Focusing on Customized Content for the Chinese Market

Characters Reminiscent of Son Ogong from Seoyugi

Introducing Numerous Chinese-Style Pets

Joint Distribution by Tencent and iDreamSky

Disappointing Results Contrary to Expectations

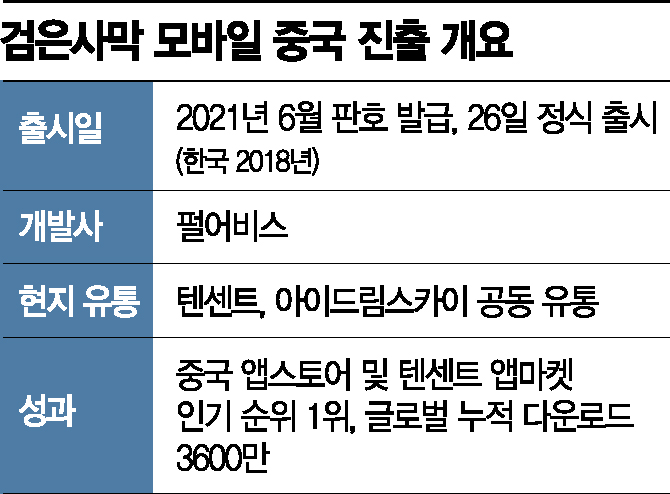

[Asia Economy Reporter Seungjin Lee] Pearl Abyss's 'Black Desert Mobile' has officially launched in the Chinese market. This is the first case since the 2017 Terminal High Altitude Area Defense (THAAD) incident where a Korean game received a license and was officially released in China. Although it garnered attention by ranking first in popularity (downloads), it recorded a disappointing 31st place in terms of revenue.

Ranked 1st in Popularity in China → 31st in Market Revenue

On the 27th, Pearl Abyss's Black Desert Mobile began its open beta test (OBT) in China, and it ranked 29th in revenue on the Chinese application (app) store, showing a disappointing performance contrary to expectations. It is the first time in about five years that a Korean game has ranked first in downloads in the Chinese market. It also ranked first in the Tencent app market 'TapTap' popularity rankings, leading the industry to evaluate that it could comfortably settle within the 'Top 5' in revenue rankings.

However, contrary to expectations, the results are disappointing. According to the mobile data platform Mobile Index, Black Desert Mobile appeared on the chart at 75th place in revenue rankings at 1 p.m. on the 26th and currently remains at 31st place. The revenue ranking is calculated every 10 minutes based on the ranking within 48 hours of release. Securities market forecasts are also negative. There is analysis that profitability will be adversely affected because a significant portion of revenue must be shared with the local Chinese publishing company.

Pearl Abyss focused on developing content tailored to the Chinese market. They introduced a new character reminiscent of Sun Wukong from Journey to the West for the first time and showcased many localized contents such as Chinese-style pets. China's largest game companies Tencent and iDreamSky jointly handled publishing (game distribution).

"Chinese Market Still Uncertain"

Although Pearl Abyss entered the Chinese market for the first time since the THAAD incident, the game industry is responding that "the Chinese market is still uncertain." This is because Chinese authorities are increasing regulatory measures on foreign games. The National Radio and Television Administration of China has completely banned streaming of online games without permission. This measure aims to block not only the service of foreign games but also their streaming.

Tencent is also joining in by discontinuing the VPN service 'Game Booster,' which has supported access to overseas games in China, starting from the 31st of next month. This is because the Chinese authorities classify playing games without a license as a "harmful fan culture."

Licenses for games developed by domestic developers are still not being issued. Among the 45 games listed in the newly issued license list announced by China on the 11th after nine months, there were no foreign game companies. Nexon received a license for Dungeon & Fighter Mobile in 2020 but was notified of a delay by Chinese authorities a day before its release. Netmarble's license application for Lineage 2 Revolution in 2017 is still pending issuance.

A game industry official explained, "Even if officially entering the Chinese market, most game companies have little expectation because it is impossible to know what measures might be imposed overnight," adding, "Competition among domestic game companies in the Chinese market is fierce, making it difficult for foreign game companies to approach."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)