[Asia Economy Reporter Donghyun Choi] The startup investment fever has been remarkable since the beginning of the year. After startup investment exceeded 11 trillion won for the first time last year, more than 1 trillion won has been raised every month this year as well. With the added expectations for the next government promising expanded startup support and deregulation, the 'second venture boom' is expected to continue for the time being.

According to Startup Alliance on the 24th, the investment amount raised by domestic startups last month was 1.1607 trillion won (109 cases), maintaining over 1 trillion won investment for two consecutive months following January (1.2552 trillion won). This is 2.2 times higher than 527.7 billion won (73 cases) in the same period last year. During the same period, the number of investments by scale increased twofold for 'over 1 billion won', threefold for 'over 10 billion won', and fivefold for 'over 30 billion won'. Investments under 1 billion won slightly decreased. This statistic only sums up cases where investment amounts were publicly disclosed, so the actual startup investment scale is expected to be larger.

By industry, the 'Healthcare' sector was the most active last month with 16 startups raising investments. Atomus, which operates the anonymous psychological counseling platform Mind Cafe, attracted attention by raising 20 billion won in Series B funding. Cypher Room, a genome analysis company, also secured 19.5 billion won in Series B funding from domestic and international venture capital (VC).

Investment in the 'E-commerce & Logistics' sector was also strong with 15 cases. Global e-commerce platform Gommi Corporation completed a 12.5 billion won Series B investment. It has been 10 months since raising Series A in the first half of last year. This time, it also attracted its first overseas investment from MDI Ventures. MDI Ventures is a VC under Telkom Group, Indonesia's largest state-owned telecommunications company.

By investment amount, the 'Content & Social' sector received the most funds. Startups in this sector raised 194.3 billion won from 13 companies. Content platform Ridi attracted 120 billion won in investment from Singapore's sovereign wealth fund, Government of Singapore Investment Corporation (GIC), among others, recognizing a corporate value of 1.6 trillion won.

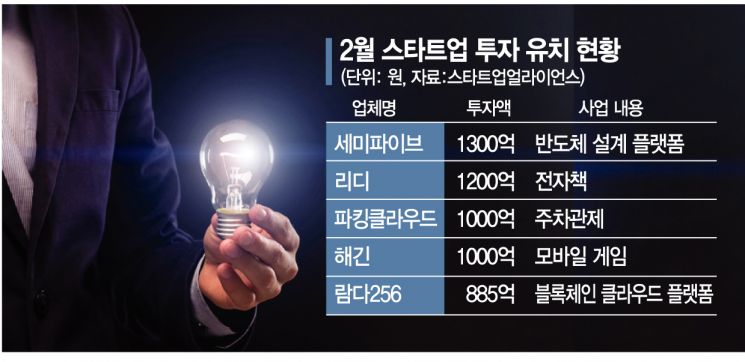

There were also four cases of 'big investments' exceeding 100 billion won. Semiconductor design platform SemiFive completed a 130 billion won Series B investment, marking the highest investment amount last month. Parking management platform iParking operated by Parking Cloud and mobile game company HaeGin also attracted investments in the 100 billion won range.

Large-scale investments continue this month as well. Metaverse platform company VA Corporation announced on the 14th that it signed a 100 billion won Series A investment contract with private equity fund (PEF) operator Paratus Investment. VA Corporation plans to use this investment to expand a virtual studio of 115,000 square meters in the metropolitan area, nurture metaverse experts, advance technology, and develop new businesses.

Autonomous driving robot startup Bear Robotics also recently raised 100 billion won in Series B funding from IMM Private Equity (PE) and others. This is the largest amount ever in the service robot industry. With this investment, Bear Robotics' cumulative investment amount has exceeded 145 billion won, including the 37 billion won Series A led by SoftBank in 2020.

Experts predict that the startup investment boom will continue in the future. Lee Gi-dae, director of Startup Alliance, said, "The era of product economy led by manufacturing conglomerates is declining, and as we enter the service economy and experience economy era, IT platform startups are taking the lead," adding, "The second venture boom is a global phenomenon occurring during a global industrial transition, not just in Korea, so this trend is expected to continue for the time being."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.