Global Nuclear Power Faces Serious Disruptions... South Korea Imports 34% of Uranium from Russia

[Asia Economy reporters Park Byung-hee and Lee Dong-woo, Sejong] Bloomberg News reported on the 9th (local time) that the U.S. government is considering sanctions against Rosatom, Russia's state-owned nuclear energy company. Rosatom is a major supplier of uranium, the raw material for nuclear power generation, and possesses nuclear power-related technology. Since South Korea imports 33.8% of the uranium needed for nuclear power generation from Russia, sanctions on Rosatom are expected to cause serious disruptions to South Korea's nuclear power industry.

◆ "Considering adding Rosatom to the sanctions list" = Bloomberg News, citing a source familiar with the matter, reported that the Biden administration is considering adding Rosatom to the sanctions list. According to the source, the White House has not made a final decision regarding sanctions on Rosatom and is consulting on the potential impact on the global nuclear industry.

Rosatom and its affiliates supply 35% of the world's enriched uranium. They export uranium across Europe as well. As of 2020, the U.S. imported 16.5% of the uranium and 23% of the enriched uranium used for commercial nuclear power operations from Russia. Sanctions on Rosatom could cause significant disruptions to nuclear power operations in the U.S. and Europe.

Chris Gadomski, an analyst at Bloomberg New Energy Finance, said, "There is not enough margin to avoid relying on Russian uranium," adding, "Russian uranium is not only cheap, but the U.S. does not produce uranium."

Another concern for the U.S. government is that Iran, which is pursuing the restoration of the nuclear deal, should be granted exceptions if Rosatom is sanctioned. Bloomberg reported that under the terms of the Iran nuclear deal, transactions between Iran and Rosatom are subject to exceptions.

However, since the uranium supply cycle required for nuclear power operation is about 18 to 24 months and nuclear power companies usually pre-purchase several years' worth of uranium to build substantial inventories, the immediate impact on nuclear power operations may be limited even if Rosatom is sanctioned. The White House has not yet made a final decision on Rosatom sanctions and is discussing the potential impact on the industry with nuclear power companies.

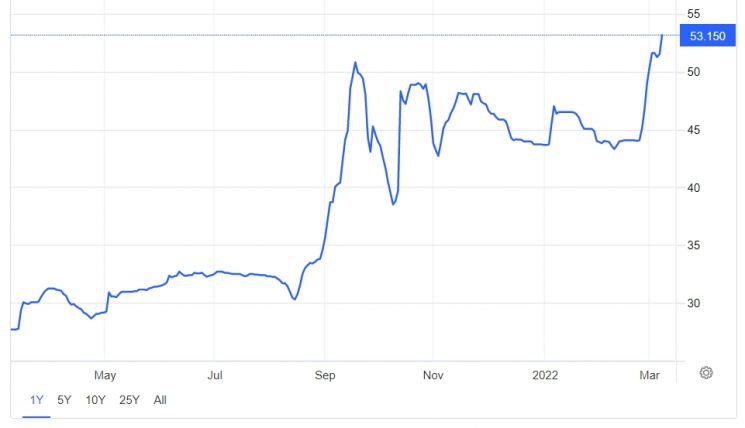

Uranium prices have risen about 22% this year. On the 8th, uranium traded at around $53 per pound, the highest price in 10 years.

Stephen Michael, CEO of Australian commodity company Bimi Resources, predicted that due to geopolitical instability caused by the armed conflict between Ukraine and Russia and the push for climate change policies, uranium prices could return to the all-time high of around $140 per pound recorded in 2007.

CEO Michael said, "Western European countries need to reduce their dependence on Russian natural gas, but they do not want to return to coal," adding, "Nuclear power could become strategically important." On the 8th, the European Commission decided to gradually reduce dependence on Russian fossil fuels and achieve energy independence from Russia before 2030. The EU plans to reduce imports of Russian natural gas by two-thirds this year.

◆ South Korea depends on Russia for 33.8% of uranium = Sanctions on Rosatom are expected to inevitably disrupt domestic nuclear power generation. According to the Korea Institute for International Economic Policy (KIEP), a government-funded research institute, 33.8% of the total domestic imports of enriched uranium used for nuclear power generation (worth $250 million) are imported from Russia. All of this is imported through Rosatom’s subsidiaries, Tenex and Internexco.

If the U.S. administration expands its ban on importing enriched uranium from Rosatom to its allies, it is analyzed that up to 30% of domestic nuclear power production could be disrupted in the long term. Kim Yong-soo, a professor in the Department of Nuclear Engineering at Hanyang University, said, "Enriched uranium is a key raw material for operating nuclear power plants and is entirely dependent on overseas sources," adding, "If the Russia-Ukraine war prolongs, serious disruptions to domestic stockpiles are inevitable."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)