37 Real Estate Listings in Financial Sector... Doubled in 2 Years

Building Area Alone 24,461㎡ Excluding Attached Land

More Than Half of Stores Concentrated in Seoul Metropolitan Area and Major Cities

Regional Banks and Mutual Finance Also Join 'Land Selling' Trend

With the acceleration of non-face-to-face and digital finance, the amount of 'bank land' put up for sale by the financial sector nearly doubled in two years last year. Despite warnings from financial authorities, banks are more actively pursuing cost-efficiency strategies by selling branches to convert them into cash.

Annual Increase in Sales of Bank Branches, Sub-branches, etc.

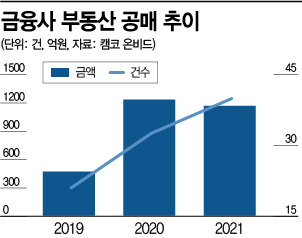

According to Onbid, a public asset disposal system operated by the Korea Asset Management Corporation (KAMCO), a total of 37 branches, sub-branches, and dormitories were announced for sale by domestic financial companies last year. This number has been increasing annually, with 19 in 2019 and 30 in 2020. The building area alone, excluding the attached land, amounts to 24,461㎡ (approximately 7,399 pyeong).

Onbid typically facilitates transactions where public institutions sell properties seized from tax delinquents or lease national assets. In addition, financial institutions such as banks and investment trust companies often put their real estate up for public auction.

The total minimum bid price for the items put up for sale was recorded at 116.09371 billion KRW, similar to the previous year's 121.253 billion KRW. Compared to 48.824 billion KRW in 2019, the scale of public auctions increased by 137.7%.

The bank most actively participating in public auctions was Woori Bank. Excluding duplicate items, Woori Bank attempted to sell 14 idle real estate properties. Starting with the Seonbu Central Branch in Danwon-gu, Ansan-si, Gyeonggi Province in February last year, other branches such as Galsan-dong, Wolpi-dong, Changwon Technopark, Pyeongchon Gwanak Town, Seongnam Southern Branch, and Suridong Branch were also listed. Additionally, dormitory properties located in Busan, Sokcho, Changwon, and Gumi were announced for sale.

The highest-priced item in the public auction was the Seongdong Financial Center in Seongdong-gu, Seoul, announced by NH Nonghyup Bank in November last year. The 1,041㎡ building was listed at 20.88 billion KRW. The Changwon Jungang-dong Branch in Seongsan-gu, Changwon, announced by KB Kookmin Bank in June last year, was priced at 11.777 billion KRW, and Woori Bank's Seongnam Southern Branch in Seongnam-si, Gyeonggi Province, was set at 10.5 billion KRW.

NH Nonghyup Bank had the largest scale of public auctions by amount. NH Nonghyup Bank put up five properties, including branches in Seoul and the Seongdong Financial Center, for a total of 37.915 billion KRW.

More than Half of the Branches for Sale Are in the Capital Area and Metropolitan Cities

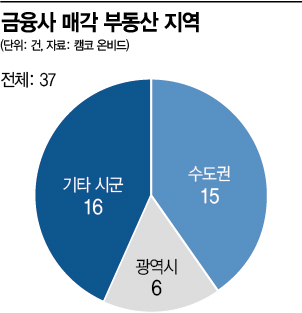

Most of the branches that financial companies are selling are located in the Seoul-Incheon-Gyeonggi capital area or large metropolitan cities. In terms of sales, they prioritized disposing of branches in large cities while leaving branches in small towns with lower profits. Among the 37 properties that financial companies attempted to sell, 15 were in the capital area. Adding six other metropolitan cities excluding Incheon, more than half, 21 locations (56.7%), were in large urban centers.

In the banking sector, it is difficult to reduce branches in small towns with poor transportation. Currently, banks conduct an 'impact assessment' involving external experts when consolidating or closing branches. This is to examine the impact of closures on customers and alternative measures. Since small towns have fewer branches, the negative effects of closures are inevitably significant. If a closure is decided, there is a high possibility of strong opposition from local residents or financial consumer groups.

The significant deterioration of the profitability structure of urban branches also influenced this trend. As the number of customers visiting counters sharply declined, even branches in large cities became unprofitable. A banking industry official said, "The capital area is heavily concentrated with financial institutions and competition among branches is fierce. Considering the costs and work environment of branches comprehensively, urban branches are not necessarily profitable."

Not only commercial banks but also regional banks and mutual finance institutions have started joining the trend of selling branches. DGB Daegu Bank announced the sale of the Manchon Woobang Branch (205㎡) in Suseong-gu, Daegu, for 839.97 million KRW. Sandong Nonghyup in Gumi, Gyeongbuk, also announced a public auction for the Jeoklim Branch (214㎡) at 7.12942 billion KRW.

Although financial authorities have strengthened regulations by introducing guidelines, the trend of decreasing bank branches continues. This is inevitable due to the development of non-face-to-face and digital finance. According to the Financial Supervisory Service, 19 banks reduced 311 branches last year, an increase from 304 in 2020.

Lee Hyung-gu, a researcher at the National Assembly Legislative Research Office, explained, "The Korean banking sector and supervisory authorities are improving and supplementing the fidelity of regulations through amendments to branch closure procedures and supervisory rules." According to current supervisory guidelines, banks must ▲ notify customers about branch closures and alternative measures three months in advance ▲ conduct internal analysis and external impact assessments regarding customer impact and alternatives ▲ disclose information related to branch openings and closures.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.