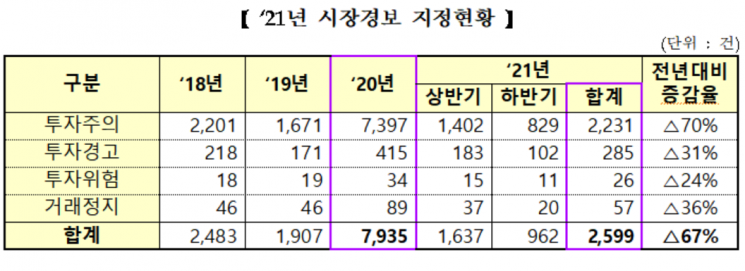

Last Year Market Alert Designations 2,599 Cases... 67% Decrease Compared to Previous Year

[Asia Economy Reporter Minji Lee] The Market Surveillance Committee of the Korea Exchange announced on the 30th that an analysis of the effectiveness of the market alert designation and inquiry disclosure request system operated last year showed that it helped stabilize rapid stock price fluctuations and prevent unfair trading in advance.

The market alert system is designed to effectively respond to unfair trading and abnormal price surges and to inform investors of risks in advance. It operates in three stages: Investment Caution, Investment Warning, and Investment Risk. Inquiry disclosure is a system that requires listed companies to disclose whether there is any important information when a sudden change in the market situation of a specific stock occurs.

Last year, the total number of market alert designations was 2,599 cases. Among them, there were 2,231 Investment Caution cases, 285 Investment Warning cases, and 26 Investment Risk cases, with a total of 57 instances where trading was suspended accordingly. This represents a 67.2% decrease compared to the 7,935 cases designated in 2020, when stock price volatility intensified due to COVID-19. The overall number of designations decreased from the second half of the year as stock price volatility eased with reduced economic uncertainty.

By reason for designation, designations related to major themes accounted for 594 cases, or 23% of the total. Among these, political themes accounted for 49%. It is analyzed that theme stocks led the market as the Seoul and Busan mayoral by-elections in April last year and the selection of candidates for the next presidential election proceeded.

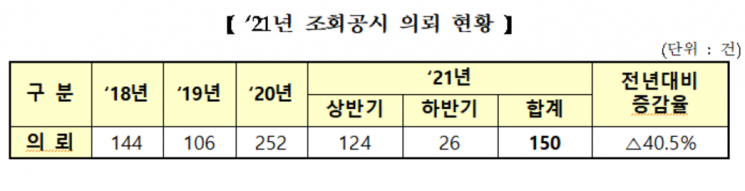

The total number of inquiry disclosure requests was 150 cases. This is a 40.5% decrease compared to 252 cases in 2020, which is attributed to the Korea Exchange's improvement of inquiry disclosure request criteria in the second half of last year. The Exchange excluded stocks identified by trading volume fluctuation criteria from requests if the intraday stock price fluctuation rate was less than 20% up or down.

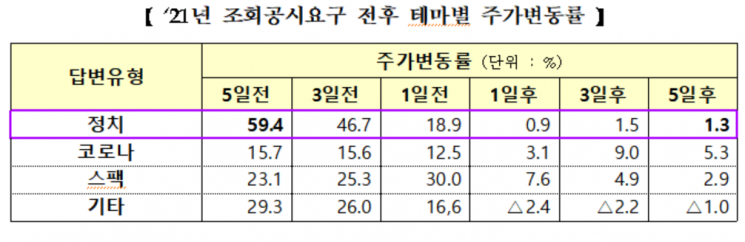

The proportion of theme stocks among inquiry disclosure requests was 29.3% (44 cases), of which 39 cases were related to political themes, accounting for most of the theme stocks. Among the 39 political theme requests, 32 were triggered together with Cyber Alert. This refers to notifying the listed company when stock price or trading volume surges due to various rumors on cyberspace, encouraging active explanations through the disclosure system or the listed company’s website.

The Korea Exchange analyzed that the market alert designation and inquiry disclosure requests suppressed rapid stock price surges in the short term. In particular, for inquiry disclosures, when a definitive response was given regarding the presence or absence of important disclosures, the stock price fluctuation rate showed a more stable trend compared to uncertain responses.

Also, the proportion of preventive measures requested to prevent unfair trading after market alert designation slightly decreased, which is presumed to be because the market alert system’s designation criteria include unhealthy conditions considering trading patterns, thereby directly playing a role in preventing unfair trading.

Furthermore, buying pressure on political theme stocks also eased. After inquiry disclosure requests on political theme stocks, their stock price volatility stabilized significantly compared to other theme stocks. Trading volume, bid quantity, and number of bids decreased markedly, showing a calming trend in overall trading, which is analyzed to have effectively prevented herd trading among market participants.

The Korea Exchange stated, “To strengthen the effectiveness of the system, we will continuously monitor the investment environment and analyze operational effects to improve the system.” It added, “Considering surges in trading and changes in trading patterns, we plan to promote improvements in the designation criteria for investment warning and risk stocks through continuous market analysis in the future.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.