China's CATL Market Share Up 6.9%p, LG Energy Solution Down 6.9%p

Over 1 Year, CATL 27.5→34.4%, LG 20.7→13.8%

3rd Place China's BYD 6.9→11.9%... LG Trails by 1.9%p

"Global Solid Electrolyte Market to Grow Over 300 Times by 2030"

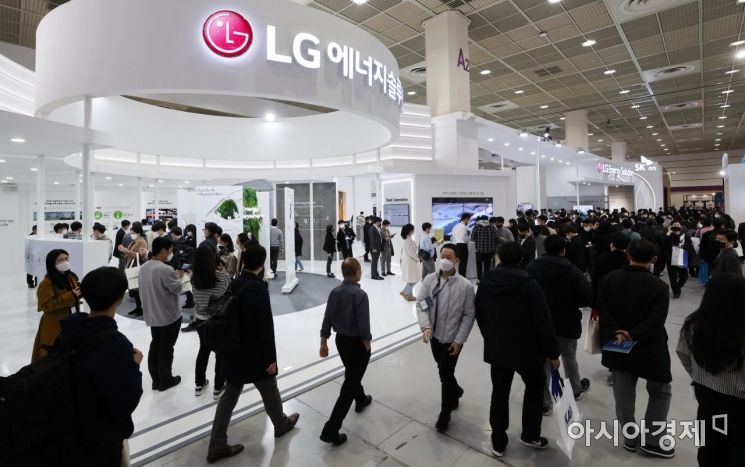

On the 17th of last month, 'InterBattery 2022' held at COEX in Samseong-dong, Gangnam-gu, Seoul, was bustling with visitors. Photo by Hyunmin Kim kimhyun81@

On the 17th of last month, 'InterBattery 2022' held at COEX in Samseong-dong, Gangnam-gu, Seoul, was bustling with visitors. Photo by Hyunmin Kim kimhyun81@

[Asia Economy Reporter Moon Chaeseok] LG Energy Solution maintained its second-place market share in the global electric vehicle battery market. The Chinese battery manufacturer CATL held onto the top spot. For LG Energy Solution, the market share gap with CATL widened by nearly 14 percentage points over the year, and it is also facing fierce competition from third-place BYD.

According to SNE Research on the 1st, the battery usage in electric vehicles registered in 80 countries worldwide from January to February this year reached 53.5 GWh, a 106.9% increase compared to the same period last year.

The growth of Chinese battery manufacturers stood out. CATL's battery usage increased by 158.5% year-on-year to 18.4 GWh. Its cumulative market share from January to February also rose from 27.5% last year to 34.4% this year. BYD, CALB, and Guoxuan also recorded battery usage increases of 256.8%, 189.1%, and 225.2% respectively during the same period, reaching 6.4 GWh, 2.4 GWh, and 1.6 GWh, ranking 3rd, 6th, and 8th respectively.

In South Korea, LG Energy Solution's battery usage increased by 37.6% compared to the same period last year, reaching 7.4 GWh and ranking second. Its cumulative market share as of February dropped from 20.7% last year to 13.8% this year. SK On and Samsung SDI saw battery usage increase by 152.2% and 30.7% respectively, reaching 3.5 GWh and 2.0 GWh.

Japan's Panasonic saw its battery usage increase by only 28.6% year-on-year to 5.8 GWh, with its market share shrinking from 17.4% last year to 10.8% this year.

Notably, the world’s second-ranked LG Energy Solution has not been able to catch up with first-place CATL and is struggling with the pursuit of third-place BYD. However, recently, it has slightly widened the gap with BYD. Looking at February alone, CATL supplied 8.3 GWh of batteries to electric vehicles, maintaining first place. LG Energy Solution supplied 4.1 GWh, Panasonic 3.0 GWh, and BYD 3.0 GWh each. Korean company SK On ranked fifth with 2.1 GWh, and Samsung SDI ranked seventh with 1.0 GWh.

SNE Research commented, "The pressure from Chinese companies shows no signs of easing this year," adding, "It will be interesting to see how the three domestic companies respond appropriately."

SNE Research also forecasted that the solid electrolyte market will grow more than 300 times by 2030. It is expected to expand from $12 million (14.5 billion KRW) this year to $3.8 billion (4.597 trillion KRW) in 2030, approximately a 317-fold increase. In terms of demand volume, it is projected to gradually increase from 8 tons this year to 76,000 tons in 2030. The demand for solid electrolytes by the three domestic battery companies is expected to grow from 70 tons in 2025 to 13,680 tons in 2030.

The rising expectations for mass production of all-solid-state batteries have influenced this outlook. Domestic and international battery companies view the development of all-solid-state batteries using solid electrolytes as essential to securing the safety of high-capacity, high-output, and large-capacity lithium-ion batteries, and are conducting related research. SNE Research expects production of all-solid-state batteries to be led by domestic companies and Japan’s Toyota, with Chinese, American, and European companies also participating, leading to fierce competition in the market.

SNE Research stated, "The all-solid-state battery market will begin to grow starting in 2025, centered on the IT market, and will start full-scale growth in 2027 as it is actively used in electric vehicles," adding, "Major domestic battery and material companies need to focus their capabilities on developing solid electrolyte technology to secure a leading position in the next-generation battery market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.