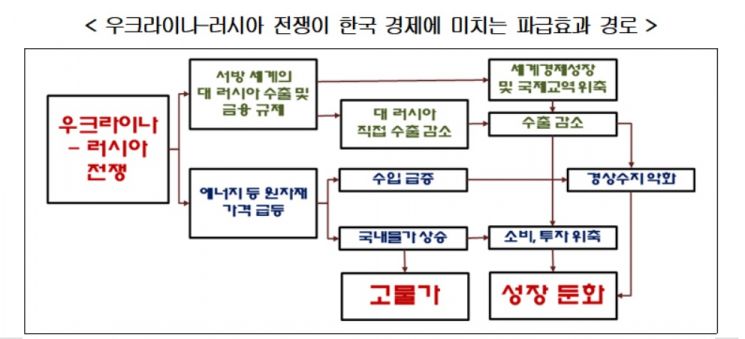

Direct and Indirect Ripple Effects of the Ukraine-Russia War

On the 14th, as international oil prices surged due to Russia's invasion of Ukraine, fuel price information was displayed at a gas station in Seoul where domestic gasoline prices are rising. Photo by Mun Ho-nam munonam@

On the 14th, as international oil prices surged due to Russia's invasion of Ukraine, fuel price information was displayed at a gas station in Seoul where domestic gasoline prices are rising. Photo by Mun Ho-nam munonam@

[Asia Economy Reporter Seo So-jeong] As raw material prices surge due to the Ukraine crisis, the possibility of South Korea entering a slowflation phase?characterized by low growth and high inflation simultaneously?is emerging. Although the global economy is recovering mainly led by the United States, and the immediate risk of stagflation (economic stagnation + inflation) is not high, concerns are rising over slowflation, where soaring prices and ongoing interest rate hikes dampen economic momentum.

According to Opinet, the oil price information site operated by the Korea National Oil Corporation, the gasoline price in Seoul reached 2,054 KRW per liter yesterday, marking the highest level in nine years since March 2013. The invasion of Ukraine by Russia has caused international oil prices to soar, pushing gasoline prices in Seoul to new highs. Due to geopolitical factors between Ukraine and Russia, the price of West Texas Intermediate (WTI) crude oil briefly surpassed $130 per barrel during intraday trading. Although recent indications from oil-producing countries about potential additional supply have somewhat eased the surge, the steep rise in oil prices continues to increase inflationary pressures.

In particular, as raw material prices continue to rise sharply, the possibility of a downturn in South Korea’s export economy is increasing, while imports of raw materials are rising, worsening the current account balance. According to the preliminary international balance of payments statistics for 2022 released by the Bank of Korea on the 11th, South Korea’s current account surplus in January this year was $1.81 billion, sharply down by nearly $5 billion compared to the same month last year.

Joo Won, head of economic research at Hyundai Research Institute, stated, "Domestic inflationary pressures are strongly affecting consumption and investment sentiment, potentially causing a contraction in the domestic market," and added, "We cannot rule out the possibility that the Korean economy is entering a slowflation phase due to the direct and indirect ripple effects of the Ukraine-Russia war."

On the same day, Lee Da-eun, a researcher at Daishin Securities, said, "In the case of the United States, although it is not stagflation, demand-side inflationary pressures are expanding, and the rise of WTI crude oil prices close to $130 is a burden on the economy," adding, "The Federal Reserve’s interest rate hikes starting in March are acting as a factor that increases the burden on economic growth, raising the likelihood that the U.S. economy is entering slowflation with weakening momentum."

However, Lee assessed that the probability of stagflation occurring is low. He explained, "Looking at past U.S. cases of entering stagflation, conditions included an oil price increase speed of more than 2.5 times, maintaining the increase for at least six months, and the central bank implementing tightening policies," and added, "Although the recent oil price increase speed is fast, it is maintaining a level of about 1.6 to 1.7 times, so there is no immediate concern about stagflation caused by an oil shock."

South Korea’s economy is also currently not at a level to worry about stagflation. Park Jong-seok, Deputy Governor of the Bank of Korea, said at a press conference on the 10th regarding the 'Monetary and Credit Policy Report,' "It is not yet a stage to worry about stagflation," and noted, "The global economy is continuing a favorable recovery mainly driven by the U.S. economic upturn, and although inflationary pressures have increased, we do not see a situation where economic recession is occurring simultaneously."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.