Adjustment of Comprehensive Real Estate Tax Cap and Payment Deferral Remain Largely Unchanged

Differences in Fair Market Value Ratio

[Asia Economy Reporter Kim Min-young] The government is scheduled to announce measures to ease the tax burden on single-homeowners along with the official public housing prices on the 23rd. However, as the issue of partially reflecting President-elect Yoon Seok-yeol’s pledges arises, coordination of real estate policies between the current and next administrations has come under scrutiny. The government plans to finalize the proposal in consultation with the Presidential Transition Committee within this week, but given the tight timeline before the announcement, it is expected that only the government’s plan will be announced first.

According to the government and National Assembly on the 14th, the Ministry of Economy and Finance, Ministry of Land, Infrastructure and Transport, and Ministry of the Interior and Safety decided to postpone the announcement of the official public housing prices, originally expected on the 22nd, to the 23rd. Along with this, the plan to ease the holding tax burden will also be announced on the same day, with detailed contents to be coordinated with the Transition Committee.

A government official said, “As announced at the end of last year, we are preparing the easing plan, and currently no schedule has been set for coordination with the Transition Committee,” adding, “If coordination with the Transition Committee is not reached, we plan to announce only the government’s plan first.”

The official public housing prices will be announced as scheduled due to procedural issues such as landowners’ submission of opinions and objections. However, there is still time before the revision of laws related to property tax and comprehensive real estate tax. Accordingly, even after the 23rd, it is expected that the government will attempt to finalize the plan by combining the tax burden easing measures it has prepared with President-elect Yoon’s pledges. However, clear differences in detailed contents are expected to cause difficulties in coordination.

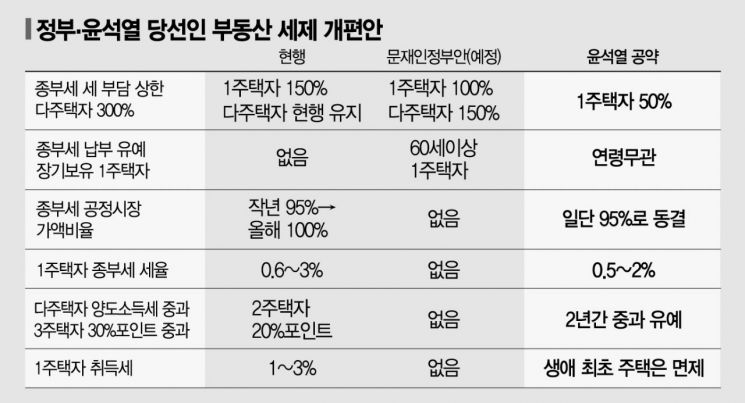

The government and the President-elect’s pledges share the broad framework of adjusting the comprehensive real estate tax cap and allowing payment deferral. Both sides aim to lower the cap to achieve a freeze effect on holding taxes. Regarding the payment deferral plan for the comprehensive real estate tax, the government’s plan sets an age limit of 60 or older, whereas the pledge does not impose an age limit and intends to provide payment deferral benefits to all single-homeowners who have held their property long-term.

The biggest point of disagreement lies in the fair market value ratio. The government has not considered lowering the fair market value ratio, but President-elect Yoon pledged to maintain the current 95%. The fair market value ratio is the rate multiplied by the official price to determine the tax base for taxation. The higher this ratio, the greater the tax burden. Although the government has not separately mentioned the comprehensive real estate tax rate, President-elect Yoon advocates restoring it to the level before the Moon Jae-in administration.

However, concerns have been raised that if only one of the government’s proposals?either lowering the holding tax cap or calculating this year’s holding tax based on last year’s official prices?is adopted, holding taxes may surge in the future. This is because the current measure is a time-limited policy effective for only one year. Especially if only the official price freeze option is chosen, there are calls for adjusting the fair market value ratio along with the tax burden cap as a buffer.

Woo Byung-tak, team leader of the Real Estate Investment Specialist Center at Shinhan Bank, said, “If only the tax burden cap ratio is adjusted, the property tax is based on the amount after repayment, and the comprehensive real estate tax is based on the amount before the cap, so the issue of comprehensive real estate tax burden on high-priced homes is not resolved,” adding, “To prevent a sharp increase in holding tax burden in the year after next, a plan to gradually raise the fair market value ratio while lowering it initially should be prepared.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.