[Asia Economy Reporter Park So-yeon] The policy proposals submitted by the Korea Venture Capital Association to the Presidential Transition Committee aim to channel funds reserved within domestic large corporations to emerging ventures, ensuring that money circulates where it is needed and securing future growth engines. From the perspective of large corporations, this can create a virtuous cycle structure that enables transformation into a younger constitution capable of surviving in the rapidly changing global business environment through discovering unicorn companies and mergers and acquisitions (M&A).

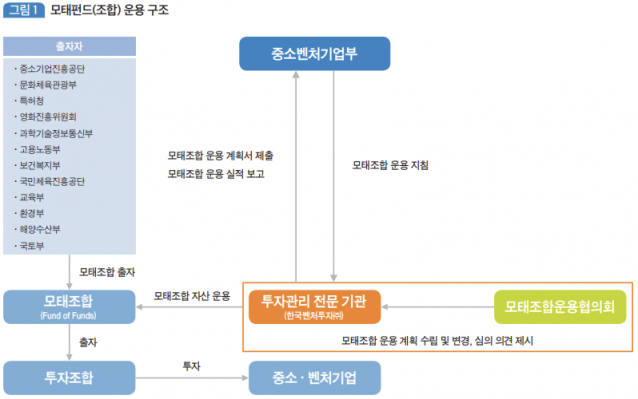

◇Rapid Growth of Domestic Ventures in the 'Second Venture Boom'... Government Funds Alone Are Insufficient= Ji Seong-bae, chairman of the Korea Venture Capital Association, explained, "Since 2005, the venture capital market has been led by government-led mother funds," adding, "The government's cumulative investment amounts to about 10 trillion won." Based on this, private capital has been matched, and the total amount formed into venture capital (VC) funds has accumulated to about 50 trillion won.

While previous venture support focused on helping early-stage companies grow, the situation has rapidly changed since the COVID-19 pandemic. In Korea, the number of startup companies has exploded to the extent that it is called the 'Second Venture Boom.' The number of K-unicorn companies with a corporate value of over 1 trillion won increased sixfold from 3 in 2017 to 18 as of December 2021. The number of companies valued at over 100 billion won has also grown to 435, indicating a thick layer of innovative companies. This means that supporting prospective unicorn companies with government funds alone is insufficient.

Chairman Ji said, "When led by the government, policy objectives focus more on social returns than financial returns," and explained, "In the case of government-led mother funds, there were many unfortunate cases where domestic funds could not participate in the scale-up of prospective unicorn-level ventures that require large-scale capital injections, as the focus was on companies located in provinces, early-stage startups, female-founded companies, and market failure areas."

He emphasized, "To grow into unicorn companies, massive investment attraction is necessary, but the current proportion of domestic capital investment is very low," adding, "For this, it is necessary to enlarge private-led funds." According to the Korea Venture Capital Association, the number of companies raising over 10 billion won increased from 75 in 2020 to 157 in 2021. For scale-up investment, the amount formed per fund must be large; as of the end of 2020, the average fund size was 31.9 billion won in Korea and 259.3 billion won in the United States, showing a significant gap. This means that the size of domestic venture funds is small.

◇Dramatic Policy Changes Such as Tax Support Needed to Expand Private Capital Inflow= Chairman Ji stated, "There are some private mother funds led by major corporations such as the three major telecommunications companies, Samsung Electronics, SK Hynix, and POSCO, but unlike government mother funds, these private funds do not receive tax-exempt benefits," and said, "To channel massive funds into technology-based startups, tax incentives must be provided to general companies."

He argued that bold policy changes are needed to grant tax-exempt benefits on capital gains from the sale of shares in invested companies not only to venture investment companies but also to general companies. Looking at the composition of venture fund investors in 2021, the increase in general corporations is clear, and their potential for future growth is evaluated as very high. The Venture Capital Association analyzes that adding general corporations to the tax support target could have an explosive effect on revitalizing venture investment.

He explained, "If private-led mother funds are formed, investments in areas relatively less covered by public mother funds, such as secondary (existing stock circulation) funds, M&A funds, and domestic and international joint funds, can be expanded." For investors, investing in mother funds offers greater risk diversification compared to individual funds and creates new investment channels.

Chairman Ji Seong-bae emphasized, "Korea must obtain future growth engines from ventures," adding, "If several more large private-led funds emerge and active venture investment takes place, it will become a greater driving force for job creation and tax revenue generation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.