Global Exposure to Russia Decreased but Divergent Interests Among Western Countries

Inflation and Supply Chain Issues May Deepen Shocks in Each Country

[Asia Economy Reporter Kim Hyunjung] It is forecasted that Russia's invasion of Ukraine will leave a deeper and longer-lasting shock than the 2014 annexation of Crimea.

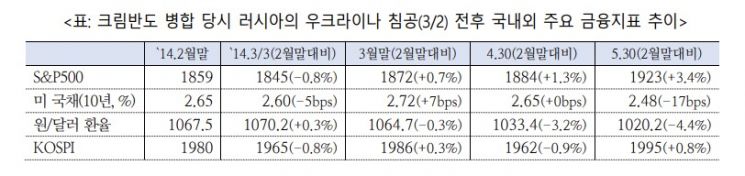

After Russia's annexation of Crimea in March 2014, the conflict continued for about a year. At that time, the international financial market reacted strongly to the situation from late February to mid-March 2014, and the effects of sanctions against Russia became visible from late 2014 to February 2015.

◆How was the market shock in 2014?= Stock prices in Russia, Eastern Europe, Germany, and other European regions fell by about 5-10% as the approval of the Crimea annexation approached, then recovered from mid-March. European stocks, which had significant economic and financial exposure to Russia, dropped sharply, but the lower-than-expected level of Western responses and Russia's diplomatic strategies alongside military tensions easing contributed to the recovery.

The US dollar showed little movement at the time, and US Treasury yields fell by 6 basis points from February 28 to March 3, reflecting only a short-term reaction. Commodities were directly affected, with natural gas prices surging over 40% in February and wheat and corn prices showing high volatility.

The impact on South Korea was limited. Early 2014 had already factored in the Federal Reserve's tapering stress, and uncertainty was easing, so downward pressure from the Crimea situation in March 2014 was limited.

The 2014 Crimea annexation was triggered amid deep-rooted regional divisions within Ukraine, lack of a unified national identity, severe economic difficulties, and the rise of a pro-Western interim government, which heightened social unrest.

However, unlike the 2014 Crimea annexation, the current Russian invasion of Ukraine differs significantly in terms of ▲weakened Russian justification ▲increased scale of military deployment ▲improved Russian economic conditions ▲conflicting interests among Western countries. Considering these factors, the severity of the conflict may be greater than in 2014, and doubts are emerging about the effectiveness of Western economic sanctions against Russia.

◆Developing into direct combat... Russia's position in the market= Among the various scenarios forecasted so far, the realization of Russia's 'full-scale invasion,' which had become a foregone conclusion, signals a greater shock than before. The market had largely expected that Russian troops would officially enter the pro-Russian separatist Donbas region, and that the US and others would respond with indirect support through economic and financial sanctions without direct military engagement with Russian forces.

However, Russian troops have already advanced beyond eastern Ukraine into the country's center. The US has imposed the strongest sanctions to date.

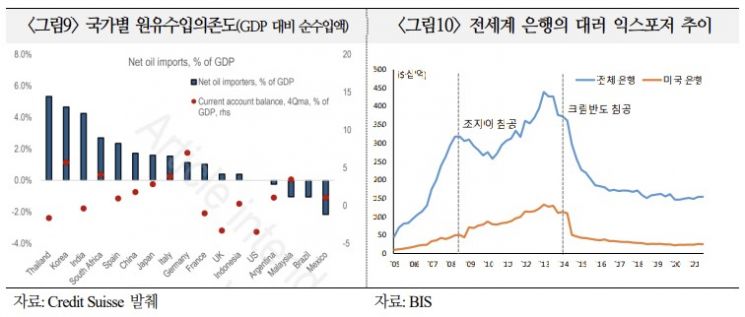

Sanctions against Russia are expected to deliver significant shocks not only to the Russian economy and financial markets but also to the global economy and financial markets. The main transmission channels are rising inflationary pressures due to increases in energy and food commodity prices and risks of supply chain disruptions. Russia accounts for 40% of Europe's natural gas imports, and among non-European countries, Thailand, South Korea, and India have high dependence on crude oil imports. According to Goldman Sachs, a 50% rise in oil prices would increase global CPI by 0.6 percentage points and core CPI by 0.3 percentage points.

Russia's share of global commodity exports is 45.6% for palladium, 15.1% for platinum, and 8.3% for crude oil, while Ukraine accounts for 16.4% of corn and 11.8% of wheat exports. Particularly, Europe imports more than one-third of its natural gas, chemical fertilizers, refined copper, palladium, and vanadium from Russia.

Russia's GDP accounts for about 1.3% of the global economy, so its overall impact may be limited. However, the Baltic States and several Eastern European countries with high export dependence on Russia will suffer significant damage.

Western financial sanctions against Russia increase default risks for Russian companies and financial institutions, which could affect Western banks. However, experts believe the risk to the financial system is low because global banks have significantly reduced their exposure to Russia since the 2014 Crimea crisis. The global banking sector's exposure to Russia is about $149 billion, roughly 40% of the level during the 2014 Crimea crisis. By country, Austria has the highest exposure relative to banking assets at 2.16%, while others are below 1% (South Korea at 0.13%).

◆Impact on the market= The effects of heightened geopolitical tensions can be categorized into stock price declines, interest rate drops, and upward pressure on the US dollar. Conversely, inflationary pressures from disruptions in energy and commodity supply act as factors pushing interest rates higher.

Many investment banks expect oil prices to exceed $100 per barrel, with some assuming increases of 40-50% or even $150 per barrel. If diplomatic solutions are reached, geopolitical risk premiums could be removed, bringing prices back to the $80 range, but this seems unlikely in the short term. JP Morgan forecasts that if oil prices rise to $150, global economic growth could slow to 0.9% in the first half of the year, and inflation could surge to 7.2%, double the current level.

Stock prices are expected to fall in the short term, but if high inflation does not persist long-term, the impact is likely to be temporary. The downward pressure on stocks is expected in the order of Russia, Europe, and the US. Goldman Sachs estimates that if this situation escalates into a full-blown crisis, the S&P 500 could potentially fall by 6.2% and the Nasdaq by 8.6%.

The impact on US Treasury yields is uncertain as inflationary pressures from rising oil prices and increased demand for safe-haven assets offset each other. Until now, most opinions have held that the Ukraine crisis would not significantly alter major central banks' policy stances, but the situation's development remains difficult to predict.

This crisis is expected to strengthen major safe-haven currencies such as the US dollar and Swiss franc. The euro, being geographically close, will experience increased volatility, but recent changes in monetary policy expectations (including the possibility of rate hikes within the year) may limit its depreciation. Emerging market currencies may face downward pressure if tensions escalate further, but Bank of America Merrill Lynch (BoA-ML) expects this impact will not spread broadly across emerging market currencies.

Regarding this, the International Financial Center stated, "Military tensions and economic and market uncertainties surrounding Ukraine will remain high for the time being, acting as a source of instability in financial markets. Unlike the limited impact on domestic and international financial markets during the 2014 Crimea annexation in March, the imminent start of the Federal Reserve's monetary tightening, high global inflationary pressures, and unresolved supply chain disruptions combined with escalating geopolitical risks will pose a burden on international financial markets."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)