[Asia Economy New York=Special Correspondent Joselgina, Reporter Jeong Hyeonjin] "Sell." "Sell." "Sell."

Amid concerns about an economic slowdown and anxiety over the big tech (large information technology companies) earnings season, the New York stock market plunged sharply on the 26th (local time) ahead of earnings announcements from Microsoft (MS), Alphabet, and others. Investors, who had just experienced the 'Netflix shock' last week, flooded the market with 'sell' orders throughout the day without even seeing the earnings reports.

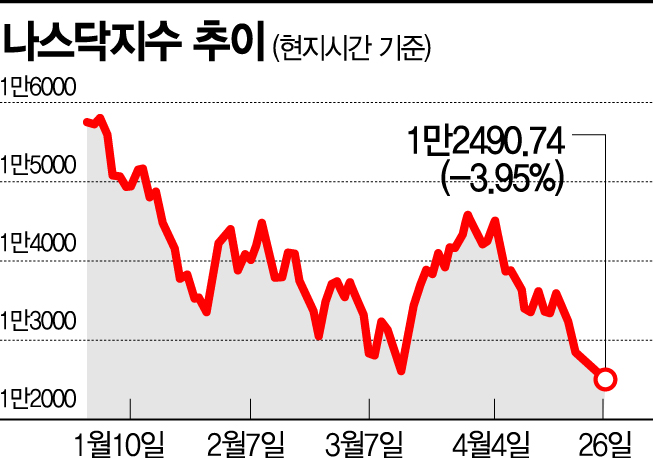

On this day, the Nasdaq index, which is tech-stock-centered, fell 3.95% compared to the previous session, hitting its lowest point since December 2020. The daily decline was the largest since September 8, 2020.

This is analyzed as a result of persistent caution throughout the day regarding the big tech earnings season, which increased selling pressure. There is concern that a situation similar to Netflix's, where growth expectations collapsed and the stock price plummeted 35% in one day, could be repeated. MS and Alphabet fell 3.74% and 3.59%, respectively. Apple (-3.73%), Meta (-3.23%), and Netflix (-5.48%) also slid consecutively.

There is also an assessment that the stock market plunge on this day reflected, albeit belatedly, the simultaneous adverse factors such as economic slowdown due to COVID-19 lockdown measures originating from China, the prolonged Ukraine crisis, and inflation concerns. Peter Bookba, Chief Investment Officer (CIO) of Blickley Advisory Group, pointed out, "There are many concerns about economic growth," adding, "China is a major customer of U.S. tech companies, and the semiconductor industry also conducts a lot of business there."

With the Federal Reserve (Fed), the central bank, signaling high-intensity tightening, investment sentiment in high-valuation growth stocks has significantly weakened, making damage inevitable if earnings are also poor. U.S. investment banks have already lowered target prices for big tech companies and recommended conservative investments.

Alphabet, which released its first-quarter earnings immediately after the market closed on this day, posted results below market expectations. Alphabet's first-quarter revenue was $68 billion, up 23% year-over-year, marking the lowest growth rate since the end of 2020. Net income was $16.4 billion, down 8.3% from the same period last year.

On the other hand, MS's earnings slightly exceeded market forecasts. Revenue increased 18% year-over-year to $49.36 billion, and net income rose 8% to $16.7 billion. Wall Street had anticipated that among the so-called big five tech companies, only MS would report an earnings surprise. Meta Platforms and Apple are scheduled to release earnings on the 27th, and Amazon on the 28th.

Voices predicting that the New York stock market's weakness will continue for some time are also growing louder. Morgan Stanley warned in a report that the S&P 500 index is preparing to enter a bear market, having fallen more than 20% from its previous high. This effectively signals further declines. Morgan Stanley's Chief Investment Officer Mike Wilson said, "Unfortunately, we have not yet seen the bottom." The Nasdaq index, already in a bear market, has fallen 12.2% just this month. In the same month, the S&P 500 index fell 7.8%, and the Dow Jones Industrial Average dropped 4.2%, respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.