Annualized Average Interest Rate 229% Extreme Usury

Exceeds Current Legal Maximum Interest Rate of 20%

Victims Subjected to Verbal Abuse and Threats

Experts Say "Smooth Funding Supply Needed for Low-Credit Groups"

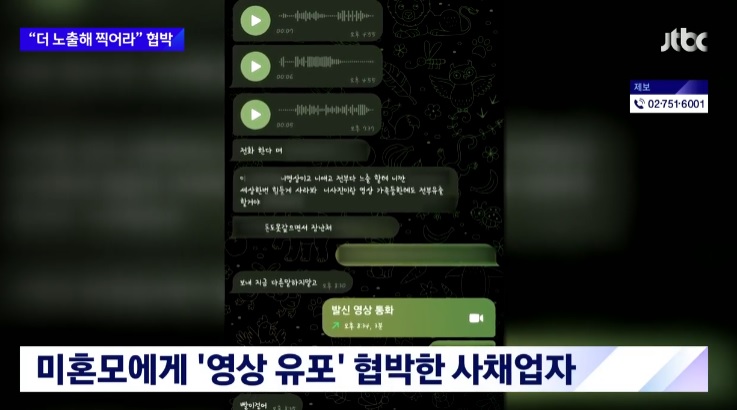

The police are tracking a group of illegal high-interest loan sharks who lent money to single mothers using sexually exploitative photos as collateral and threatened to distribute them if the principal and interest were not repaid on time. / Photo by JTBC Broadcast Capture

The police are tracking a group of illegal high-interest loan sharks who lent money to single mothers using sexually exploitative photos as collateral and threatened to distribute them if the principal and interest were not repaid on time. / Photo by JTBC Broadcast Capture

[Asia Economy Reporter Lim Ju-hyung] It has been revealed that financially marginalized groups relying on high-interest illegal loans are suffering severe damage, including various insults and threats. Loan sharks have committed heinous crimes against victims under the pretext of collateral and have also generated enormous profits by exploiting extreme usury structures.

According to 'JTBC' on the 19th, recently, illegal loan sharks have been increasing who lend money to single mothers by taking "nude videos" as collateral. They ask single mothers who urgently need money to send videos of themselves undressing, save these videos, and then lend money. If the principal and interest are not repaid on time, they threaten to spread the videos.

Additionally, these groups demanded victims to "bring someone who wants to borrow money." It is reported that they recruited victims in a multi-level marketing manner by promising to pay a referral fee of 60,000 won to single mothers who introduced people who would owe them debts.

The police are currently tracking and investigating the loan shark groups.

Illegal private loans charging interest rates exceeding the current legal maximum of 20% continue unabated. / Photo by Yonhap News

Illegal private loans charging interest rates exceeding the current legal maximum of 20% continue unabated. / Photo by Yonhap News

Illegal loan damage targeting financially marginalized groups who find it difficult to get loans from financial institutions is intensifying.

On the 18th, the Korea Credit Finance Association analyzed a total of 2,933 illegal loan transaction cases, including 1,517 damage complaints received last year and 1,416 cases referred by judicial authorities. The annualized average interest rate was 229%. The average loan amount of victims was 13.02 million won, and the average transaction period was 72 days.

Previously, the government lowered the legal maximum interest rate from 24% to 20% starting July last year. Accordingly, charging interest exceeding 20% is illegal. Financial companies and lenders who receive interest exceeding the current legal maximum interest rate may face imprisonment of up to three years or a fine of up to 30 million won, and the excess interest collected must be nullified and returned to the debtor.

However, as the number of low-income people suffering from the COVID-19 pandemic has increased, illegal financial lending targeting financially marginalized individuals continues to run rampant.

Victims were also exposed to verbal abuse and threats from loan sharks. According to the "Illegal Loan Damage Counseling" casebook published by the association, loan sharks typically engage in verbal abuse and threats or collect excessive interest by deducting interest in advance. There are also cases where victims are cursed at when they contact for negotiation.

Experts suggested that to prevent financially vulnerable people from falling victim to illegal loans, it is necessary to strengthen support policies for low-income financial services.

Lim Seung-bo, president of the Korea Credit Finance Association, said, "It is necessary to facilitate the supply of funds to low-credit financially vulnerable groups," adding, "Expanding support policies for excellent low-income financial lending companies will be necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)