"It has reached its peak but remains persistently and frustratingly high." This was the assessment made by Jeffrey Gundlach, CEO of DoubleLine Capital and known as Wall Street's 'Bond King,' on the 12th (local time) following the release of the U.S. Consumer Price Index (CPI).

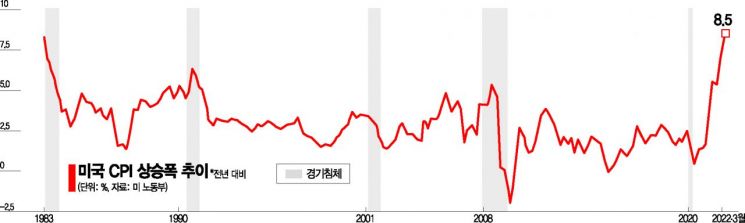

The March inflation data, which also reflected the impact of Russia's invasion of Ukraine, surged by a staggering 8.5% compared to a year ago, marking the largest increase since December 1981, as initially feared. Now, Wall Street's question boils down to one: Has U.S. inflation peaked?

◇ Wall Street Expresses Optimism on 'Inflation Peak'

Major investment banks including Deutsche Bank, UBS, and Morgan Stanley evaluated the March CPI released that day as the 'inflation peak.' This is because prices of used cars, previously considered a major driver of inflation, have started to decline, and signs of supply chain improvements have been confirmed. Additionally, the Federal Reserve (Fed), the central bank, has begun to concretely signal not only interest rate hikes but also the timing of balance sheet reduction, marking the start of a tightening stance, which is also seen as a background for future inflation easing.

Morgan Stanley highlighted that the March core CPI, excluding the volatile energy and food sectors, came in below expectations, suggesting the possibility of an inflation peak. The March core CPI rose by only 0.3% month-over-month, the lowest in six months. This was due to falling prices of major manufactured goods such as used cars.

Deutsche Bank stated, "Considering that the base effect from last year's surge in used car prices will begin to appear in the April data, the March CPI could be the peak." Andrew Hunter of Capital Economics said, "The notable point in the March report is that inflationary pressures are finally easing," and assessed that "it has peaked."

UBS, which accurately predicted the 8.5% rise in March CPI, forecasted that U.S. inflation has now peaked and will decline to 7.2% in May, 5.9% in August, and 4.5% in October. Reflecting this peak theory in the market, the yield on the U.S. 10-year Treasury note fell that day, and the year-end policy rate forecast in the futures market dropped from 2.59% to 2.42%. Fed Vice Chair nominee Lael Brainard emphasized the same day that "the core inflation falling more than expected is noteworthy," clearly indicating the intention to curb inflation through rapid future rate hikes.

◇ Skepticism: "Still Far Away" and Concerns Over Inflation Entrenchment

However, skeptics bring up the case when Fed Chair Jerome Powell and U.S. President Joe Biden dismissed last year's soaring inflation as 'transitory,' which turned out to be a misjudgment. They point out that at this point, their assessments have all been proven wrong. Even after the CPI release that day, international oil prices rose more than 6%.

Supply chain disruptions caused by the ongoing spread of COVID-19, such as the recent lockdown measures in Shanghai, China, continue. The prolonged Russia-Ukraine conflict also exerts upward pressure on inflation. Moreover, strong increases in housing costs, food, services, and wages are all evident, raising voices that inflation entrenchment should now be a concern. Since wage growth, which accounts for a larger share of corporate costs than energy, continues, it is premature to be confident about inflation slowing down.

Gundlach's remarks are also interpreted as suggesting such entrenchment. In an interview with CNBC that day, he said, "I think inflation is close to its peak," but also mentioned, "It has reached the peak but will remain persistently and frustratingly high." Bank of America (BoA) assessed that while March CPI peaked, "inflation could remain hot throughout the year."

Political debates surrounding inflation are expected to intensify ahead of the U.S. midterm elections. President Biden unveiled additional measures that day, including temporarily allowing the sale of high-ethanol-content gasoline to curb soaring oil prices.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)