[Asia Economy Reporter Ryu Tae-min] It has been found that the apartment transaction fluctuation rate in the 1st generation new towns surged sharply after the presidential election. This is interpreted as the anticipation of the Special Act on the Redevelopment of 1st Generation New Towns, a key real estate pledge of President-elect Yoon Seok-yeol, being reflected in apartment prices.

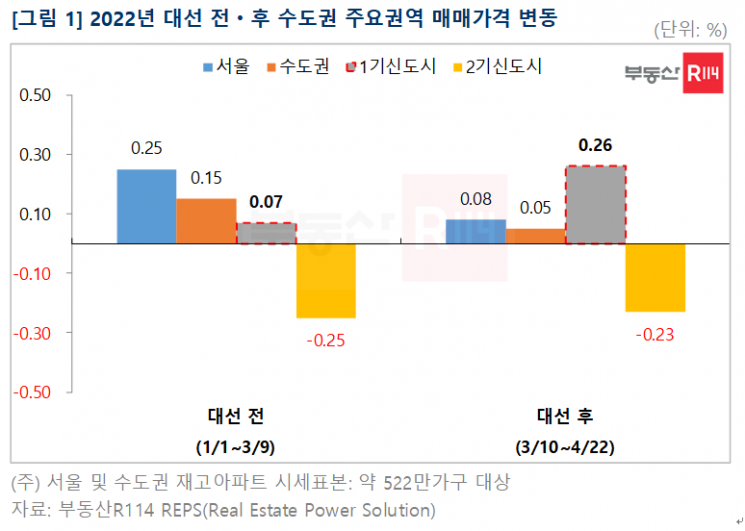

According to Real Estate R114 on the 27th, the 1st generation new towns rose by 0.26% over two months from March 10, after the presidential election, showing an increase more than three times higher. This contrasts with the minimal increase of 0.07% between January and March 9, before the election.

Among major metropolitan areas, the 1st generation new towns were the only region showing notable apartment price changes before and after the presidential election. Yongsan-gu, which attracted market attention due to the presidential office relocation, saw its increase rate decline from 1.15% to 0.39% during the same period. By region, the increase rates actually slowed down: ▲Seoul 0.25%→0.08%, ▲Gyeonggi 0.06%→0.03%, ▲Capital area 0.15%→0.05%. The 2nd generation new towns continued a weak trend with -0.25%→-0.23%, and Incheon also declined from -0.16% to -0.19%.

Among the 1st generation new towns, Goyang Ilsan New Town recorded the highest increase at 0.52%. This was followed by ▲Jungdong (0.29%), ▲Bundang (0.26%), ▲Sanbon (0.14%), and ▲Pyeongchon (0.12%). Based on average price per household, the order was ▲Bundang 1.25 billion KRW, ▲Pyeongchon 870 million KRW, ▲Ilsan 680 million KRW, ▲Sanbon 570 million KRW, and ▲Jungdong 560 million KRW. It is analyzed that demand from financially constrained buyers flowed mainly into new towns where loan regulations and price burdens are relatively lighter.

Meanwhile, the total stock of apartments in the 1st generation new towns was found to be 277,760 households. Bundang has the largest stock with 92,327 households, followed by ▲Ilsan (59,509 households), ▲Sanbon (42,412 households), ▲Pyeongchon (41,879 households), and ▲Jungdong (41,633 households). Currently, the average floor area ratio (FAR) of the 1st generation new towns is around 200%. If the FAR increases to 300-500% through the Special Act on 1st Generation New Towns, the total scale is expected to expand to about 400,000 to 500,000 households through redevelopment. In the mid to long term, this could result in an additional supply of 100,000 to 200,000 apartments in the metropolitan area.

Following the presidential election, price instability centered on the 1st generation new towns has led the Presidential Transition Committee to take a 'speed adjustment' approach. A Real Estate R114 official said, “The Presidential Transition Committee seems to be adjusting the pace of deregulation, and the pledge to abolish detailed safety inspections appears to be under full reconsideration. However, procedures such as strengthened safety inspections, considered a major obstacle to reconstruction, the reconstruction surplus profit recovery system, and the pre-sale price ceiling system are likely to be adjusted to fit market realities. Therefore, a phase of asset value re-evaluation is expected to continue, especially for old apartments in Seoul and the 1st generation new towns.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.