[Asia Economy New York=Special Correspondent Josel Gina] "When the Federal Reserve (Fed) fights inflation, do not oppose the Fed."

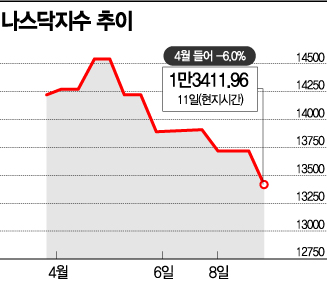

In an unusual situation where global asset markets, from stocks to bonds and crude oil, are simultaneously plunging, Ed Yardeni, chief of Yardeni Research, issued a meaningful warning on the 11th (local time). Amid rising upward pressure on inflation due to Russia's invasion of Ukraine, asset markets are facing a storm.

This aligns with the diagnosis of a U.S. investment firm that the global economy may be entering a 'war-cession' phase?a period of economic slowdown caused by war-induced supply shocks where inflation does not subside, rather than a typical recession. The inflation level expected by U.S. consumers has once again broken all-time records.

◇ "U.S. Inflation in March Will Be Extremely High" ... Possibility of Consecutive Big Steps

According to the March survey released by the New York Federal Reserve Bank on the 11th (local time), the median expected inflation over the next year was 6.6%. This is a 10% increase from the previous month (6.0%) and the highest figure since the New York Fed began the related survey in 2013. It reflects the inflation fears that sharply rose after Russia's invasion of Ukraine in February.

In particular, this announcement drew more attention as it came a day before the release of the U.S. Consumer Price Index (CPI) for March. Wall Street expects the March CPI to show an 8.4% increase compared to the same month last year. If so, it would be the largest increase since December 1981. White House Press Secretary Jen Psaki said at a briefing that "the previous report (February CPI) did not fully reflect the sharp rise in oil and gas prices caused by Russia's unjust invasion," adding, "March inflation is expected to be extremely high."

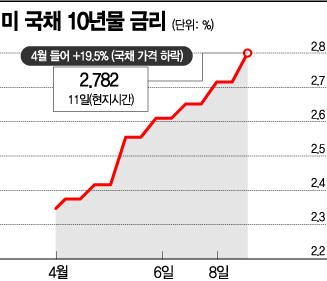

Such indicators are expected to further amplify inflation concerns and accelerate the Federal Reserve's monetary tightening moves. The Fed has already strongly warned that it will use all means and methods to curb inflation, which is at its highest level in 40 years.

Charles Evans, president of the Chicago Fed, said in a speech that day, "I do not support excessively rapid rate hikes," but noted that two 'big steps' of 0.5 percentage points each could occur within the year. Fed Governor Christopher Waller predicted, "Rate hikes could shock the economy." If the Fed, which has drawn its sword against inflation, underestimates the impact on financial markets, the aftershocks could inevitably grow larger.

Recently, a Reuters survey of 102 economists found that more than 80%, or 85 respondents, expected a big step at the May Federal Open Market Committee (FOMC) meeting. Additionally, 50% of respondents predicted another 0.5 percentage point increase in June following May. The possibility of a recession next year due to the Fed's tightening moves was estimated at 40%.

◇ Moody's "Perfect Storm Coming" ... Concerns Over Entry into War-cession

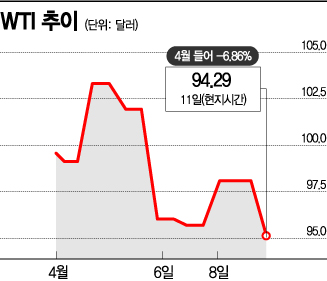

As Russia's invasion of Ukraine increases global economic uncertainty, soaring inflation is making solutions even more difficult. Wall Street voices concerns that the global economy may be driven into a war-cession?a recession compounded by war shocks.

David Roche, investment strategist at Independent Strategy, warned, "Financial markets are underestimating the possibility of a war-cession," cautioning that as Russia's invasion of Ukraine prolongs, the economy could face the unusual situation of soaring inflation amid recession. Unlike typical recessions where supply and demand decrease and inflation falls, in a war-cession, costs and inflation can both surge. He said, "Central banks are in a strange situation where they must choose between inflation targets and growth."

Moody's recently described the inflation trend as a "perfect storm" caused by Russia's invasion, China's COVID-19 lockdowns, supply chain disruptions, and accelerating wage increases.

Since the beginning of this month, with stocks, bonds, and crude oil all falling simultaneously, warning signals around the global economy have intensified. According to Bloomberg, as of the end of March, U.S. financial markets have seen stocks, bonds, and crude oil all decline together. This simultaneous decline is the first since October 2018. Robert DeLucia, chief economic advisor at Empower, said, "The common denominator is fear of recession."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.