Samsung Electronics announced on the 8th that it recorded third-quarter sales of 73 trillion won and an operating profit of 15.7 trillion won. This is the first time quarterly sales have exceeded 70 trillion won. On the same day, employees are seen moving around at Samsung Electronics' Seocho building. Photo by Moon Honam munonam@

Samsung Electronics announced on the 8th that it recorded third-quarter sales of 73 trillion won and an operating profit of 15.7 trillion won. This is the first time quarterly sales have exceeded 70 trillion won. On the same day, employees are seen moving around at Samsung Electronics' Seocho building. Photo by Moon Honam munonam@

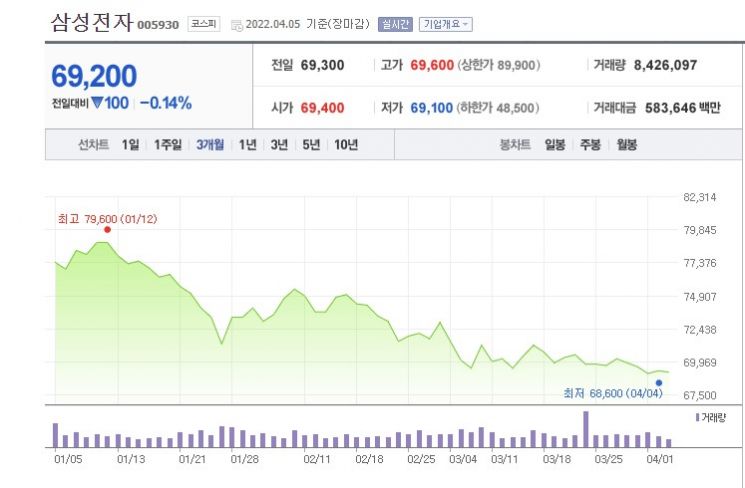

[Asia Economy Reporter Lee Seon-ae] Securities firms have shown mixed views on Samsung Electronics, which is trapped in the "60,000 won range." While the stock price has been sluggish, recently falling near a 52-week low during intraday trading, some have raised their target prices due to expectations of earnings improvement, whereas others have lowered them citing doubts about sustained growth and difficulties in a rebound.

On the 6th, IBK Investment & Securities announced it was raising Samsung Electronics' target price to 100,000 won, reflecting expectations of earnings improvement.

Kim Un-ho, a researcher at IBK Investment & Securities, analyzed, "The recent stock price decline fully reflects concerns about the DRAM market, and while a rebound in DRAM prices is unlikely, the downside is expected to be limited. We expect the NAND market conditions to continue their favorable trend through the second quarter."

He added, "We forecast that earnings improvement will continue from the first quarter as a bottom, and operating profit for 2022 is expected to reach 60 trillion won, indicating significant potential for stock price appreciation, hence the upward revision of the target price."

On the other hand, some perspectives question the sustainability of DRAM growth. Eugene Investment & Securities lowered Samsung Electronics' target price to 88,000 won. Lee Seung-woo, a researcher at Eugene Investment & Securities, stated, "Although the stock price is sluggish, the semiconductor market continues to perform well this year. However, considering inflation, interest rate hikes, and changes in consumption patterns post-COVID-19, it is uncertain whether DRAM growth will continue for the fourth consecutive year through next year." He added, "Especially, Samsung's technological capabilities and future prospects are currently under question. Nonetheless, since the current stock price is near the lower bound of this year's estimated price fluctuation range, there is a high possibility of stock price increase in the second to third quarters."

Sangsangin Securities also lowered Samsung Electronics' target price to 77,000 won, citing unfavorable external environments due to geopolitical risks, negative reputation from the GOS (Game Optimizing System) issue, and emerging doubts about competitiveness in non-memory foundry. Kim Jang-yeol, a researcher at Sangsangin Securities, forecasted, "The stock price is struggling not only to stabilize at 80,000 won but even at the 70,000 won level. The consensus operating profit of around 13 trillion won for the first quarter is unlikely to significantly impact the stock price." He continued, "The practical target for the time being is to stabilize at 70,000 won. If macro issues show no signs of resolution and internal issues make no concrete progress, the stock price could fall below the mid-60,000 won range in the short term." However, he noted, "If macro issues gradually resolve without further deterioration and internal issues become visibly resolved, there is sufficient potential to restore the stock price to the 80,000 won range. But to increase the stock price beyond that, meaningful mergers and acquisitions (M&A) or significant steps to narrow the gap with key competitors like Apple and TSMC must be prerequisites."

Currently, Hanwha Investment & Securities has raised Samsung Electronics' target price to 110,000 won, while Hyundai Motor Securities and Kiwoom Securities maintain it at 100,000 won. DB Financial Investment newly set a target price of 100,000 won, and Shin Young Securities newly set it at 96,000 won. Hi Investment & Securities maintains 94,000 won, and BNK Investment & Securities newly set it at 87,000 won.

Meanwhile, Samsung Electronics closed at 69,200 won the previous day. Starting the year in the 78,000 won range, Samsung Electronics' stock price has continued to decline, breaking below 70,000 won on the 8th of last month and becoming trapped in the "60,000 won range." On the 4th, it fell intraday to 68,600 won, marking the lowest level this year. This is close to the 52-week low of 68,300 won. The last time Samsung Electronics recorded a closing price in the 68,000 won range was on October 13 of last year (68,800 won).

The steepest rise in Samsung Electronics' stock price was from January 2016 to October 2017, with an increase of about 164%. At that time, the surge in demand for server DRAM and 3D NAND due to large-scale global data center expansions led by AWS resulted in record annual earnings, which drove the stock price up. After a sharp drop due to the COVID-19 outbreak, Samsung Electronics rose 114% from March 2020 to January 2021, marking the second-highest increase in history. However, last year, Samsung Electronics' stock price fell by 3.3%, underperforming the KOSPI (3.6%) by 7%. In the first quarter of this year, it also declined by 11.1%, continuing to lag behind the KOSPI (-7.4%).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.