[Asia Economy Reporter Ji Yeon-jin] Due to the Ukraine crisis, which has increased inflationary pressures including international oil prices, there is a forecast that an era of inflation will begin. Since the 2008 global financial crisis, the global economy, which has suffered from deflation, is transitioning to an inflation era, and it is pointed out that asset allocation strategies must also change.

According to the asset allocation monthly report published by Korea Investment & Securities on the 9th, the worst investment in an inflation era is cash. While it may be a good strategy in the short term to reduce the proportion of risky assets such as stocks and secure liquidity, it is analyzed that this strategy is likely to be dangerous from a long-term perspective.

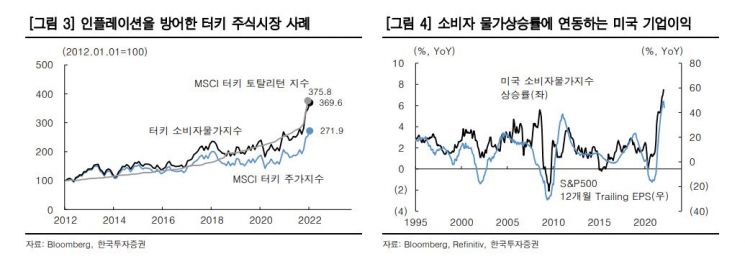

For example, Turkey has long suffered inflationary pressures due to its current account deficit and the resulting depreciation trend of the lira. In particular, with recent strong inflation, prices have risen 2.7 times over the past 10 years.

What is noteworthy is the stock price. Turkey's stock index rose more than 170% during the same period, and including dividends, it rose more than 270%. Stocks are interpreted as having perfectly hedged inflation. Hyuncheol Jung, a researcher at Korea Investment & Securities, said, "The story may change when considering exchange rates, but what is clear is that stock investment based on the domestic currency is an excellent means to sufficiently defend against inflation," adding, "Rather than leaving the market to avoid short-term volatility, it is a situation that requires a strategy to pursue mid- to long-term returns by managing volatility through asset allocation."

Researcher Jung suggested a strategic asset allocation of 58% stocks, 15% bonds, 24% alternative investments, and 3% cash. This was allocated with an expected annual return target of 5.5%.

He explained, "The Ukraine crisis is certainly a factor that increases the possibility of global stagflation, but the commodity, stock, and foreign exchange markets have already priced in much of the risk. Even if the crisis prolongs, through the reorganization of commodity supply chains and the economy’s self-correcting ability, the global economy is expected not to follow the worst-case scenario. Rather, it is time to gradually shift attention to the economic turnaround due to the reopening effect, which has not been receiving much attention."

Among stocks, South Korea, which is emerging from the worst phase, and Emerging Asia, which can benefit from rising commodity prices, are expected to deliver relatively good returns. Among bonds, a turnaround possibility is expected for global investment-grade bonds, which have recently experienced excessive declines. A neutral opinion was given on the sharply rising commodities, and real estate, which plays an inflation-hedging role, received a favorable opinion.

Researcher Jung emphasized, "Entering an inflation environment means the end of the previous low-growth, low-interest rate trend, and the overall interest rate level is likely to rise," adding, "The prices of all assets expressed in nominal terms are likely to increase. Therefore, whether investors can accept the upcoming changes and well incorporate them into asset allocation strategies will determine future investment performance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)