading last year due to a disclaimer of opinion in its audit report. At that time, the stock price surged fueled by expectations for the U.S. Food and Drug Administration (FDA) Phase 3 clinical trial of ‘Oregovomab,’ an ovarian cancer treatment held by Duol Mulsan. The stock price, which was 107 KRW at the time of listing in September last year, soared to 300,000 KRW intraday on February 18 this year.

The surge in Hyundai Feed’s stock price is understood in the same context. With Diarc suspended from trading, expectations that Duol Mulsan would enter KOSDAQ through the acquisition of Hyundai Feed drove the stock price up. Additionally, the invasion of Ukraine by Russia caused grain prices to rise, raising expectations for improved performance in feed stocks, which also contributed to the stock price boost. The raw material for feed is grain, and Ukraine, the world’s largest wheat producer, missed the April planting season due to the Russian invasion, signaling a grain shortage crisis in the second half of this year. Jeon Woo-je, a researcher at Hanwha Investment & Securities, said, “Due to the activation of biofuel policies in the process of eco-friendly energy transition, global grain prices have already surged. Last year, grain production decreased by 11 trillion KRW due to cold waves and hurricanes in the U.S., and since Ukraine, which accounts for 12% of global grain exports, is currently under evacuation, production disruptions are expected in the second half of this year.” Hyundai Feed recorded a 666.45% increase this year up to the previous day, ranking first, followed by Hanil Feed at 459.28%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)