[Asia Economy Reporter Lee Seon-ae] Although the Edison Motors consortium, which received a notice of termination of the investment contract for the acquisition and merger (M&A) of Ssangyong Motor, is expressing its intention to acquire Ssangyong Motor through successive lawsuits, it is facing difficulties in raising funds. With Edison EV undergoing delisting procedures, there is a growing outlook that finding new financial investors (FI) is virtually impossible due to the stringent investigations by financial authorities.

On the 14th, an industry insider familiar with financial authorities said, "Since the financial authorities are closely scrutinizing Edison EV, the view toward the Edison Motors consortium is negative," adding, "The success or failure of acquiring Ssangyong Motor depends on financial capability, and it will not be easy for new investors to join hands with Edison Motors."

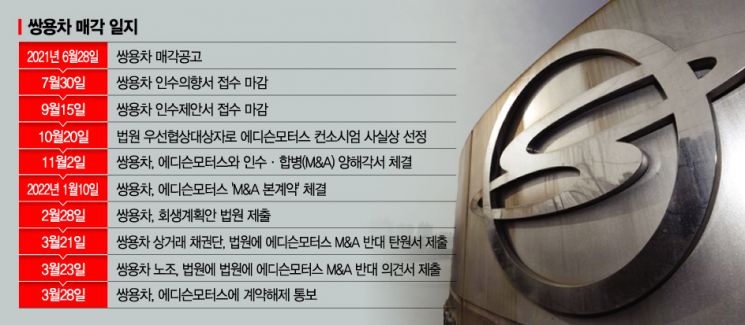

The Edison Motors consortium has shown its acquisition intention by entering into litigation against Ssangyong Motor and recruiting additional new investors in preparation for regaining the priority negotiation position for acquisition. They also sent a love call to Kumho HT as a new FI. However, Kumho HT took a step back, stating, "If the court accepts the lawsuit filed by Edison Motors, we will decide whether to participate (at that time)."

Moreover, the Edison Motors consortium has encountered the obstacle of Edison EV’s delisting. Edison EV was subject to delisting after receiving a disclaimer of opinion from auditors but ultimately failed to submit a 'Certificate of Resolution of Reasons' by the 11th, which would have indicated that the reasons for the disclaimer had been resolved. There is a 15 business day period (until May 2) to file an objection, and if no objection is filed, the delisting process will proceed. Edison EV is preparing to file an objection to the KOSDAQ Market Headquarters by next month’s 2nd regarding the delisting reasons, but this issue is seen as placing them at a disadvantage in the ongoing legal battle with Ssangyong Motor.

Earlier, Edison Motors filed a provisional injunction with the Seoul Central District Court on the 29th of last month, requesting suspension of the effect of the M&A investment contract termination, and on the 4th, filed a special appeal to the Supreme Court against the Seoul Bankruptcy Court’s decision to exclude its rehabilitation plan. On the 12th, they also filed a provisional injunction with the Seoul Central District Court against the Ssangyong Motor administrator to prohibit the sale process.

The fate of Ssangyong Motor hinges on this week. The Seoul Bankruptcy Court is expected to decide on whether to proceed with the resale of Ssangyong Motor and the method of sale based on the opinions of creditors and others as early as this week. Since the deadline for approval of Ssangyong Motor’s rehabilitation plan is less than six months away and multiple preliminary letters of intent have been submitted, the industry consensus is that the court is unlikely to reject the resale application. An industry insider said, "There is a high possibility that the court will side with Ssangyong Motor, so Edison Motors’ attempt to acquire Ssangyong Motor should be considered completely failed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.