Securing Investment Funds Key for Three Battery Companies

Samsung SDI's Financial Soundness 'Solid'

SK On Completes First Half Pre-IPO

[Asia Economy Reporter Oh Hyung-gil] As the three 'K-Battery' companies announced multi-trillion won investment plans to dominate the electric vehicle battery market, their financing capabilities have emerged as a key variable in territorial expansion.

From independent production plants to joint ventures with automakers, these three companies are fiercely competing worldwide in North America, Europe, China, and other regions. Their ability to secure stable funding is expected to be crucial in securing market leadership.

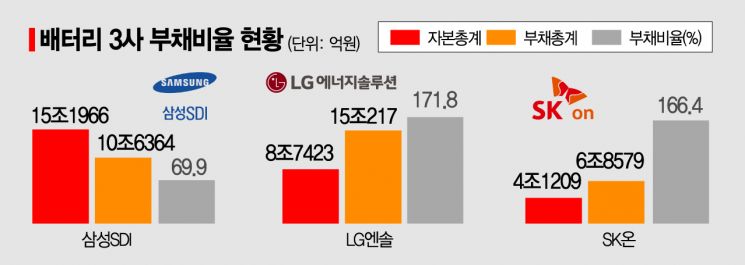

According to the business reports released on the 4th by LG Energy Solution, Samsung SDI, and SK On, as of the end of last year, Samsung SDI's capital stood at 15.2 trillion won. Of this, debt amounted to 10.6 trillion won, resulting in a debt ratio of 70%. This is the lowest debt ratio among the three battery companies and the only one where debt is less than capital.

LG Energy Solution has capital of 8.7 trillion won but debt of 15 trillion won, with a debt ratio reaching 172%. SK On also recorded a debt ratio of 166%, with capital of 4.1 trillion won and debt of 6.8 trillion won.

Considering Samsung SDI's debt ratio, it can be interpreted that despite relatively conservative investments compared to competitors, a significant portion of investment costs has been self-financed.

On the 17th, visitors attending 'InterBattery 2022' held at COEX in Samseong-dong, Gangnam-gu, Seoul, are examining batteries for electric scooters at the Samsung SDI booth. Photo by Hyunmin Kim kimhyun81@

On the 17th, visitors attending 'InterBattery 2022' held at COEX in Samseong-dong, Gangnam-gu, Seoul, are examining batteries for electric scooters at the Samsung SDI booth. Photo by Hyunmin Kim kimhyun81@

The electronic materials division is considered the foundation. Samsung SDI's electronic materials division produces semiconductor material EMC and display material polarizing films, recording sales of 2.6063 trillion won and operating profit of 530 billion won last year. Although sales (10.9469 trillion won) are significantly lower than those of the energy solutions division engaged in the battery business, operating profit (537.6 billion won) is a comparable 'cash cow.'

A Samsung SDI official said, "We have utilized cash reserves and profits from key businesses such as electronic materials to fund investments in the battery sector," adding, "As investments prepared so far begin in earnest this year, we will secure profitability and growth based on technological competitiveness."

Samsung SDI has been continuously investing about 2 trillion won annually in the electric vehicle battery business. Currently, batteries are produced at the Ulsan plant (9GWh), G?d in Hungary (24GWh), and Xi'an in China (8GWh).

Additional expansions are becoming visible this year. With investment in expanding the Hungarian plant, production capacity will increase to 37GWh this year, and when the second plant under construction starts operation, capacity is expected to expand to 67GWh by 2025.

The joint venture with the American automaker Stellantis is also planning to finalize the investment location in the U.S. soon and begin factory construction. The joint plant aims to produce battery cells and modules at a scale of 23GWh starting in the first half of 2025. Expansions are also underway in Ulsan and China, with total battery production capacity expected to reach 114GWh by 2025.

On the 17th, visitors are touring the Samsung SDI exhibition hall at 'InterBattery 2022' held at COEX in Samseong-dong, Gangnam-gu, Seoul. Photo by Hyunmin Kim kimhyun81@

On the 17th, visitors are touring the Samsung SDI exhibition hall at 'InterBattery 2022' held at COEX in Samseong-dong, Gangnam-gu, Seoul. Photo by Hyunmin Kim kimhyun81@

Considering that the electric vehicle battery business is a growth industry where initial investment is crucial, there is a view that interpreting the relatively high debt ratios of LG Energy Solution and SK On as poor financial health is an overstatement. For example, LG Chem, a representative chemical company, has a debt ratio of about 120%, which is not significantly different when simply comparing numbers.

To ease financial burdens, joint ventures with automakers or attracting funds from investors are actively underway. SK On is preparing a pre-IPO investment contract to secure investment funds. The contract amount is expected by the market to reach 3 to 4 trillion won.

Kim Jun, Vice Chairman of SK Innovation, said at last month's shareholders' meeting, "Since we are in negotiations for a pre-IPO, it is not appropriate to mention the amount, but it is not significantly different from the figures reported in the media," adding, "We expect the contract to be finalized within the first half of the year."

An industry insider said, "Although the debt ratios of the three battery companies may differ immediately, considering the characteristics of the battery business where investment is important, all three should be regarded as having stable financial health."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)