K-RE100, LG Chem and 74 Companies Participate

Most Use 'Green Premium'... No Direct PPA Contracts with KEPCO

40% More Expensive Than Regular Electricity Rates

[Asia Economy Reporter Oh Hyung-gil] Although it has been one year since the introduction of the 'Korean-style RE100 (K-RE100)' for companies to use 100% renewable energy, participation by companies remains low due to high costs.

So far, concerns have been raised that the sustainability of the project may be undermined as participating companies in K-RE100 have heavily relied on the green premium as a means of compliance. The green premium, which purchases energy through a bidding process, has a lower electricity unit price than RECs and makes achieving energy transition targets easier, but its price inevitably rises as the market becomes more active.

With changes in carbon neutrality policies expected under the new government, it has been pointed out that benefits for participating companies must be increased for K-RE100 to stabilize and take root.

Growing Calls for RE100... Pressure on Companies

According to POSCO Research Institute on the 18th, as of the end of last year, 74 companies including LG Chem, LG Display, SK Telecom, SK Materials, and Hanwha Solutions participated in K-RE100 implementation, resulting in 76 cases.

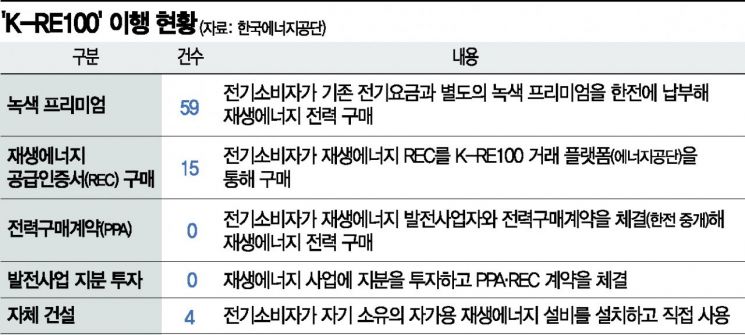

K-RE100 recognizes green premiums, REC (Renewable Energy Certificate) purchases, PPA (Power Purchase Agreements), equity investments, and self-construction as ways to procure renewable energy directly or indirectly.

The problem is that most participating companies rely on the green premium. By compliance method, green premium accounts for 59 cases, or 78%. REC purchases account for 15 cases (19%), self-construction 2 cases, while there are no PPA achievements.

The green premium is a method where companies pay a green premium separately from electricity bills to Korea Electric Power Corporation (KEPCO) to purchase renewable energy power, making it the cheapest and easiest way to buy renewable energy.

However, since it is not linked to greenhouse gas reduction performance, its effectiveness is limited, and more than 90% of the bidding volume remains unsold. In two rounds of bidding last year, 17,827 GWh and 12,319 GWh were bid respectively, but only 1,252 GWh (7.0%) and 203 GWh (1.6%) were awarded. Most green premium contracts were concluded at the bidding floor price of 10 KRW per kWh. This means companies spend money on purchasing renewable energy but see little greenhouse gas reduction effect.

REC transactions have been made about 30 times since the market opened in August last year, but this accounts for only 0.3% of green premium sales volume. As REC prices rise, they are traded at about five times the price of the green premium. On the 4th, eight REC transactions totaling 1,634 MWh were made in the REC market, with an average price reaching 54,600 KRW per MWh, a 37.5% increase from last year's average price of 39,700 KRW.

There have been no PPA contract cases. PPAs are globally recognized as a way to trade power directly or indirectly with renewable energy producers or KEPCO without going through the power market. However, in Korea, they are shunned because the general electricity rate is about 40% cheaper.

In contrast, in the United States, REC accounts for 51% of RE100 compliance methods, PPA 27%, and green premium 20%. The additional cost of PPA compared to general electricity rates is only about 3-5%, making it less burdensome for companies.

Jo Yoon-taek, senior researcher at POSCO Research Institute, said, "It is necessary to provide reasonable incentives for the use of renewable energy," and added, "We need to discuss measures such as exempting participating companies from reporting and reducing indirect greenhouse gas emissions or reducing climate environment charges from electricity bills."

LG Energy Solution, First Domestic Company to Advise RE100

Meanwhile, LG Energy Solution has been selected as the first domestic company to serve as an advisory member of the RE100 board. Alongside Apple, Unilever, Meta, Sony, Pepsi, and others, LG Energy Solution will evaluate and review expertise, experience related to renewable energy, and future RE100 achievement plans, serving as a policy advisory role on the RE100 board.

In April last year, LG Energy Solution became the first in the battery industry to simultaneously join RE100 and EV100. Its Poland plant has been operating with 100% renewable energy since 2019, and its U.S. plant since July 2020. According to the 'RE100 2021' annual report published last month, LG Energy Solution's RE100 transition performance was 33% (as of 2020), the highest among domestic companies.

LG Energy Solution stated, "We will respond to the eco-friendly demands of customers, investors, and stakeholders and fulfill our role as a leading company in the battery industry, which is key to a carbon-neutral society."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.