Oil Market Monitoring Team Announces Investigation Results

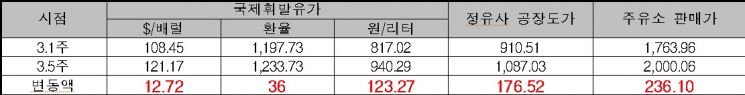

Figures for Week 5 of March Compared to Week 1 of March

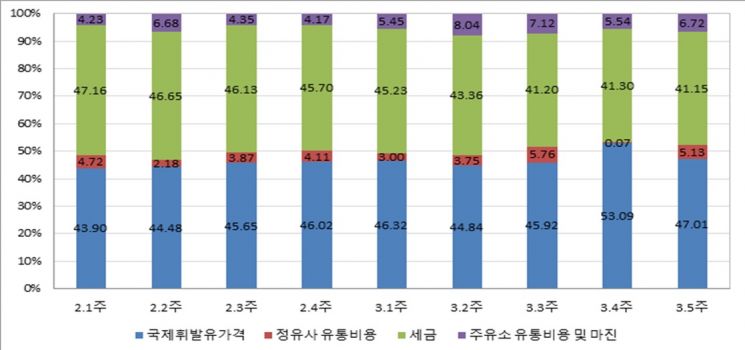

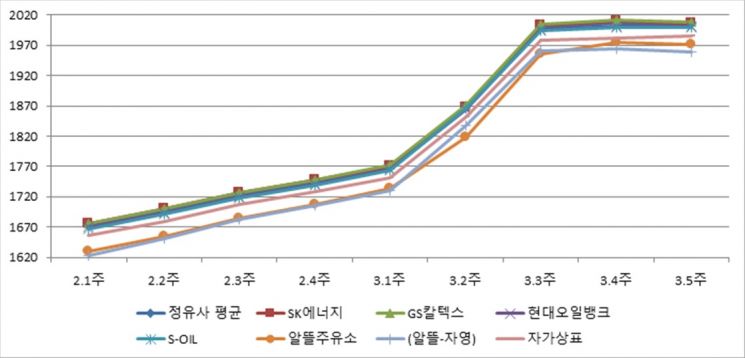

Data Surveyed Over 9 Weeks from Week 1 of February to Week 5 of March

[Asia Economy Reporter Moon Chaeseok] Amid the surge in international oil prices last month due to Russia's invasion of Ukraine, it has been pointed out that the price increase at refineries for gasoline (?176.52 per liter) was 44% higher than the rise in international oil prices (?123.27 per liter).

The increase in gasoline prices at gas stations, which consumers feel more directly (?236.1 per liter), was found to be 92% higher than the rise in international oil prices. This means gas stations effectively raised prices nearly twice as much as the international oil price increase. Generally, fluctuations in international oil prices are reflected in domestic gas station gasoline prices about two weeks after importation.

The Energy and Oil Market Monitoring Group, a civic organization that monitors gasoline prices, released an analysis of last month's gasoline market on the 4th. The analysis compared gasoline prices at domestic refineries and gas stations with domestic and international oil prices, divided into the first and last weeks of last month and the period from early February to the end of March.

Comparison of Domestic and International Oil Price Fluctuations in March. (Source: Oil Market Monitoring Team)

Comparison of Domestic and International Oil Price Fluctuations in March. (Source: Oil Market Monitoring Team)

First, looking at the price trends from the first to the last week of last month, the international gasoline price rose from ?817.02 per liter to ?940.29 per liter, an increase of ?123.27. During the same period, refinery prices (pre-tax) rose from ?910.51 to ?1087.03 per liter, an increase of ?176.52, and gas station prices (pre-tax) increased from ?1763.96 to ?2000.06 per liter, a rise of ?236.10. While international oil prices rose by ?123.27 over the month, refinery prices increased by ?176.52 and gas station prices by ?236.1.

Even excluding variables such as fuel taxes passed on in prices, the monitoring group pointed out that the magnitude of fluctuations between refineries, gas stations, and international oil prices differed. From the first to the last week of last month, the total increase difference between international gasoline prices and pre-tax refinery prices was ?44.19, but the total decrease difference was ?97.44, meaning that overall, refinery price increases were ?53.25 higher than international oil prices.

According to the monitoring group, the total increase in international gasoline prices was ?245.82, while the pre-tax refinery price increase was ?201.63. The ratio of international gasoline price to refinery price was about '1:0.82'. On the other hand, the decrease in international gasoline prices was ?122.55, but the pre-tax refinery price decrease was only ?25.11, a ratio of '1:0.2'. In other words, although refineries raised prices less than international oil prices, the price decreases were not properly reflected, resulting in an overall price increase that also affected gas station prices.

This pattern was similarly applied to gas station prices. During the same period, the total increase in international gasoline prices was ?245.82, and the gas station price increase was ?237.97, a ratio of '1:0.97'. However, the decreases were ?122.55 and ?1.87 respectively, a ratio of only '1:0.015'.

The monitoring group explained that the proportion of international gasoline prices in gas station selling prices is overwhelmingly larger than the distribution costs and margins claimed by refineries and gas stations. Although the tax proportion is not small, the argument that distribution costs and expenses force a significant increase in gasoline prices is somewhat unconvincing.

Looking specifically at the composition of gasoline prices consumers actually pay, international gasoline accounts for 46.36%, taxes 44.21%, refinery distribution costs and margins 3.62% (?66.13 per liter), and gas station distribution costs and margins 5.81% (?107.12 per liter).

The monitoring group even pointed out that price differences exist between refineries and among gas stations by region.

By refinery, GS Caltex recorded the highest prices for 6 out of 9 weeks from the first week of February to the last week of last month. Hyundai Oilbank had the lowest prices for 5 weeks. The largest difference between the highest and lowest prices was ?171.05 per liter in the first week of February, and the smallest was ?61.4 in the third week of last month. Regarding price differences among gas stations by refinery, GS Caltex was the most expensive throughout the 9 weeks. The average difference between the highest and lowest prices was ?47.8 per liter. The largest difference between the highest and lowest prices over 9 weeks was ?52.8 per liter in the first week of February.

By region, Jeju Island was the most expensive last month with an average price of ?2005.35 per liter, while Gwangju was the cheapest at ?1903.07 per liter. The difference between the highest and lowest prices by region was as much as ?102.27 per liter.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)