Most Variable Rate Loans in 8 Years

Variable Rates Relatively Low at Loan Origination

Variable Rate Burden Increases Over Time

[Asia Economy Reporter Sim Nayoung] Although the interest rate hike trend continues, the proportion of variable-rate household loans, which increase interest burdens when loan interest rates rise, is steadily increasing.

According to the Bank of Korea on the 3rd, the proportion of variable-rate loans among household loans from deposit banks as of February was 76.5% based on outstanding balance. This is the highest figure in eight years since March 2014 (78.6%). The proportion of variable-rate household loans based on outstanding balance showed a downward trend since December 2009, when related statistics began to be compiled, but reversed to an upward trend after March 2020 (65.6%), right after the COVID-19 outbreak. The proportion of household loans choosing variable interest rates also reached 78.0% based on new loan disbursements in February.

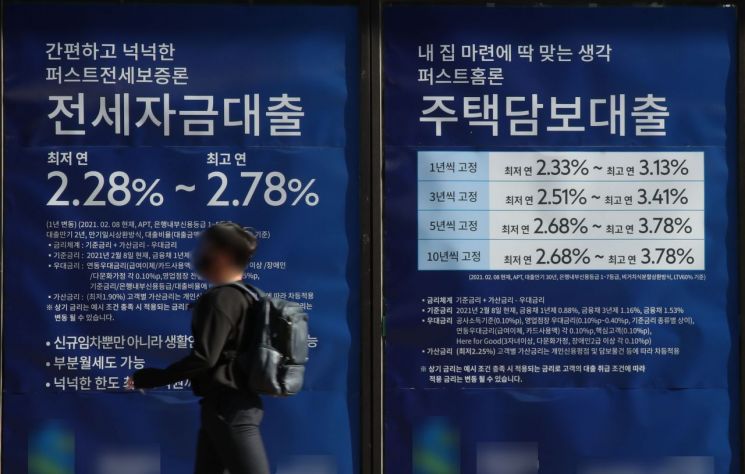

It appears that household borrowers choose fixed interest rates less often because fixed rates at the time of loan origination are relatively higher than variable rates. As of the end of March, KB Kookmin Bank’s apartment mortgage loan interest rates for variable-rate loans (new COFIX 6-month cycle) range from 3.51% to 5.01% per annum. This is about 0.50 percentage points lower than the mixed type with a fixed rate for five years (4.00% to 5.50% per annum).

There is also an analysis that many households do not choose long-term fixed interest rates because they either aim to gain capital gains or move to a larger home rather than repaying the principal and interest until maturity when buying a house. The fact that the fixed interest rate period for fixed-rate (mixed type) mortgage loan products at commercial banks is limited to five years is also due to this reason.

Households that took out variable-rate mortgage loans instead of fixed-rate loans before the interest rate hike now face a higher interest burden compared to fixed-rate loans. As of the end of September last year, KB Kookmin Bank’s apartment mortgage loan interest rates were 3.03% to 4.65% per annum for variable-rate (new COFIX 6-month cycle) and 3.22% to 4.72% per annum for mixed type (5-year fixed rate), with an interest rate difference of about 0.1 to 0.2 percentage points. The interest burden for households that chose variable-rate products at that time has increased as of the end of March, six months later, compared to households with fixed-rate loans.

Shin Yong-sang, head of the Financial Risk Research Center at the Korea Institute of Finance, said, "Since 2020, the proportion of variable-rate loans among household loans has rapidly increased, making borrowers’ debt repayment ability more sensitive to interest rate changes."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.