Electric Vehicle Battery Core Material 'Lithium'

Vital to Securing Lithium from China, Chile, and Others

[Asia Economy Reporter Oh Hyung-gil] 'March Lithium Supply Crisis'

The battle to secure 'lithium,' a key material for electric vehicle batteries, is heating up. China is aggressively acquiring overseas mines, and Chile, one of the world's top three lithium holders, has boldly declared plans to nationalize lithium. Recently, domestic companies including POSCO have also jumped into the lithium securing race, putting their very survival on the line.

According to the Korea Resource Information Service on the 27th, the supply stabilization index indicating the risk level of lithium supply stood at 1.5 this month, marking two consecutive months of a 'supply crisis (0~5).' It has been on a steady decline from 11.24 in December last year to 5.79 in January this year, and further down to 1.94 in February.

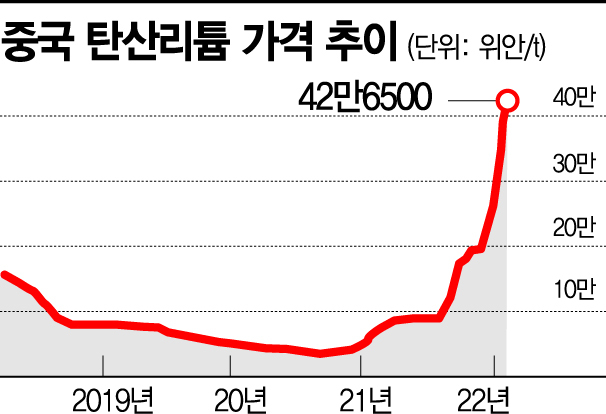

Meanwhile, lithium prices have skyrocketed. In the fourth week of March, the price of lithium carbonate reached 472.50 yuan per kg (approximately 80,000 KRW), marking 36 consecutive weeks of increase since the first week of July 2021.

The concern is that lithium prices may rise even further. As governments and companies worldwide, including China?the largest lithium compound producer?move to secure lithium, the supply situation is expected to worsen.

China's lithium-ion battery production surged by 106% year-on-year to 324 GWh last year due to increased demand from its low-carbon transition plans. Production of key materials such as cathode materials, separators, and electrolytes also exceeded 100% compared to the previous year. The total production value of the lithium battery industry approaches 600 billion yuan (approximately 114.78 trillion KRW).

China is also intensifying efforts to secure materials. A subsidiary of China National Materials Group acquired a 74% stake in the Bikita lithium mine in Zimbabwe for 180 million USD. It is reported that they plan to purchase the remaining shares of the mine in the future.

Sichuan Yahua Group plans to acquire a 3.4% stake in Australian battery metals company ABY, which operates lithium mines in Sudan and Ethiopia, for 2 million USD before ABY's initial public offering (IPO).

The newly elected Chilean government under Gabriel Boric, who took office in December last year, is pushing for constitutional amendments to nationalize lithium, copper, and gold mines. The constitutional amendment passed the National Congress on the 5th (local time) and is expected to be finalized through a national referendum. Chile, as one of the world's top three lithium holders and the largest copper producer, could disrupt global battery material mineral prices and supply if resource nationalization succeeds.

In particular, South Korea is vulnerable to supply and price instability due to its high import dependence on Chile.

As of January, South Korea's lithium carbonate imports surged by 202% year-on-year to 5,756 tons. Chile accounted for an overwhelming 87.2% of imports by country, followed by China at 9.8% and Argentina at 3%. Last year, total lithium carbonate imports also increased by 31.8% to 41,164 tons compared to the previous year.

In this situation, POSCO Group recently broke ground on a lithium commercialization plant at the Ombre Muerto salt lake in Salta Province, opening a new avenue for lithium supply.

POSCO Group is investing 830 million USD (approximately 950 billion KRW) to secure production facilities capable of producing 25,000 tons per year of lithium hydroxide by the first half of 2024. From the end of 2024, additional investments will increase lithium production to a maximum of 100,000 tons by 2028.

Additionally, from 2024, POSCO Lithium Solution will produce 43,000 tons of lithium annually through its ore lithium plant in Gwangyang. The 93,000 tons of lithium POSCO Group secures annually on its own is enough to supply batteries for approximately 2.2 million electric vehicles.

Lithium, a key material for electric vehicle batteries, is white in color and is sometimes called 'White Gold.'

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.