Financial Services Commission to Announce New Securities Guidelines Soon for Fractional Investment

Key to Securities Determination is 'Economic Substance'

Surge in NFT Issuance in Art Fractional Investment

Heightened Attention on First Securities Regulation Applied to Virtual Assets

[Asia Economy Reporter Ji Yeon-jin] As financial authorities have judged Musicow's copyright royalty claims as "securities," there is a high likelihood that new technologies using blockchain such as cryptocurrencies and NFTs (Non-Fungible Tokens) will also be subject to regulation.

According to financial authorities on the 21st, the Financial Services Commission plans to soon announce the "Guidelines on New Securities Businesses such as Fractional Investment" and recommend that other fractional investment operators review the securities nature of their businesses and take necessary actions according to the guidelines. The Financial Services Commission’s Securities and Futures Commission recognized Musicow's copyright royalty claims as securities the day before and deferred sanctions for six months on the condition that investor deposits be separately deposited in external financial institutions.

Although Musicow's copyright claims are issued and circulated similarly to securities, it was found to have conducted "illegal business" by prohibiting unauthorized business activities and imposing obligations such as submitting securities registration statements for investor protection, without applying the capital market law securities regulations. All members of the Securities and Futures Commission judged that Musicow's fractional investment profit rights, i.e., claims, are investment contract securities under the Capital Markets Act.

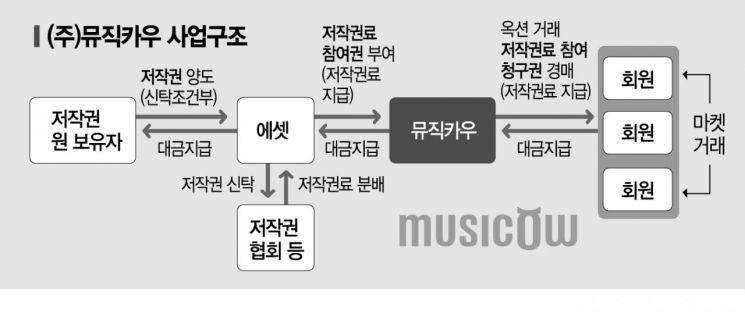

According to Article 4 of the Capital Markets Act, securities are classified into six types: debt, equity, profit, investment contracts, derivative-linked, and securities deposit. Investment contract securities are defined as ▲ contracts indicating rights to invest money or other assets in a joint business with other investors and third parties, ▲ rights to receive profits or losses based on the results of the joint business performed by others, and ▲ must have the purpose of earning profits or avoiding losses. Musicow’s business structure involves its subsidiary Musicow Asset purchasing copyrights from creators and entrusting them to the Copyright Association, then issuing fractional claims representing the right to receive distributed copyrights to investors. Investors can receive royalties from Musicow Asset’s business results or dispose of claims to gain capital gains, which corresponds to investment contract securities.

Similarly, NFTs and cryptocurrencies using blockchain technology, which have recently seen a strong investment boom, fall under this category. NFTs, which serve as digital certificates, use blockchain technology for distributed asset storage and are the most active field for fractional investment. In the case of fractional investment in artworks, platforms purchase expensive paintings and issue multiple NFTs. Investors earn profits through resale gains of the paintings or capital gains from disposing of NFTs, a structure similar to Musicow’s claim profit structure. A Financial Services Commission official stated, "Securities nature is judged by considering the 'economic substance' of investing money with the purpose of earning profits or avoiding losses," adding, "Fractional investments using new technologies such as blockchain and NFTs, as well as paper certificates, are recognized as securities and included in securities regulation targets. We are considering imposing a grace period for business restructuring."

Within the industry, expectations for institutionalization of alternative investment platforms and concerns about contraction of virtual asset investments coexist. Kang Sung-hoo, chairman of the Korea Digital Asset Business Association, said, "Fractional investment is a natural trend of the times," and added, "Since digital assets have both financial and physical attributes, if the Capital Markets Act based on traditional financial attributes is applied, it could hinder the creation of the industrial ecosystem. Therefore, it is necessary to separately establish systems suitable for digital assets."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.