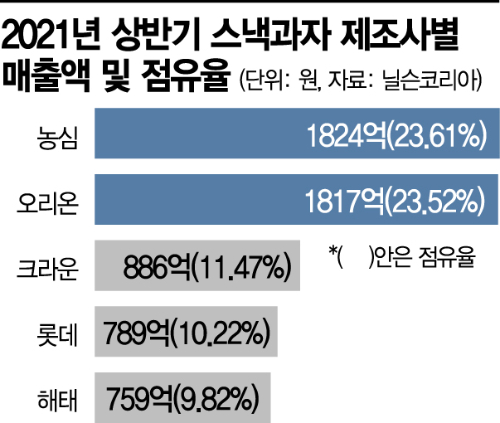

Market Share as of First Half of Last Year... Nongshim 23.6%, Orion 23.5%

Nongshim Leading with Kkang Series, Planning Outing-Focused Marketing

Orion Focusing on Texture Differentiation, Competing with Kkobuk Chip and More

[Asia Economy Reporter Eunmo Koo] The fierce competition for the top spot between Nongshim and Orion, the two giants in the domestic snack market, continues. Both companies maintain strong positions with traditional brands like ‘Saewookkang’ and ‘Pocachip,’ while Nongshim focuses on trend-reflective products and Orion emphasizes differentiated textures to expand their market shares.

According to Nielsen Korea on the 14th, as of the first half of last year, Nongshim and Orion’s snack sales amounted to 182.4 billion KRW and 181.7 billion KRW, respectively. Their market shares were 23.6% and 23.5%, combining for a total of 47.1%. While Nongshim and Orion occupy nearly half the market, Crown (11.5%), Lotte (10.2%), and Haitai (9.8%) are chasing the two companies.

The domestic snack market has steadily grown over the past few years. The snack market, which was worth 1.4829 trillion KRW in 2018, grew to 1.5763 trillion KRW in 2020, recording an average annual growth rate of 2.5% over three years. As the market shows growth, Nongshim and Orion are not satisfied with their duopoly and are accelerating lineup enhancements to expand their market shares.

Nongshim’s strategy is to strengthen its market position through new products that reflect trends, based on the solid popularity of its traditional brands. Steady sellers such as the Kkang series including Saewookkang and Gamjakkang, as well as Honey Twist, Potato Chip, and Banana Kick, continue to be popular, while new products considering consumer needs are steadily being introduced. Last year, Nongshim launched ‘Saewookkang Black,’ which added black truffle to Saewookkang, and earlier this year introduced ‘Petit Paris Roll Bread,’ a bakery dessert concept. Nongshim plans to conduct marketing themed around ‘snacks good for outings,’ anticipating more outdoor activities in the future.

Orion’s key focus for market penetration is differentiated ‘texture.’ The Kkobuk Chip, which Orion aims to develop as a global brand following Choco Pie, highlights its four-layer crispy texture as a selling point. The market has responded, with cumulative sales exceeding 200 billion KRW five years after its launch in 2017.

Orion also emphasizes unique textures in other products besides Kkobuk Chip. The Kwasa Chip, released last year, reduced the typical potato chip thickness of 1.3?3mm to 0.8mm, making it thinner, and earlier this year, they introduced the Daewang Oh! Gamja, which is more than twice the size of existing products, emphasizing a light, crumbling texture when chewed. The Noonul Gamja focuses on delivering a distinctive crunchy texture through vacuum frying technology at low temperatures.

The industry expects the snack market to continue growing steadily. This is because there is strong demand for popular and familiar-tasting snacks enjoyed by all ages, as well as light snacks suitable as side dishes. From the manufacturers’ perspective, the broad category of snacks can encompass a variety of flavors, from premium products to those with new textures and forms, and products emphasizing specific ingredients.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.