[Asia Economy (Daejeon) Reporter Jeong Il-woong] The Korea Customs Service is expanding the scope of tax support for small and medium-sized enterprises (SMEs). The aim is to allow companies to receive broader tax support benefits, rather than limiting it to companies affected by COVID-19 last year.

On the 23rd, the Korea Customs Service announced that this year's tax support program will be implemented starting from the 24th. The tax support is designed to assist import-export companies facing liquidity difficulties due to changes in the international trade environment and unexpected disasters.

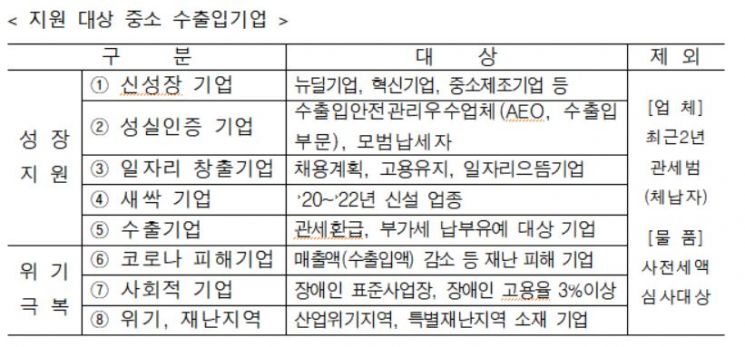

In particular, this year, growing SMEs such as Korean New Deal companies driving future economic growth, technology and management innovation companies, job-creating companies, and young startup companies will be eligible for tax support.

The key point is that the scope, which was limited last year to companies suffering from business difficulties such as decreased sales due to the prolonged COVID-19 pandemic or damage caused by disasters like earthquakes and typhoons, will be expanded.

The Korea Customs Service will allow eligible companies to extend the payment deadline for customs duties imposed on imported goods by up to one year or to pay in installments through tax support.

Additionally, during the extended period, companies can omit providing collateral, thereby reducing financial costs such as fees related to collateral provision.

Measures to activate the 'Value-Added Tax (VAT) Payment Deferral System' will also be promoted to reduce the burden on companies. This system allows small and medium-sized enterprises and mid-sized companies with an export ratio of 30% or more of the previous year's sales to submit a certificate from the head of the tax office to defer VAT payment on imports and settle it at once with the tax office.

Furthermore, to assist SMEs lacking understanding of the refund system, the head of the customs office will directly provide information on unclaimed refunds, and if the exporter marks automatic refund on the export declaration form, the refund will be paid without a separate refund application procedure.

A Korea Customs Service official said, “We will actively utilize tax support to revitalize SMEs struggling due to the prolonged COVID-19 pandemic and support the growth of future technology industries. Since the tax support program benefits are granted only to applying companies, we hope companies visit their nearest customs office to check eligibility and receive guidance on benefits.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)