Asia Economy-Samsung Securities Individual Investor Survey '15,768 Participants, 100% Response Rate'

7 out of 10 View Domestic Stock Market Conservatively...Increase in Overseas Stock Investment by Seohak Gaemi Expected

[Asia Economy Reporter Lee Seon-ae] "It will be difficult for the Korean stock market to recover from the Korea discount. Increasing the proportion of overseas stocks over domestic stocks and investing long-term is the way to generate profits."

"Our country lacks systems to protect the rights of individual investors. The domestic stock market can only develop if these systems are improved and unfair practices are eradicated."

"You say the KOSPI will reach 3000 in the second quarter? I think it will fall back to the 2600 range." Individual investor A, who participated in the 'Samsung Securities Untact Conference' held on the 26th of last month, expressed a pessimistic view on the stock market in the second quarter. Few individual investors expected a KOSPI recovery.

While the securities industry predicted a recovery cycle by setting the upper band of the KOSPI forecast for the second quarter at an average of 2950, individual investors viewed this somewhat conservatively. Those who judged it difficult to overcome the 'Korea discount' due to the absence of systems protecting individual investor rights and unfair trading practices showed more interest in the 'overseas stock market' than the 'domestic stock market' and planned to increase their overseas investment ratio. This is the result of a survey conducted by Asia Economy targeting 15,768 individual investors (100% response rate) who participated in the 'Samsung Securities Untact Conference' regarding their outlook and investment plans for the second quarter stock market.

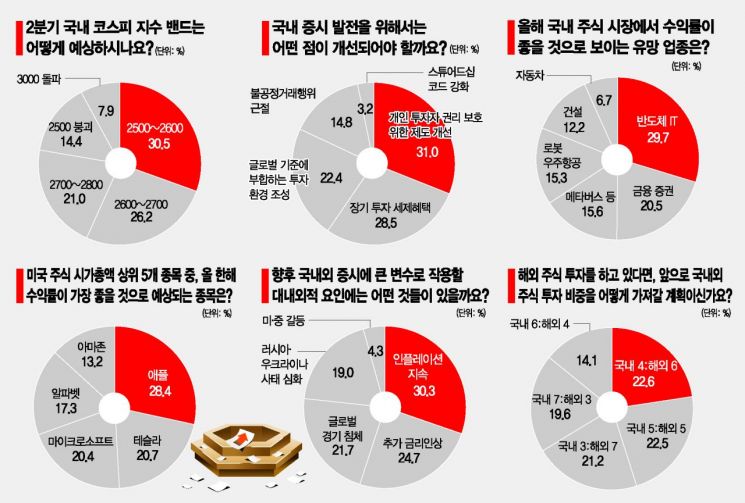

◆ 7 out of 10 are 'conservative' and disappointed with the Korea discount= According to the survey on the 4th, 4,808 individual investors (30.5%) answered that the KOSPI would remain in the 2500-2600 range, and 4,126 (26.2%) said 2600-2700 in the second quarter. Next, 3,309 (21.0%) expected 2700-2800. This means that 7 out of 10 view the domestic stock market conservatively. Only 2,274 (14.4%) were extremely pessimistic, expecting the 2500 level to collapse, while optimistic investors expecting the KOSPI to surpass 3000 were fewer at 1,251 (7.9%).

This is somewhat different from the securities industry's second-quarter outlook. The securities industry expected volatility in the KOSPI in April but anticipated a market recovery. This judgment is based on the view that negative factors such as the US Federal Reserve's interest rate hikes and market adjustments were already reflected in the first quarter (January-March) index. Most expected the range to be around 2800. Moreover, looking beyond April to the entire second quarter, securities firms' average forecast is in the mid-2900s, even higher.

Why do individual investors view the domestic stock market conservatively? The 'Korea discount' is firmly rooted in their minds. The reason they raise voices for various system improvements and show collective movements such as the 'Save KOSPI Movement' is to resolve the undervaluation of the Korean stock market.

This was clearly revealed in the survey. The most common response (4,894 people, 31.0%) regarding what needs to be improved for the development of the domestic stock market was the improvement of systems to protect individual investor rights. With high expectations following President Yoon Seok-yeol's pledge during his candidacy to strengthen tax benefits for individual investors, long-term investment tax benefits came next with 4,497 responses (28.5%). Other responses included creating an investment environment in line with global standards (3,537, 22.4%), eradicating unfair trading practices (2,339, 14.8%), and strengthening the stewardship code (501, 3.2%).

◆ 'Seohak Ants' over 'Donghak Ants'= Individual investors plan to increase their overseas stock investment ratio. The largest group, 3,564 people (22.6%), said they would maintain a 4:6 ratio between domestic and overseas stock investments. Those planning to raise the overseas ratio to 7 accounted for 3,341 people (21.2%). A 5:5 ratio was chosen by 3,547 people (22.5%). Those planning to keep domestic ratios at 7 or 6 were 3,086 (19.6%) and 2,230 (14.1%), respectively.

The securities industry expects the number of so-called Seohak Ants?investors continuously investing in overseas stocks?to increase. The reason securities firms are competing to strengthen overseas stock services is that the scale of overseas stock investments grows every year. The overseas market most loved by Seohak Ants is the United States. The proportion of US stocks in overseas stock settlement amounts exceeds 90% on average. According to the Korea Securities Depository, the settlement amount for US stocks increased significantly from $22.47 billion (about 27.27 trillion KRW) in 2018 to $370.05 billion (about 450 trillion KRW) last year.

Individual investors viewed the NASDAQ index more positively than the KOSPI. The largest group, 5,219 people (33.1%), expected the NASDAQ index to be in the 12,000-13,000 range by the end of June. Among the top five US stocks by market capitalization, the stocks expected to have the highest returns this year were Apple, Tesla, Microsoft, Alphabet, and Amazon, in that order. These are all favorite staple stocks of Seohak Ants.

Meanwhile, regarding major domestic and international variables affecting the stock market this year, more respondents cited global economic recession, additional interest rate hikes, and persistent inflation than US-China conflicts or the worsening Russia-Ukraine situation. Persistent inflation was the largest factor, with 4,781 responses (30.3%). The most promising domestic sectors expected to yield high returns this year were semiconductors and IT (4,686, 29.7%). Defensive sectors such as finance and securities (3,231, 20.5%) were also popular. The metaverse craze from last year has somewhat faded, and expectations for construction and automobiles were not high.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)