On the 17th, visitors attending 'InterBattery 2022' held at COEX in Samseong-dong, Gangnam-gu, Seoul, are touring the SK On exhibition hall. Photo by Hyunmin Kim kimhyun81@

On the 17th, visitors attending 'InterBattery 2022' held at COEX in Samseong-dong, Gangnam-gu, Seoul, are touring the SK On exhibition hall. Photo by Hyunmin Kim kimhyun81@

[Asia Economy Reporter Myunghwan Lee] Amid the recent surge in raw material prices such as nickel and lithium affecting battery manufacturers, securities analysts have emphasized the need to focus on the spent battery recycling business.

On the 24th, KB Securities analyzed, "The sharp rise in raw material prices and interest rates translates into cost increase risks for companies."

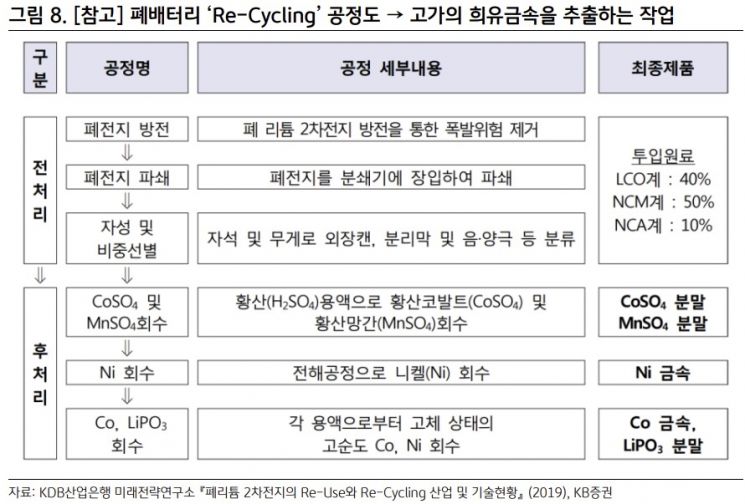

KB Securities pointed out that not only have raw material prices like lithium and nickel risen, but major raw material producing countries such as Russia, Ukraine, and China are experiencing supply chain disruptions due to war and lockdowns. They further analyzed that if securing raw materials in the battery sector becomes difficult, the 'spent battery recycling' process of extracting raw materials from used batteries is highly likely to gain attention.

KB Securities also emphasized the importance of focusing on corporate management strategies aimed at reducing costs in the battery sector. Rising interest rates and other factors lead to cost increase risks for companies, and it is highly probable that companies will adopt cost-saving methods through 'reuse and recycling.'

They cited the example of SpaceX, the space exploration company founded by Elon Musk, which recycles its launch rockets. Despite the enormous costs, SpaceX chose to produce rockets in-house, and Elon Musk devised the idea of reusing the rockets produced. Ultimately, SpaceX's space launch vehicle, Falcon 9, succeeded in relaunching more than 10 times, leading to a reduction in overall rocket launch costs since the 2000s.

In particular, KB Securities advised that South Korea should actively pursue battery reuse among major countries. Considering economic bloc formation and raw material price burdens caused by the US-China conflict and the Ukraine war, it is important to secure raw materials stably in the secondary battery sector. However, it was pointed out that while China’s electric vehicle battery company CATL can reliably source raw materials domestically, South Korea does not have such conditions.

They advised moving toward extracting rare metals through spent battery recycling to reuse in battery production and building energy storage systems (ESS) through spent battery reuse.

Hainhwan KB Securities researcher stated about spent battery recycling, "It is the reason why Korean automakers and secondary battery companies not only make their own efforts but also cooperate between companies, and why companies expanding their business or newly entering through financing are increasing. It is also likely the reason why the government is actively fostering this sector, and there is no doubt about this direction."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)