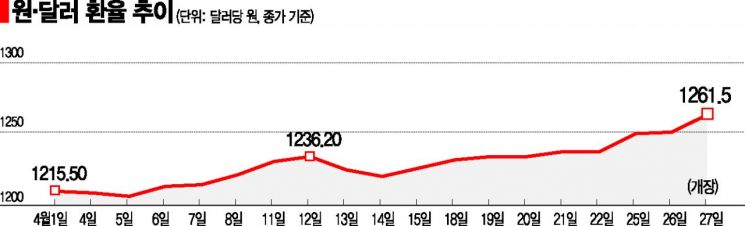

The 1250 Won Level Seen Above

May Now Become a Support Line

Volatility Likely to Increase Amid Continued Concerns Over Aggressive US Tightening

"Concerns That Exchange Rate Stimulates Inflation"

[Asia Economy Reporter Seo So-jung] "The lid has been opened."

On the morning of the 27th, as the won-dollar exchange rate soared sharply, traders in the foreign exchange market sighed deeply. The rate easily broke through the 1250 level, which was previously considered a strong psychological resistance line, and even touched the 1260 level, causing urgent reactions. One trader said, "We expected the exchange rate to rise, but the speed of the increase is steeper than anticipated," adding, "The 1250 level, which was seen as the upper limit, may now become a support level."

On that day, the won-dollar exchange rate opened at 1261.5 won, 10.7 won higher than the previous session, in the Seoul foreign exchange market. The dollar has continued to strengthen against major currencies amid the U.S. Federal Reserve's (Fed) monetary tightening, prolonged Ukraine war, and China's COVID-19 lockdown measures, which have increased risk aversion. The dollar index, reflecting the value of the dollar against six major currencies, surpassed the 102 level, reaching its highest point since March 2020.

The ultra-strong dollar continues due to external factors rather than internal supply and demand issues in the foreign exchange market, rendering verbal interventions by foreign exchange authorities ineffective. Despite the foreign exchange authorities' official verbal intervention on the 25th, the first in over a month since March 7, the upward trend was not curbed.

The market expects the won-dollar upward trend to continue for the time being. Oh Chang-seop, a researcher at Hyundai Motor Securities, said, "Until the Federal Open Market Committee (FOMC) meeting on the 3rd or 4th of next month (local time), concerns about aggressive tightening will persist, increasing exchange rate volatility," adding, "Since the 1250 level, previously expected as the upper limit for the first half of the year, has already been breached, the upward trend may intensify."

In particular, the Fed has made a 'big step' of raising the benchmark interest rate by 0.5% in May a foregone conclusion, and the possibility of a 'giant step' of a 0.75 percentage point hike in June has also been raised, rapidly spreading fears of tightening. Kim Seung-hyuk, a researcher at NH Futures, forecasted, "Due to the Fed's hawkish (monetary tightening preference) stance and strengthened risk aversion, upward pressure on the won-dollar exchange rate is inevitable for the time being."

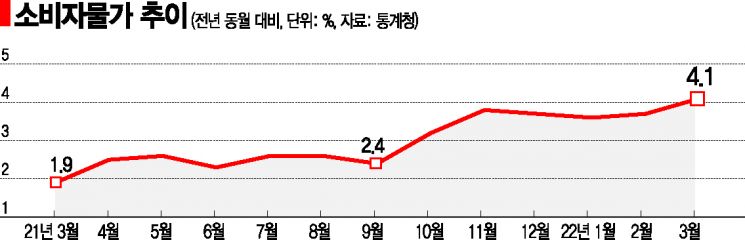

The problem is that the exchange rate could further stimulate already high inflation. Kim Jeong-sik, an emeritus professor of economics at Yonsei University, said, "International raw material prices purchased in dollars have risen significantly, and with the won exchange rate also rising, imports become more expensive domestically," adding, "A high exchange rate negatively affects inflation as well as the trade balance."

In fact, last month, the import price index hit a record high, rising more than 7% due to a sharp increase in international oil prices. According to the Bank of Korea, the import price index in March was 148.80, the highest level since statistics began in January 1971. It rose 7.3% from February, marking the largest increase in 13 years and 10 months since May 2008 (10.7%) during the financial crisis. Compared to the same month last year, it surged by 35.5%.

Previously, exchange rate increases positively affected exports, but the situation has changed recently. It is difficult to secure price competitiveness as the exchange rates of export competitors' currencies, such as China's yuan and Japan's yen, have also risen against the dollar. There are also numerous domestic and external obstacles, including the prolonged Ukraine crisis and regional lockdowns in China. Kang Sung-jin, a professor of economics at Korea University, stated, "Although the U.S. Fed plans aggressive rate hikes to curb inflation, factors such as the Ukraine crisis and China's economic slowdown are unlikely to be resolved in the short term, continuing to exert global inflationary pressure."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)