$635.7 Billion Inflow into Short-Term Bond ETFs After US Interest Rate Hikes

Top Fund Inflow: 'KODEX Short-Term Bond PLUS'

Increased Volatility in Stock and Bond Markets Due to Rate Hikes

Interpreted as Cautious Capital Inflow Before Seeking Investment Destinations

[Asia Economy Reporter Hwang Yoon-joo] As the pace of tightening by major central banks around the world accelerates faster than expected, funds unable to find investment destinations are flowing into short-term bond exchange-traded funds (ETFs).

According to the Korea Exchange on the 20th, the ETF with the largest inflow of funds in the past month (March 17 to April 19) was ‘KODEX Short-Term Bond PLUS,’ which attracted 500.7 billion KRW. ‘TIGER Short-Term Monetary Stabilization Bonds’ also saw an inflow of 132.7 billion KRW, ranking ninth in terms of fund inflows.

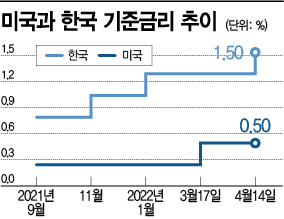

March 17 was the day the U.S. Federal Reserve (Fed) raised the benchmark interest rate by 0.25 percentage points for the first time in 3 years and 3 months. The difference is striking compared to last year. During the same period last year, the ETF with the highest fund inflow was ‘KODEX 200 Futures Inverse 2X,’ which attracted 353.4 billion KRW. This was followed by ‘TIGER Short-Term Monetary Stabilization Bonds’ (322.3 billion KRW) and ‘KODEX Short-Term Bond PLUS’ (152.6 billion KRW).

During this period, a total of 635.7 billion KRW flowed into short-term bond-related ETF products, an increase of 30.7% compared to 440.4 billion KRW in the same period last year.

Short-term bond ETFs appear to have become a ‘temporary stopover’ for investors. The reason money is gathering in short-term bond ETFs is that the faster-than-expected pace of interest rate hikes has increased volatility in both the stock and bond markets. The market is taking for granted a ‘big step’ (raising the benchmark interest rate by 0.5 percentage points at once) at the U.S. Federal Open Market Committee (FOMC) meeting scheduled for early May (3rd to 4th). Recently, analyses have emerged on how many ‘big steps’ might follow within the year.

The KOSPI fell 9.0% from 2,988.77 at the beginning of this year (January 3) to 2,718.89 on the previous day, and in the Seoul bond market, on the 11th, the yield on the 30-year government bond (3.146%) and the 3-year bond yield (3.186%) inverted for the first time ever. Although the 30-year bond has low representativeness as a long-term bond and low demand, the occurrence of the long- and short-term yield inversion for the first time caused a significant ripple effect.

In particular, the atmosphere in the bond market is deteriorating to the worst level. The recent three-month returns of government bond ETFs, which were low-yield but stable, have recorded negative returns. This is due to valuation losses caused by the benchmark interest rate hikes.

On the other hand, short-term bond yields are showing 0.1% to 0.3%. Jae-kyun Lim, a researcher at KB Securities, said, "Short-term bonds under one year are relatively less affected by bond valuation losses," adding, "Since both the stock and bond markets have been unfavorable recently, short-term investment funds are gathering into short-term bond ETFs."

Accordingly, there are signs of moves to newly launch short-term bond ETFs. Korea Investment Trust Management plans to newly list a short-term bond ETF in July. It is known that this ETF will include monetary stabilization bonds under one year and bank bonds.

An asset management industry official explained, "For ETFs, net asset size and market preemption are important," adding, "In a situation where stock market volatility has increased, competition among products that meet investment demand and market trends will become more intense."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.