AMD, Qualcomm, ARM, and Others Join Collaborative Consortium

[Asia Economy Reporter Park Sun-mi] Samsung Electronics is joining hands with global semiconductor companies such as Intel and TSMC to establish chip packaging standards. As governments around the world encourage industry cooperation to address competitive weaknesses and foster the semiconductor industry, the trend of forming alliances?even with rivals when interests align?is accelerating.

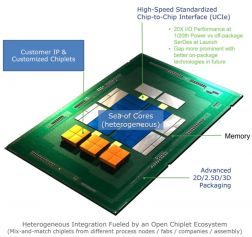

According to industry sources on the 4th, Samsung Electronics has agreed to collaborate with U.S.-based Intel and Taiwan-based TSMC to develop next-generation chip packaging industry standards. They plan to form a consortium for cooperation related to chip packaging and stacking technologies, which are essential in the final stage of semiconductor processing. The consortium will also include global fabless semiconductor companies such as AMD, Qualcomm, and ARM, as well as technology companies like Google Cloud, Meta, and Microsoft.

The newly formed consortium aims to create a unified chip packaging standard called ‘UCIe’ to establish a new ecosystem and promote collaboration among companies in the chip packaging and stacking sectors.

This unprecedented cooperation among the world’s leading semiconductor companies and technology firms clearly demonstrates how important chip packaging and stacking technologies have become in the semiconductor industry.

Chip packaging technology, which belongs to the post-processing stage, was traditionally considered less important and technically less challenging compared to front-end processes, as its difficulty and contribution to performance improvement were relatively lower. Until now, semiconductor development has focused mainly on integrating more transistors within a limited chip area to enhance performance.

However, recently, semiconductor companies including Samsung have been putting more effort into post-processing technologies to produce chips with stronger performance. This is because significant semiconductor performance improvements have become possible through post-processing as well.

Since the shorter the electron travel distance between transistors, the faster the semiconductor speed, foundry companies are focusing on narrowing the space between transistors. Thus, how to most efficiently package and stack small chips with various functions has become crucial.

Samsung Electronics also welcomes industry cooperation. A Samsung official said, "If chip packaging standards are established through industry cooperation, it will open the way to more efficiently combine different types of chips," adding, "This will enable the creation of more powerful chip systems."

Choosing to Collaborate with Rivals to Overcome Semiconductor Weaknesses Worldwide

This movement aligns with the atmosphere where governments worldwide, aiming to further grow the semiconductor industry, encourage cooperation among semiconductor companies to compensate for competitive weaknesses.

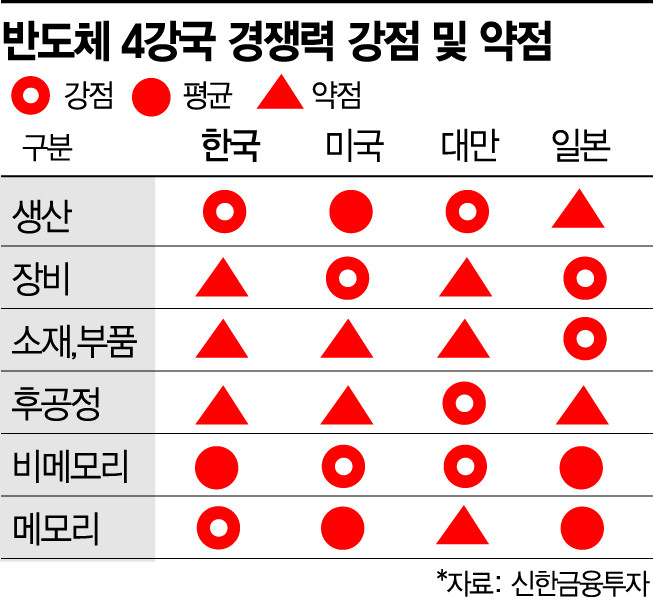

For example, the United States leads the global semiconductor market by leveraging strengths in semiconductor design and equipment, while addressing its production weaknesses by attracting foundry fabs such as TSMC and Samsung Electronics through massive government support.

According to a semiconductor report by Shinhan Financial Investment, Japan, which is weak in production, and Taiwan, which has weaknesses in equipment and materials, have started government-level cooperation to complement each other’s weaknesses. TSMC announced plans to build a new semiconductor fab in Japan this year. The Japanese government plans to provide a subsidy of 19 billion yen to support TSMC’s semiconductor research and development (R&D) hub in Ibaraki Prefecture. TSMC intends to collaborate with Japanese materials, parts, and equipment companies at the R&D hub and focus on post-processing research.

Micron is also considering building a memory fab in Hiroshima, Japan. The Japanese government is reportedly considering providing subsidies for part of the investment amounts to both TSMC and Micron.

Shinhan Financial Investment researchers Choi Do-yeon, Ko Young-min, and Nam Goong-hyun stated, "Although Korea has strengths in memory semiconductor production centered on Samsung Electronics and SK Hynix, production concentration is strong, and there are weaknesses in non-memory fields and other areas such as design, equipment, materials and parts, and post-processing," adding, "It is necessary to find strategic cooperation partners to complement these weaknesses."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.