Banks Raise Interest Rates for High Credit Borrowers

Targeting Credit Scores in the 900s, Grades 1-2

Loan Interest Increased by Over 1 Percentage Point

Existing Borrowers Face Hikes Upon Renewal

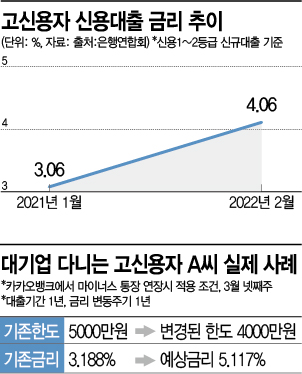

[Asia Economy Reporter Sim Nayoung] Lee Youngjae (pseudonym, 45), who works at a large corporation in Seoul, was shocked when he applied to extend his KakaoBank overdraft account. Just a year ago, the limit was 50 million KRW with an interest rate of 3.18% per annum, but last week the new rate sent to his phone was 5.11%. He said, "My annual salary increased over the year, I haven't taken out any additional loans elsewhere, and my credit score remains at 970, yet the interest rate on my unsecured loan rose by 2 percentage points. If I borrow and invest this money, I don't think I can even cover the interest, so I closed the overdraft account." Kim Mina (pseudonym, 38), who works at the same company, also said, "I opened a 100 million KRW overdraft account at KakaoBank, but when I tried to extend it last January, I was notified that the interest rate increased from 2.9% to 4.9%. When I inquired, the only response I got was that it was 'adjusted due to internal policy.'"

Credit Scores in the 900s Also Face 4.06% Interest on Unsecured Loans

Even high-credit borrowers now face a high-interest era where they must pay annual interest rates of 4-5% on unsecured loans. Not only internet banks but also commercial banks have raised their rates simultaneously. On the 29th, the average interest rate for high-credit unsecured loans (based on new loan amounts) from 17 banks, as announced by the Korea Federation of Banks, was 4.06% in February. This is a 1 percentage point increase from 3.06% a year ago. Although each bank has different criteria for grading, customers with credit scores around 900 from NICE and KCB are generally classified as high-credit borrowers in grades 1-2.

Among the top five banks, Woori Bank (4.08%) and Shinhan Bank (4.00%) had the highest rates, followed by KB Kookmin Bank (3.81%), NH Nonghyup Bank (3.75%), and Hana Bank (3.52%). Compared to the average rate of 2.6% among the top five banks in January last year, the increase exceeds 1 percentage point significantly.

Looking only at internet banks, the interest rates for grades 1-2 were raised to 4.50% for K Bank and 4.19% for Toss Bank in January, but were slightly adjusted to 3.93% and 3.94%, respectively, in February. KakaoBank has stopped issuing new loans to high-credit borrowers since November last year and has not separately announced rates. However, it appears that interest rates are being raised when existing grade 1-2 borrowers apply for extensions on their unsecured loans.

Customers Hesitant to Borrow... Household Loan Balances Decline, Banks Also in Trouble

As a result, posts on online communities for office workers say things like, "The Bank of Korea raised the base rate three times since January last year by about 0.75 percentage points, but banks have more than doubled their loan interest rates. These days, I pay off loans as soon as I get my salary," and "Due to the high uncertainty in stocks and coins, investment is discouraged, but the interest rates are so high that I don't even dare to borrow money."

Banks are not entirely happy about the rate hikes either. Household loan balances at the top five banks have decreased for three consecutive months this year. Banks need loan growth to secure net interest margins, which are a major source of income. If the current high-interest environment continues to cause loan contraction, profits will inevitably decline. The recent simultaneous increase of unsecured loan and overdraft limits to 100 million to 200 million KRW by commercial banks is an emergency measure because their unsecured loan growth targets are far from being met.

A representative from a commercial bank said, "The demand for unsecured loans among young people was almost exhausted last year, and with interest rates so high, it is unlikely that a loan boom like last year will occur. Above all, the bank's loan performance will depend on how real estate policies and the housing market develop, so these days banks are only watching real estate policies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.