Youth Hope Savings Controversy and Differentiation

Banks on Edge Ahead of Unprecedented Savings Account Launch

President-elect Yoon Suk-yeol and Transition Committee Chairman Ahn Cheol-soo are moving to a restaurant for lunch on the 16th at the office in Jongno-gu, Seoul. Photo by Yoon Dong-ju doso7@

President-elect Yoon Suk-yeol and Transition Committee Chairman Ahn Cheol-soo are moving to a restaurant for lunch on the 16th at the office in Jongno-gu, Seoul. Photo by Yoon Dong-ju doso7@

[Asia Economy Reporter Shim Nayoung] "The Youth Leap Account will consider not only the individual's assets but also the parents' assets when accepting subscription applications. This is not a financial product but a welfare policy." Professor Kim Soyoung of Seoul National University stated this during a phone interview with Asia Economy Newspaper on the 23rd of last month, right after announcing the Youth Leap Account pledge. As a member of the Economic Subcommittee 1 of the Presidential Transition Committee, she is also the architect of this pledge. The explanation was that only citizens aged 19 to 34 whose own and parents' assets are below a certain level would be eligible to join the Youth Leap Account.

Considering Both Individual and Parental Assets Prevents Unfairness Controversies

Attention Needed to Establish Detailed Criteria

The Youth Hope Savings introduced by the Moon Jae-in administration set the eligibility criteria solely based on annual income (below 36 million KRW), which led to controversies over fairness. For example, a young person owning a house under their name could join the savings plan if their salary was low, but someone living in a monthly rental house with an annual income above 36 million KRW was excluded. To address these issues, the Youth Leap Account plans to consider both the individual's and parents' income levels.

Since the eligibility conditions for the Youth Leap Account are stricter than those for the Youth Hope Savings, there are practical challenges to overcome. A representative from a commercial bank said on the 17th, "The government needs to carefully set the asset criteria for both individuals and parents, and also provide detailed guidelines on whether housing prices will be assessed based on official land prices or market prices to reduce confusion for banks." They added, "If these are the conditions to consider at the time of subscription, banks might have to develop separate IT systems specifically for the Youth Leap Account product."

'10-Year Maturity, 3.5% Compound Interest' An Unprecedented Savings Product

Banks Must Pay 13,403,358 KRW Interest Per Subscriber

When the Youth Leap Account is launched, the interest burden on banks will increase unprecedentedly. It applies a 3.5% interest rate compounded annually over a 10-year maturity, which grows faster than simple interest. If a subscriber completes the term, the interest the banks must pay per person reaches 13,403,358 KRW (based on tax-exempt criteria). This is 21 times the interest of 625,000 KRW per subscriber that banks pay for the Youth Hope Savings (2-year maturity, 5% simple interest).

Compared to the usual commercial bank savings period of 3 years, where interest rates are in the 3% range for simple interest and 2% range for compound interest, banks are bound to express reluctance to accept subscribers under government policies considering the subscription period and interest benefits.

Budget of 7.5 Trillion KRW Over 5-Year Term

Subscriber Scale Minimum 700,000 to 1 Million... Could Increase Further

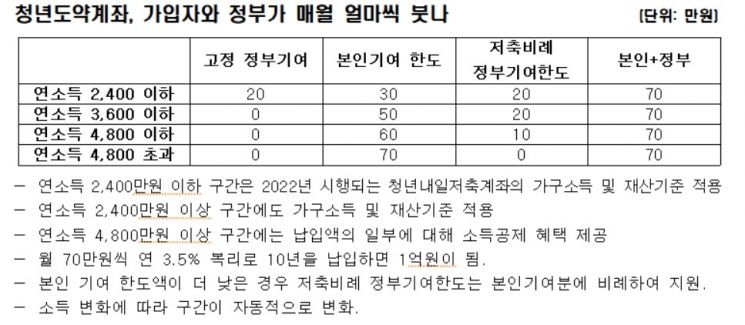

The key issue is the number of subscribers. The government budget input and banks' interest burden depend on the number of Youth Leap Account subscribers. Professor Kim Soyoung said, "Over the 5-year presidential term, a budget of 7.5 trillion KRW will be invested, making it possible to benefit at least 700,000 to 1 million people." She added, "(Based on 700,000 subscribers) we expect ▲104,000 people with annual income below 24 million KRW ▲256,000 people below 36 million KRW ▲180,000 people below 48 million KRW ▲160,000 people above 48 million KRW, and if demand is high, we plan to increase these numbers." Compared to the 2.9 million Youth Hope Savings subscribers last month, this is about one-quarter to one-third. The lower number of subscribers in the lower income brackets is likely because those earning less have less capacity to save.

The Youth Leap Account sets four income brackets and provides monthly government support payments of 400,000 KRW (annual income below 24 million KRW), 200,000 KRW (below 36 million KRW), and 100,000 KRW (below 48 million KRW) to subscribers according to income. Those earning above 48 million KRW receive tax-exempt benefits. For subscribers in the lowest income bracket, if they deposit 300,000 KRW monthly into savings, the government money (400,000 KRW monthly) is also deposited into their account. The goal is for all Youth Leap Account subscribers to save 700,000 KRW monthly for 10 years to accumulate 100 million KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.