[Asia Economy Reporter Kang Nahum] India is rapidly emerging as an alternative market amid China’s renewed restrictions on foreign games. The domestic gaming industry is also increasing investments in the Indian market, regarded as a blue ocean, to reduce its dependence on China.

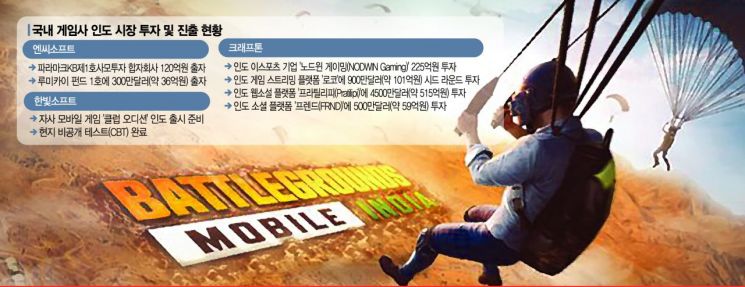

◆ Capture India, with 400 million gamers = According to NCSoft’s 2021 business report released on the 24th, NCSoft invested 12 billion KRW in Paramark KB No.1 Private Equity Fund in October last year to secure investment partners among growth-stage tech and platform companies in India. In November of the same year, it invested 3 million USD (about 3.6 billion KRW) in Lumikai Fund No.1. The purpose was to secure investment partners for early-stage game startups in India.

NCSoft’s expanded investment in India is based on the judgment that the Indian game market has great potential. According to market research firm Niko Partners, the Indian game market size last year was estimated at 534 million USD (about 640 billion KRW), with approximately 340 million gamers. This year, the market size is expected to jump to 1 billion USD (about 1.2 trillion KRW), and the number of gamers is projected to increase to 400 million, accounting for more than one-fifth of all gamers in Asia.

Competitors are also increasing their investments in India. Krafton made a Series B investment of 20 million USD (about 24.7 billion KRW) in India’s largest audio content platform, KukuFM. KukuFM has 6 million active paying users (APU), making it the largest audio content platform in India.

Last month, Krafton invested 5.4 million USD (about 650 million KRW) in Nautilus Mobile, an Indian sports game specialist developer. Prior to that, it invested 45 million USD (about 5.15 billion KRW) in Pratilipi, the largest web novel platform. Krafton’s total investment in India has reached approximately 100 billion KRW to date.

Its flagship intellectual property (IP), Battlegrounds, is also achieving remarkable results in India. ‘Battlegrounds Mobile India,’ launched for Indian users in July last year, has accumulated 90 million users since its release. The daily peak users and maximum concurrent users were recorded at 16 million and 2.4 million, respectively.

HanbitSoft is preparing to launch its mobile game ‘Club Audition’ in India. A local closed beta test (CBT) was completed earlier this year. The company expects significant success in the Indian market, as K-pop remains highly popular there.

◆ Domestic gaming industry accelerates?China = Domestic game companies have turned their attention to India because it has become increasingly difficult to penetrate China, once considered the world’s largest market. The foreign game license (panho) required for game service approval in China has not been issued for nearly eight months since July last year. Chinese local media reported that the number of licenses issued last year was 755, a 46.2% decrease compared to the same period the previous year.

This is largely due to China’s strengthened crackdown on the gaming industry as part of its youth protection policy last year. Local media also reported that about 14,000 game companies have closed since July last year as the Chinese government increased pressure on domestic game businesses. The timing for resuming license issuance remains uncertain this year, forcing domestic game companies to endure an indefinite wait. This is why the domestic industry has no choice but to urgently seek alternative markets.

An industry insider said, “As uncertainty in the Chinese market grows, the overall industry consensus is that new sales channels must be developed to replace it. India is an attractive market for game companies because all key indicators such as purchasing power, talent pool, and capital inflow are rapidly growing, and digital infrastructure is developing swiftly.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)