At the End of 2021, Loan Proportion for People in Their 60s Increased Sharply Compared to Pre-COVID

Likely Chose Entrepreneurship as Employment Became Difficult

With Declining Repayment Ability, Risk of Default May Rise if Interest Rates Increase

Need to Strengthen Risk Monitoring

The prolonged COVID-19 crisis has deepened the worries of small business owners and self-employed individuals. A closed store in Myeongdong, Seoul. Photo by Mun Ho-nam munonam@

The prolonged COVID-19 crisis has deepened the worries of small business owners and self-employed individuals. A closed store in Myeongdong, Seoul. Photo by Mun Ho-nam munonam@

[Asia Economy Reporter Sim Nayoung] Kim Bong-geon (63), who lives in Jungnang-gu, Seoul, opened a twisted doughnut (Kkwabaegi) chain store in his neighborhood last November. After retiring in his 50s, he worked as an apartment security guard but lost his job due to being pushed out by younger people. He decided, "Before I get any older, my only answer is to run my own business." He said, "Despite the COVID-19 situation, Kkwabaegi is a snack, and the operating hour restrictions did not have much impact, so I thought it wouldn't fail," adding, "I used my severance pay saved in my bank account and took out a bank loan to open the store." The problem is that the unit price is too low, and Kkwabaegi shops that were once trendy are closing one by one. Kim said, "One piece costs 500 won, and no matter how many I sell, after material costs and rent, the remaining money is only about 50,000 won per day, and my body is too tired because of my age," and confessed, "The Kkwabaegi trend is also fading, so I should have researched more before starting the business, but now I am wondering whether I should continue this business."

Since the COVID-19 outbreak, loans to elderly self-employed individuals have increased more than those to young and middle-aged groups. It is analyzed that the elderly have relatively lower ability to repay money compared to other age groups, raising the risk of loan defaults among them.

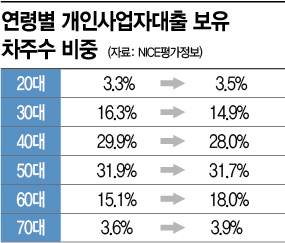

While the proportion of self-employed in their 30s decreased from 16.3% to 14.9%,

the proportion of self-employed in their 60s increased significantly from 15.1% to 18.0%

According to the ‘Proportion of Personal Business Loan Borrowers by Age’ compiled by NICE Information Service on the 4th, compared to the fourth quarter of 2019 just before the COVID-19 outbreak, the proportion of borrowers in their 60s among personal business loan holders increased significantly from 15.1% to 18.0% in the fourth quarter of 2021. Those in their 70s also slightly increased from 3.6% to 3.9%. In contrast, the proportion of those in their 30s decreased from 16.3% to 14.9%, those in their 40s from 29.9% to 28.0%, and those in their 50s from 31.9% to 31.7%. Kim Young-il, head of the NICE Information Service Research Center, warned, "Risk monitoring for borrowers aged 60 and above should be strengthened," adding, "With future interest rate hikes, the risk of default among them is likely to increase."

The reason for the increased loan proportion among business operators in their 60s appears to be aging. Unlike younger people who can enter the job market, the elderly find it difficult to find other options except starting a business. According to the Bank of Korea’s report on ‘Employment Status of Self-Employed by Characteristics after COVID-19,’ the number of self-employed in their 60s increased by 4.1% from before to after COVID-19 (February 2020 to April 2021). This contrasts with the 40s and 50s age groups, which recorded -5.4%, and the 30s with -3.6%. During the same period, the population growth rate was 6.6% for those in their 60s, -0.6% for those in their 40s and 50s, and -2.1% for those in their 30s. The Bank of Korea explained, "With the increase in retirement age during the COVID-19 situation, many entered self-employment."

16.7% of all self-employed households are running at a loss

By industry, the risk of default is expected to increase in face-to-face service sectors such as travel and transportation, and accommodation and food services. According to the growth rate of credit card approval performance by industry (Statistics Korea), travel and transportation decreased by 51.5% in 2020 and 47.1% in 2021 compared to 2019. Accommodation and food services also decreased by 14.3% in 2020 and 15.8% in 2021. In contrast, non-face-to-face services increased by 24.8% in 2020 and 51.1% in 2021.

The Korea Institute of Finance stated, "As of December 2021, it is estimated that 16.7% of self-employed households with loans are running at a loss," adding, "Their loans amount to 177 trillion won, accounting for 36.2% of the total debt of self-employed households." Financial experts emphasize the need for preemptive crisis response to prevent latent defaults from erupting all at once as COVID-19 support ends. The Presidential Transition Committee is promoting the establishment of a ‘bad bank,’ a special fund to manage non-performing loans and support debt restructuring.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.