[Asia Economy Reporter Lee Seon-ae] Since the beginning of the year, the hot topic has been inflation. Due to the deepening global supply chain bottlenecks caused by China's lockdowns and rising wages, inflationary pressures remain high, and high price levels are expected to continue for the time being. Accordingly, the securities industry advises looking for investment opportunities in companies with strong pricing power. This investment strategy is clearly reflected in the approach of the world-renowned investor Warren Buffett.

According to NH Investment & Securities on the 14th, the U.S. Consumer Price Index (CPI) in March rose 8.5% year-on-year, marking the highest inflation level since 1982. Furthermore, the inflation forecast for April currently exceeds 8%, indicating that it will take time for prices to stabilize.

Researcher Ha Jae-seok of NH Investment & Securities stated, “Due to the recent spread of COVID-19 and lockdowns in China, the supply chain bottlenecks that have persisted since the pandemic are unlikely to be easily resolved,” adding, “Structural inflationary pressures such as wage increases are high, making it difficult to see a low inflation environment like the 1.8% average annual inflation rate of the 2010s for the time being.”

During the 1970s, when inflation was most severe, the real returns of earnings and stock prices of Standard & Poor’s (S&P) 500 companies were sluggish. By sector, upstream industries related to raw materials such as energy and mining, as well as materials like chemicals and steel, showed strength, while automotive and retail sectors underperformed. Researcher Ha suggested, “In such an environment, investments should be made in companies with high pricing power that can raise product prices above the inflation rate.”

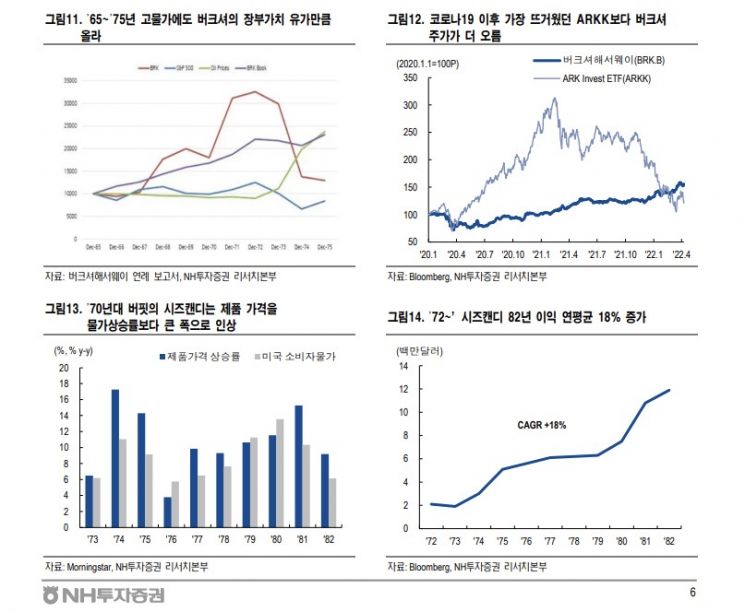

During the inflation period from 1965 to 1975, Warren Buffett’s Berkshire Hathaway book value growth rate consistently exceeded the rise in oil prices. Since the start of the COVID-19 pandemic in 2020, Berkshire Hathaway’s stock returns have outperformed Cathie Wood’s ARKK ETF, which was the hottest in 2020. This is because, in an inflationary environment, Berkshire Hathaway steadily increased product prices at a rate higher than inflation. See’s Candies, acquired by Buffett in 1972, consistently raised product prices well above the inflation rate. As a result, See’s Candies’ profits grew at an average annual rate of 18% from 1972 to 1982, surpassing inflation during the same period.

Consumer goods, energy, mining, and financial sectors with high pricing power can pass cost increases on to consumers. Mining and energy sectors, which recorded excellent stock returns in the 1970s, are industries where rising raw material prices directly translate into profit increases. Additionally, financial sectors also belong to this category during periods of rising interest rates.

Researcher Ha emphasized, “There is a quality indicator that can be used to assess a company’s pricing power,” explaining, “Quality scores related to ROE, ROA (profitability), and debt ratio (stability) show that high-quality companies tend to deliver superior long-term performance compared to the market.”

In the U.S. stock market, many well-known companies such as Apple, Coca-Cola, and Costco are considered high-quality (with high quality scores). However, high-quality companies tend to have high valuations, which has led to stock underperformance during recent periods of rising interest rates. Researcher Ha explained, “Combining quality with value could help offset this.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.