March Seoul Apartment Sales 938 Cases... Increase After 8 Months

Apartment Prices Stable After 11 Weeks... Yongsan-gu Up 0.38% in One Month

Expectations for Market-Friendly Policies Like Reconstruction and Loan Regulation Easing

The volume of apartment transactions in Seoul has turned to an upward trend after 8 months. Prices have also stopped declining. The real estate market atmosphere has completely changed after the presidential election. The jeonse (long-term deposit lease) prices are also stirring as the moving season coincides with the resumption of bank loans. The fact that Yongsan-gu, where the presidential office is located, is the area with the highest increase in housing prices in Seoul after the election shows how quickly the real estate market reacts to the changed political landscape.

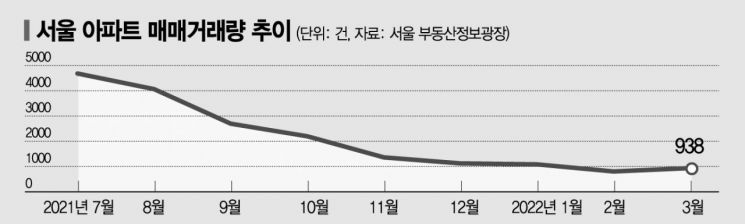

According to the Seoul Real Estate Information Plaza on the 11th, the number of apartment sales in Seoul last month was 938 as of that day. It had been decreasing for 7 consecutive months from August last year (4,064 cases) to February this year (805 cases), but reversed to an increase after 8 months. The number of apartment sales in Seoul in February was the lowest ever recorded since monthly statistics began in 2006, falling below 1,000 for the first time. Since then, it has rebounded due to the presidential election, and the market expects the number of apartment sales in Seoul last month to exceed 1,000, considering the 30-day registration deadline for sales contracts.

According to the Korea Real Estate Board survey on the 4th, Seoul apartment prices stopped declining and remained flat for the first time in 11 weeks. This is interpreted as reflecting expectations for the new government's market-friendly policies such as reconstruction and loan regulation easing, and temporary exclusion of heavy capital gains tax on multi-homeowners. In particular, the three Gangnam districts?Gangnam, Seocho, and Songpa?all turned to price increases within a month after the presidential election. Lim Byung-chul, head of the Research Team at Real Estate R114, explained, "As expectations for deregulation grew, apartment prices in Seoul rose mainly in areas with urban redevelopment (reconstruction) issues."

Especially, Yongsan-gu showed the largest increase in the past month. According to Real Estate R114 statistics, apartment prices in Yongsan-gu rose by 0.38% in the month following the presidential election, the highest increase in Seoul. Yongsan-gu has many favorable factors, including the relocation of the presidential office, the creation of Yongsan Park, development projects on the railroad maintenance depot and UN Command site, redevelopment of Hannam New Town, and the abolition of the 35-floor height limit along the Han River.

In recent transactions, Yongsan apartments have not only set new record prices but also seen asking prices jump by over 200 million KRW in just one month. At the end of March, the sale price of a 206.90㎡ unit at Nine One Hannam was 8.5 billion KRW, up 1.22 billion KRW from 7.28 billion KRW eight months ago in July last year. The asking price for a 109㎡ unit at Yongsan e-Pyeonhansesang, a newly built apartment near the Yongsan office, is currently 2.1 billion KRW, up 260 million KRW from last month's sale price of 1.84 billion KRW. The representative of nearby A Real Estate Agency expressed expectations, saying, "Since President-elect Yoon needs to achieve results during his term, the creation of Yongsan Park might proceed quickly."

In the rental market, the number of jeonse and monthly rental listings is decreasing due to increased rental demand during the spring moving season. According to Asil, the number of jeonse and monthly rental listings for Seoul apartments has decreased by 17.7% and 17.5%, respectively, in the past month. As the threshold for jeonse loans lowers again, prices are also stirring. On the 2nd, a jeonse contract was signed for 1.3 billion KRW (23rd floor) for an 84.98㎡ unit at Boramae SK View in Singil-dong, Yeongdeungpo-gu, Seoul, setting a record high price.

Some express concerns that the rental market may become unstable starting in August, when the two-year lease renewal rights expire for many jeonse and monthly rental units. This is because landlords, who were only able to raise prices by 5% over the past two years, may suddenly reflect four years' worth of increases at once, causing rental prices to soar abruptly.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.