Following the presidential election, expectations for the easing of real estate regulations have grown, reviving housing transaction sentiment.

According to the "March 2022 Real Estate Market Consumer Sentiment Survey" released on the 15th by the Real Estate Market Research Center of the Korea Research Institute for Human Settlements, the nationwide housing transaction market consumer sentiment index last month was 113.1, up 4.6 points (p) from 108.5 in the previous month. This marks the second consecutive month of increase following the previous month.

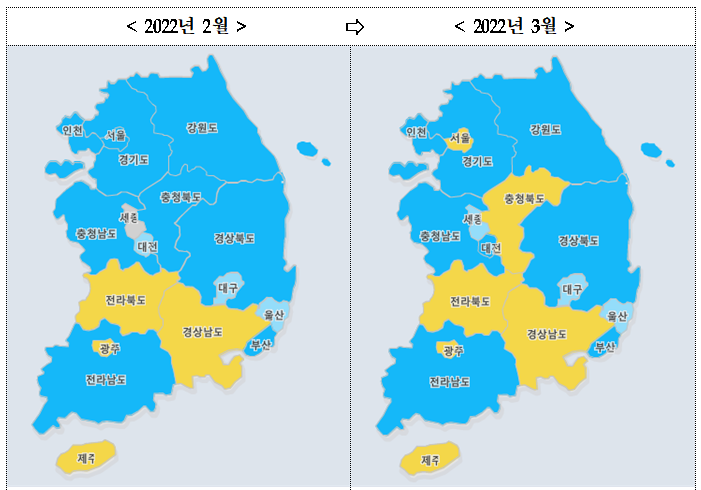

The Korea Research Institute for Human Settlements classifies the real estate market situation into three phases using the consumer sentiment index: rising (115 or above), stable (between 95 and less than 115), and declining (below 95).

In particular, Seoul's housing transaction market consumer sentiment index rose 9.6p from 105.9 in the previous month to 115.5, shifting from a stable phase to a rising phase for the first time in four months since November last year (118.8). Seoul also experienced two consecutive months of increase. The growing expectations for easing real estate regulations such as reconstruction after the presidential election, especially around major reconstruction complexes in Seoul, are analyzed to have influenced the rise in the index.

Gyeonggi Province's index increased from 108.0 in February to 113.1 in March, while Incheon fell from 114.2 to 110.2 during the same period. The entire metropolitan area rose from 108.1 to 113.5.

The index in provincial areas also rose from 109.2 to 112.5. In the provinces, Sejong's index increased from 89.1 to 104.7, moving from a declining phase since November last year to a stable phase after four months.

Sentiment in the jeonse (long-term lease) market is also recovering. Seoul's jeonse market consumer sentiment index slightly increased from 97.0 to 98.9.

Seoul's index has remained in a stable phase for five consecutive months, declining from 121.4 in September last year to 111.2 in October, then 104.9 in November, 96.2 in December, 96.2 in January this year, 97.0 in February, and 98.9 in March.

Gyeonggi Province recorded a continuous decline for four months from August to December last year with 121.6 → 120.5 → 110.8 → 104.3 → 97.7, but has risen for three consecutive months this year with 97.8 in January, 99.1 in February, and 102.5 in March. Incheon recorded 101.3, the same as the previous month.

The entire metropolitan area rose from 98.7 to 101.2, and nationwide, the index increased from 99.9 to 101.4, both recovering above the baseline.

Meanwhile, apartment prices are fluctuating significantly, mainly in Seoul's reconstruction areas and Gyeonggi Province's first-generation new towns. According to a survey by the Korea Real Estate Board, in Gangnam-gu, asking prices surged around reconstruction-promoting complexes, doubling the increase from 0.02% last week to 0.04% this week. Seocho-gu also saw two consecutive weeks of 0.02% increase, with record-high transactions in Banpo-dong.

In Gyeonggi Province, apartment prices in first-generation new towns, where reconstruction possibilities have been raised due to regulatory easing such as floor area ratio under the new government, increased. In Bundang, while the old downtown areas such as Jungwon-gu, Seongnam, fell by 0.04%, widening the decline from last week (-0.02%), Bundang-gu rose by 0.01% this week from stable last week as homeowners withdrew listings or raised asking prices amid reconstruction expectations. Goyang-si, home to Ilsan New Town, also shifted from two consecutive weeks of stability to a 0.01% increase this week.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.