Kakao Bank Piggy Bank, Perfectly Targeting MZ Generation

4.22 Million Accounts, Triple Growth Since Launch

62% Popularity Among 2030 Generation

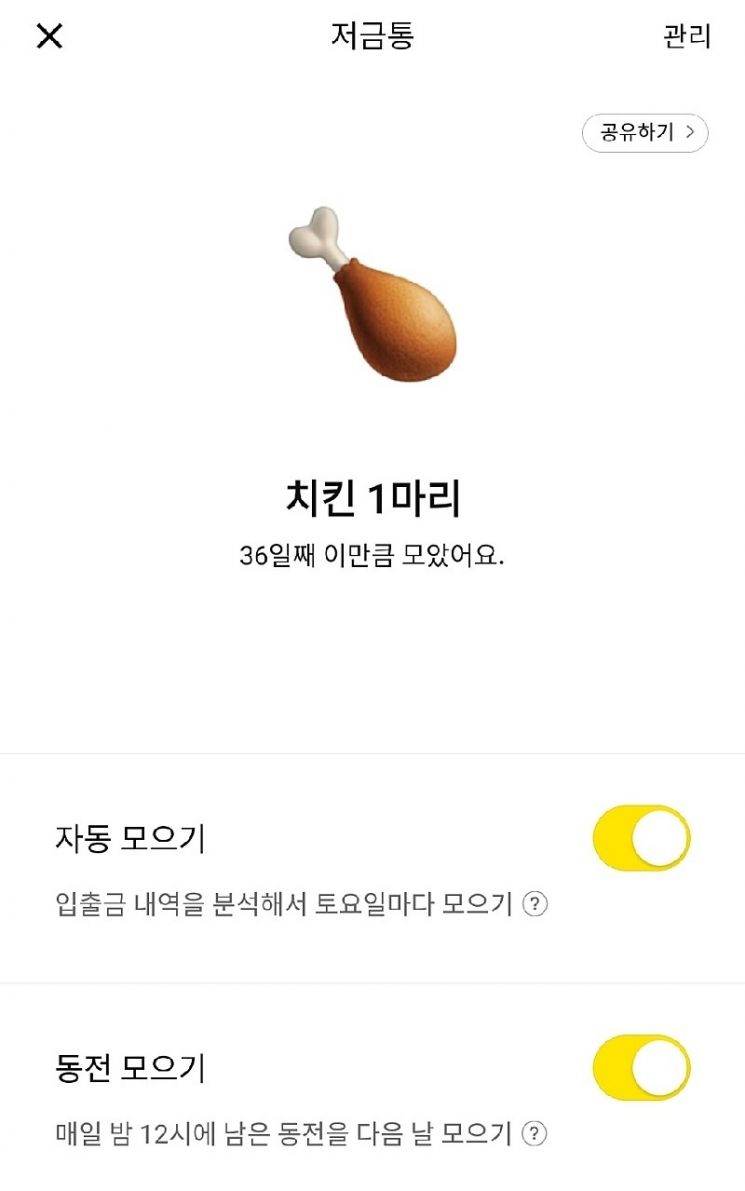

"I made a whole chicken with my KakaoBank piggy bank." On online communities popular among the MZ generation (Millennials + Generation Z), posts boasting about their items often appear. The piggy bank is a method that saves spare change from a linked checking account, and it displays witty items such as a pizza, chicken, or Chinese restaurant set A corresponding to the amount saved, gaining popularity among the MZ generation.

According to KakaoBank on the 7th, the cumulative number of piggy bank accounts opened reached 4.22 million as of the end of February. This is more than three times the 1.25 million accounts at the end of 2019 when the service first launched. The age group of users is dominated by those in their 20s and 30s, accounting for 62%. The piggy bank collects spare change and offers a 3% interest benefit. It has two functions: 'Coin Collection' and 'Automatic Collection.' Coin Collection automatically gathers spare change under 1,000 KRW from the linked checking account every night at midnight. Automatic Collection uses artificial intelligence (AI) to analyze transaction history from the past six months and automatically saves money every Saturday. The amounts saved automatically range from a minimum of 1,000 KRW to a maximum of 5,000 KRW.

The 26-week installment savings product, launched in 2018, is also still growing. As of the end of February, 11.61 million accounts have been opened, with about 3 million new accounts opened annually, maintaining steady popularity. The 26-week installment savings allows users to select a weekly deposit amount from 1,000 KRW, 2,000 KRW, 3,000 KRW, 5,000 KRW, or 10,000 KRW as the first week's payment, then increase the deposit by that amount each week. For example, if 1,000 KRW is chosen as the initial amount, the deposit in the 26th week will be 26,000 KRW. The basic interest rate is 2% per annum (based on 6 months), with an additional preferential interest rate of 0.5 percentage points applied upon successful completion of 26 weeks. This product also has a 70% user ratio in the 20s and 30s age group.

K Bank's 'Challenge Box' recently surpassed 100,000 accounts. Challenge Box helps individuals achieve modest goals such as 'Saving on late-night snacks to buy something big' or 'Trip to Jeju Island in 100 days.' Users set the amount and period according to their situation, and the weekly saving amount is automatically calculated. The target amount is up to 5 million KRW, and the period ranges from 30 to 200 days, with a maximum interest rate benefit of 2.5% per annum. According to K Bank, the MZ generation frequently uses Challenge Box for short-term pocket money savings. The MZ generation accounts for 62% of users, with women making up 72% of users in their 20s and 56% in their 30s, showing high popularity among women in their 20s and 30s.

Toss Bank also launched a 'Spare Change Savings' product linked to checking accounts, with about half of all account holders using this feature, indicating high interest. An internet bank official said, "The amounts are not burdensome, and by incorporating social and fun elements, it is well received by young people," adding, "The advertising business linked to the item display screen that can be purchased with spare change savings is also expanding."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)